FAQs: Understanding the Foreign Earned Income Exclusion

If you are a U.S. citizen or resident alien living and working in a foreign country, you may be eligible to exclude a portion of your foreign earned income from U.S. taxation. This article will help you understand the basics of the Foreign Earned Income Exclusion (FEIE) using Form 2555, the eligibility criteria, and how it affects your U.S. tax obligations.

We will be citing IRM 21.8.1.2.16.1 (10-01-2021) as the source for this FAQ.

What is Foreign Earned Income Exclusion?

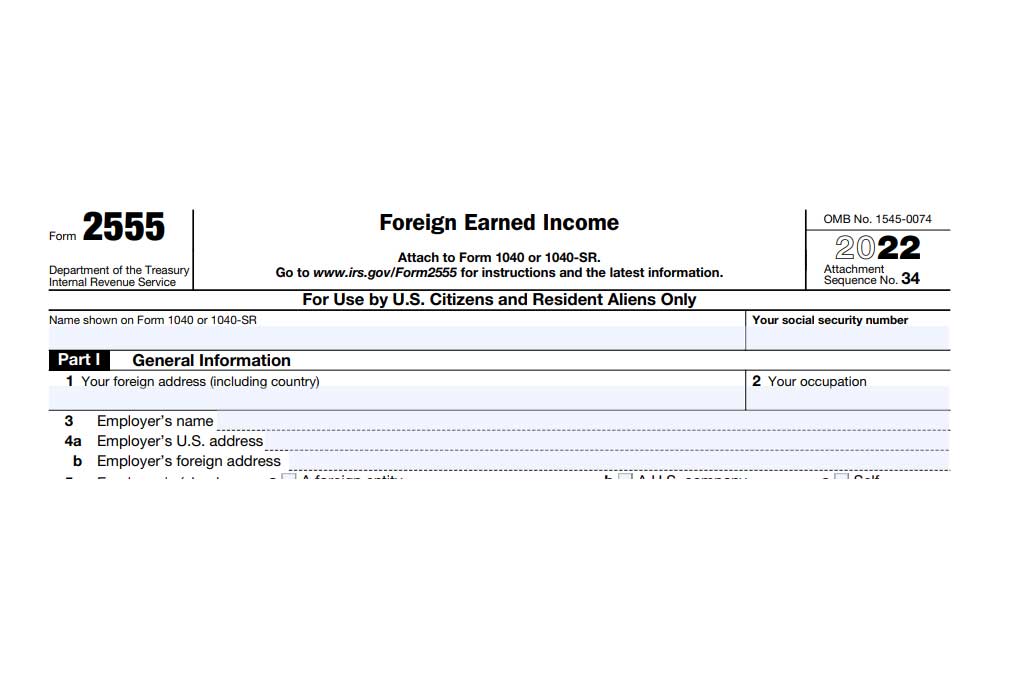

Once a taxpayer establishes their tax home in a foreign country and meets either the bona fide residence test or the physical presence test, they may elect to exclude some or all of their foreign earned income from their taxable income. This is known as the Foreign Earned Income Exclusion and is reported on Form 2555.

How much foreign earned income can be excluded?

The excludable foreign earned income is calculated on a daily basis, and there is a maximum annual limit that can be excluded. This limit is adjusted annually for inflation. For example, in 2022, the limit was $112,000.

| Taxable Years | Annual Rate |

|---|---|

| 2018 | $103,900 |

| 2019 | $105,900 |

| 2020 | $107,600 |

| 2021 | $108,700 |

| 2022 | $112,000 |

What If Both Spouses Have Foreign Earned Income?

If both spouses are earning income in a foreign country and each meet the bona fide residence or the physical presence test, each must file a separate Form 2555. In this case, for the tax year 2022, up to $224,000 can be excluded.

How Does The Exclusion Affect Other Tax Items?

The law prevents taxpayers from “double-dipping” by claiming the foreign earned income exclusion and not reducing it by adjustments to income, or certain itemized deductions and credits related to the excluded income. These adjustments and reductions are documented on Form 2555, line 26.

What about Itemized Deductions?

Itemized deductions related to excluded income must be reduced. These deductions can include moving expenses, employee business expenses, etc. More information is provided in Publication 54.

How Does The Exclusion Affect Nonrefundable Credits?

Generally, the reduction of nonrefundable credits is limited to the portion specifically related to the excluded income.

How Does The Exclusion Apply Under Community Property Laws?

The total community income that can be excluded can’t exceed the amount excludable if the income isn’t considered community property income.

Who Can’t Claim The Exclusion?

Certain U.S. Government employees working overseas are not eligible for the foreign earned income exclusion. These employees include:

- Military personnel

- State Department employees

- IRS employees

- Drug Enforcement Agency (DEA) employees

How does the FEIE affect self-employment tax and IRA contributions?

Claiming the FEIE does not exempt you from paying self-employment tax on your foreign earned income. Also, if you exclude income under the FEIE, that income is not considered compensation for determining the amount of your IRA contribution.

Are there any restrictions on the FEIE?

Yes, certain restrictions apply to the FEIE. For instance, U.S. government employees working overseas, such as military personnel, State Department employees, and IRS employees, are not eligible for the FEIE. Additionally, the exclusion is not available if travel and employment in a foreign country are restricted under certain U.S. laws.

How do I claim the FEIE on my tax return?

To claim the FEIE, you must file Form 2555, Foreign Earned Income, with your U.S. federal income tax return. Taxpayers who claim the foreign earned income exclusion, housing exclusion, or housing deduction on Form 2555 must use the Foreign Earned Income Tax Worksheet to calculate their tax liability.

In summary, the Foreign Earned Income Exclusion is a valuable tax provision for U.S. citizens and resident aliens working in foreign countries. Understanding the eligibility criteria, exclusion limits, and how to claim the FEIE on your tax return can help you minimize your U.S. tax obligations while living and working abroad.

***Disclaimer: This communication is not intended as tax advice, and no tax accountant -client relationship results**