In the wake of the COVID-19 pandemic and the resulting economic fallout, the U.S. federal government has scrambled to provide financial relief to businesses and citizens across the country. They’ve already taken a number of steps, but many feel that the government still hasn’t gone far enough to protect those in need.

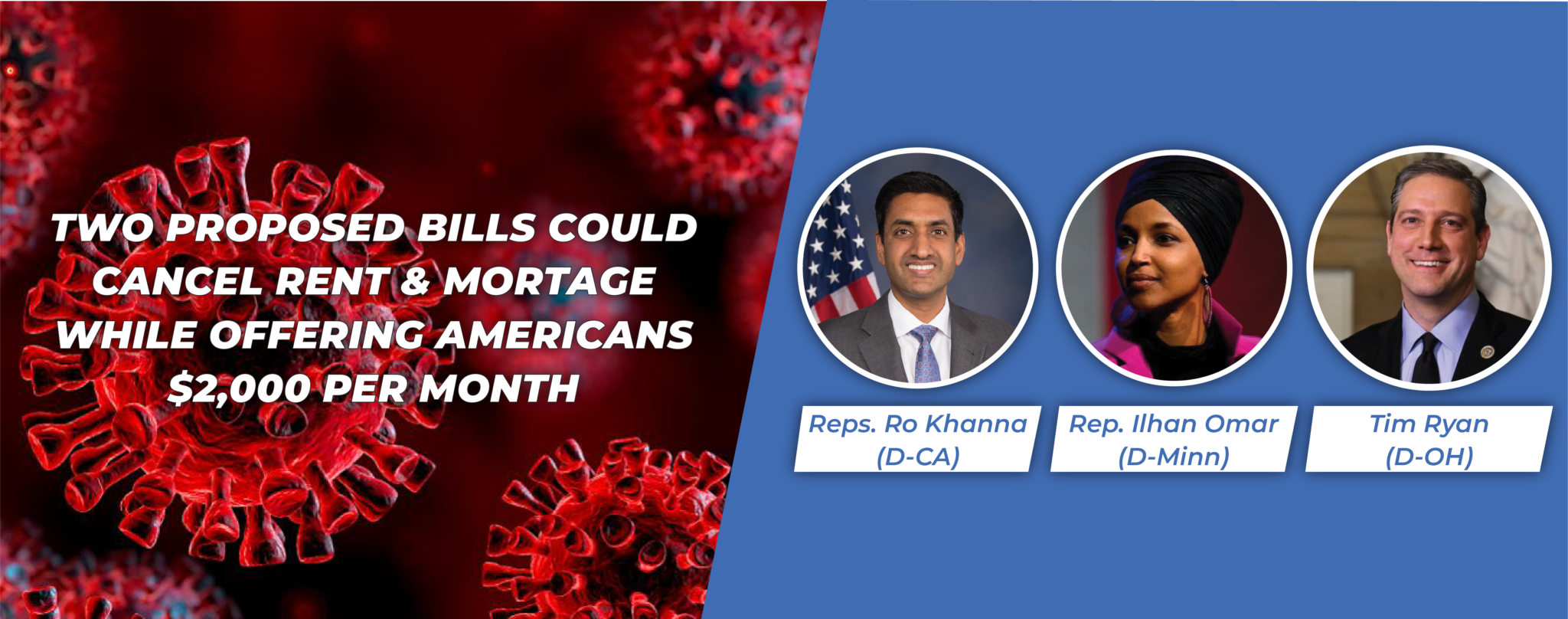

Two currently proposed bills could offer a turning point, however. If passed, they would mean serious safeguards for many Americans, especially renters and homeowners.

- The first proposed bill introduced by Rep. Tim Ryan, D-Ohio, and Rep. Ro Khanna, D-Calif., would provide most U.S. citizens with $2,000 per month for at least six months.

- The second proposed bill introduced by Rep. Ilhan Omar (D-Minn) would freeze all rents and mortgages, while simultaneously providing support for landlords.

Now, neither bill has been passed yet—it’s all just a possibility at this point. But if it does, what would that mean for you? Here’s what the two bills contain in their current form:

1. The Emergency Money for the People Act

The federal government has already passed several financial relief packages. Perhaps most notable is the $1,200 stimulus check. (Though many Americans are still waiting for theirs to arrive.)

Even if you’ve already received your $1,200, you might be wondering if there’s any more assistance coming. After all, $1,200 will only go so far, and no one knows how long these quarantines will last and how long businesses will stay shut down.

So is there more help on the way? There could be, yes. Congressional representatives are proposing yet another financial relief package. This time, they’re discussing sending out checks for $2,000 every month for a minimum of six months—and possibly longer. It’s called the Emergency Money for the People Act.

Here’s what it looks like:

- U.S. citizens 16 years and older would be eligible for the full monthly payments if they earn $130,000 or less. For couples, the cutoff would be doubled to $260,000 or less.

