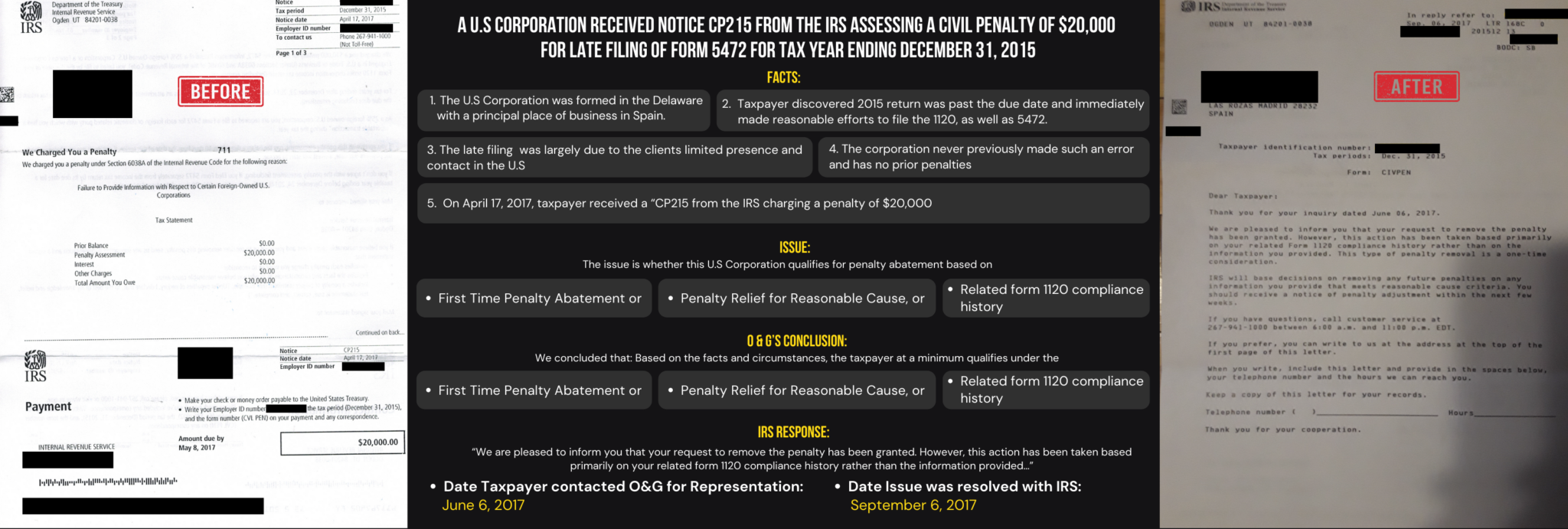

A U.S Corporation received Notice CP215 from the IRS assessing a civil penalty of $20,000 for late filing of Form 5472 For Tax Year Ending December 31, 2015