- Unlike with the $1,200 stimulus payment, even college students and disabled persons who are claimed as a dependent on another person’s taxes would be eligible to receive the payments.

- Those who have no income would also be eligible.

- Eligible Americans would receive payments from the federal government each month for at least six months, and longer than that if necessary, until the U.S. employment-population ratio gets above 60%.

- Individual Americans would receive $2,000 per month, and couples would receive $4,000 per month. Parents would also receive $500 per eligible child for up to three children.

- The payments would be free gifts from the government that would not have to be repaid at any point.

- The money would not be counted as income and would not be taxed at all.

- The payments wouldn’t affect anyone’s ability to receive other federal or state benefits.

As you can see, there would be some major changes from the stimulus package that provided $1,200 to certain citizens. Many who didn’t qualify for the last relief check would qualify for these, and they would receive quite a bit more if they did. Perhaps most importantly of all, it would be guaranteed to last at least six months, rather than being a one-time payment, as was the case with the $1,200.

But that’s not the only bill currently proposed as an option in Congress.

A second bill would also provide assistance for renters, homeowners, and even landlords. That’s the Rent and Mortgage Cancellation Act.

2. The Rent and Mortgage Cancellation Act

Right now, the U.S. is facing an unprecedented housing crisis. Many are unable to afford their rents or mortgage payments. Millions have lost their jobs. Worst of all, the situation may only become bleaker with time.

Some banks have offered to let homeowners miss a few months on their mortgage payments. But after that period, the homeowners would have to pay all the missed bills at once.

For example, let’s say a homeowner pays $1,000 for their mortgage payment every month. Their bank may be offering to let them defer payments for three months, but once those three months are up, they’d owe the back-payments for those three months on top of that month’s due—for a grand total of $4,000 all at once.

Because that would only kick the can down the road to a time when homeowners may not be in any better financial situation to pay, many don’t see it as much help.

So far, the solutions offered by the federal government have been limited. The Cares Act stimulus package included $12 billion for the Department of Housing and Urban Development

(HUD) to help with rental problems and homelessness. But some voices claim that those measures don’t truly address the problems millions of more Americans are suddenly facing.

Now a new bill proposed in congress might help solve that problem—without necessarily leaving landlords high and dry, either. Under the proposed legislation, all rent or mortgage payments would be canceled until the COVID-19 pandemic is over and Americans can return to a more normal way of life.

The bill would grant 100% debt forgiveness for all rents and mortgage payments to anyone with an existing rental agreement or loan agreement for their primary residences. Those residences could be:

- Apartments

- Condos

- Manufactured homes

- Single-family homes

- Duplexes

- Room rentals

- Legal subleases

And unlike the standard terms for mortgage forbearance, there would be no accumulation of debt. Anyone who took advantage of this would also not have their credit or rental history affected in any way.

This would apply retroactively, reaching back to March 13, 2020. Anyone who has made payments after that date would get a full reimbursement. Rents and mortgages would then stay frozen for a full year until March 13, 2021.

The only real catch is that the mortgage deferment is only applicable to a primary residence. Second homes, vacation homes, or any other non-primary residences wouldn’t fall under this legislation in its current form.

The bill doesn’t leave landlords completely high and dry, either. The federal government would also be establishing a relief fund for landlords and mortgage holders of occupied units with lease agreements already in place.

The catch for landlords is that in order to receive any support from this relief fund, they’d have to have to agree to certain renting terms for the next 5 years, including:

- a rent freeze

- provision of 10% equity to tenants

- just-cause evictions—with mandatory documentation

- no admission restrictions on the basis of:

- sexual identity or orientation

- gender identity or expression

- conviction or arrest record

- credit history

- immigration status

- coordination with local housing authorities to make new vacancies eligible to voucher holders

- landlords can’t attempt to collect any back-rent once the moratorium is lifted

- they cannot report residents to debt collectors or to debt services to harm their credit

If any of these conditions are violated during the 5-year period, the federal government can demand repayment of the relief funding they gave you. In essence, landlords would lose all leverage for the 5-year period of the contract. If three years from now a tenant refused to pay, the landlord couldn’t even threaten to report them to a debt service or to affect their credit score.

The bill also includes an optional affordable housing fund used to finance purchases of private rental properties. This gives HUD an opportunity to provide more affordable housing by finding buyers such as nonprofits and local and state governments that landlords can sell to if they need fast money. Any companies or governments who bought these properties would then have to abide by certain guidelines, similar to those imposed on landlords.

That’s the summary of two potential bills, the Emergency Money for the People Act and the Rent and Mortgage Cancellation Act.

Of course, both of these bills are only proposed. There’s no guarantee that either will actually pass. And even if they do, they could be heavily modified by that point.

Still, they may offer some hope to people that help could really be on the way.

Book a paid consultation

Yes, Book My Slot