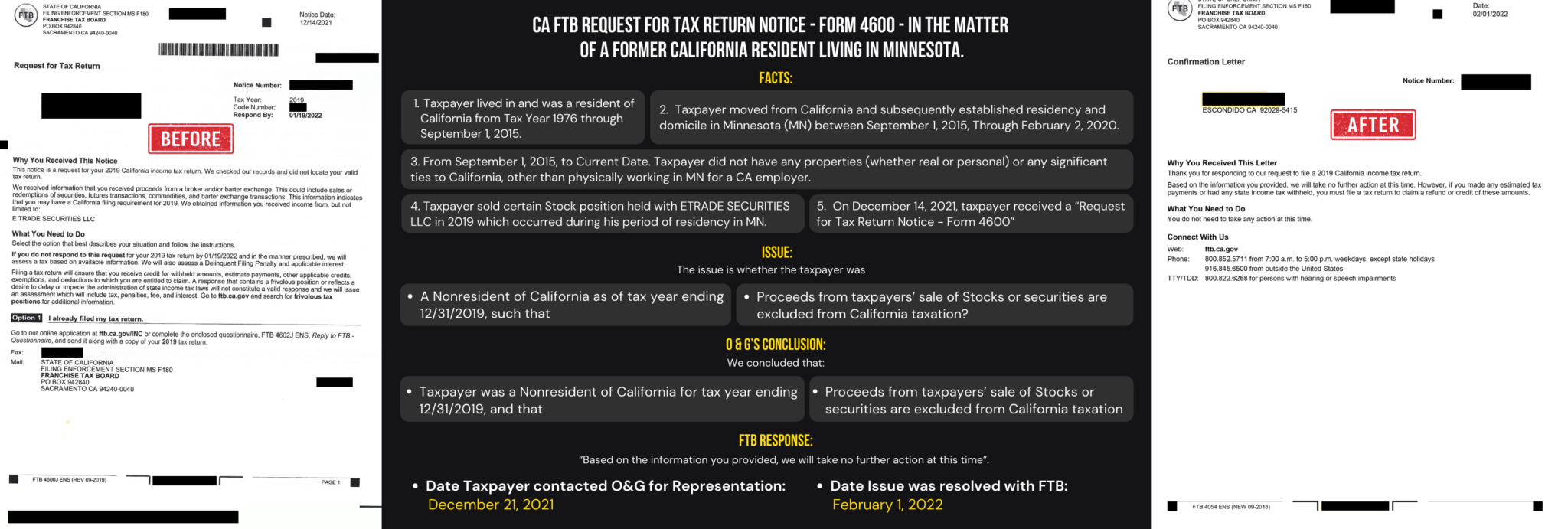

California FTB Request for Tax Return Notice – Form 4600 – In the matter of a Former California domiciled in Minnesota.

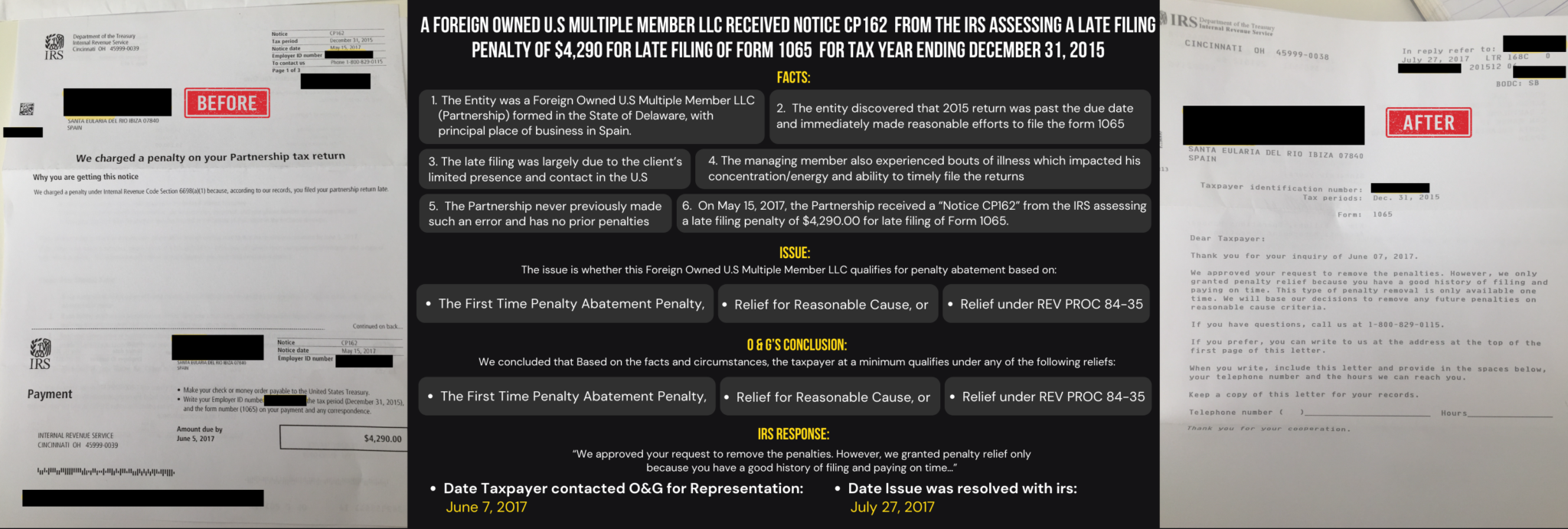

A Foreign Owned U.S Multiple Member LLC received Notice CP162 from the IRS assessing a late filing penalty of $4,290.00 for late filing of Form 1065 For Tax Year Ending December 31, 2015

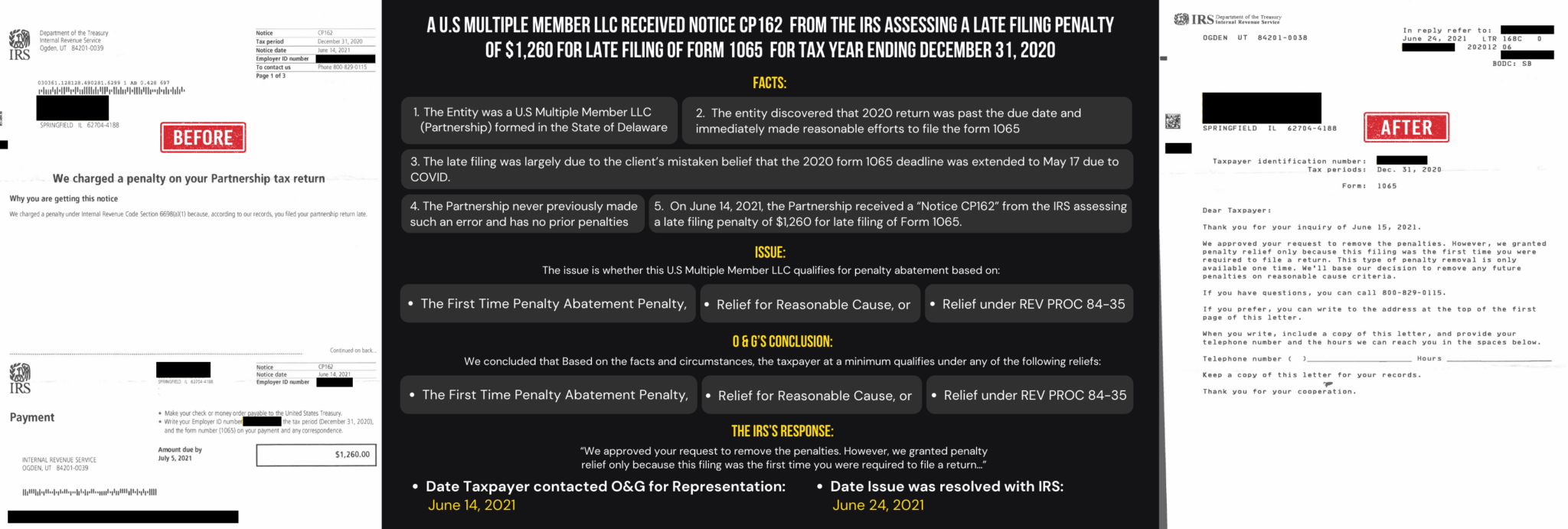

A U.S Multiple Member LLC received Notice CP162 from the IRS assessing a late filing penalty of $1,260.00 for late filing of Form 1065 For Tax Year Ending December 31, 2020

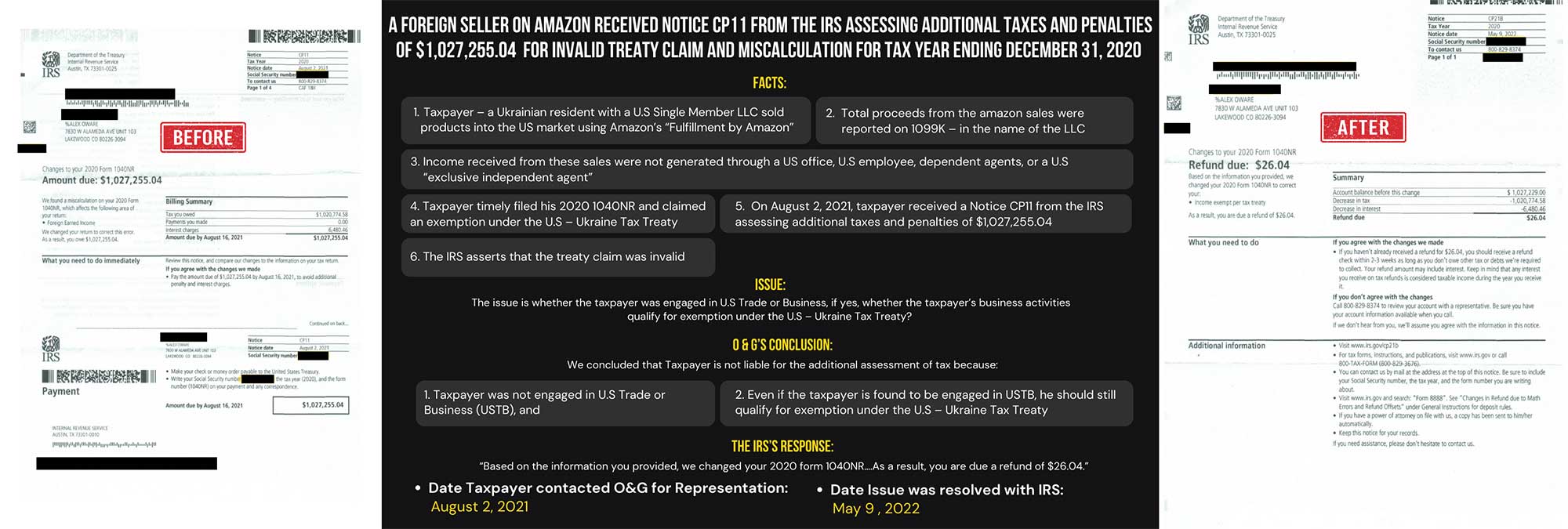

A foreign seller on Amazon received Notice CP11 from the IRS assessing additional taxes and penalties of $1,027,255.04 for invalid treaty claim and miscalculation For Tax Year Ending December 31, 2020

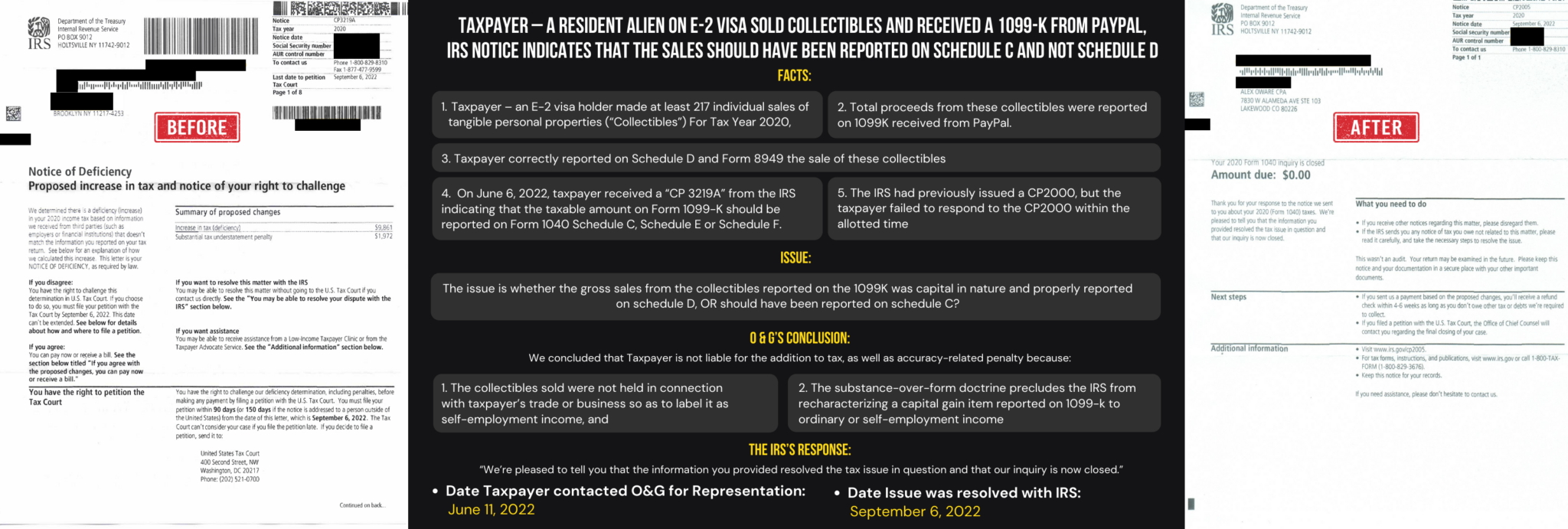

Taxpayer – A resident Alien on E-2 Visa sold Collectibles and received a 1099-K from PayPal, IRS issues a Notice of Deficiency assessing additional taxes, penalties and interest of $11,833, and further indicating that the sales should have been reported on schedule C, and not schedule D.

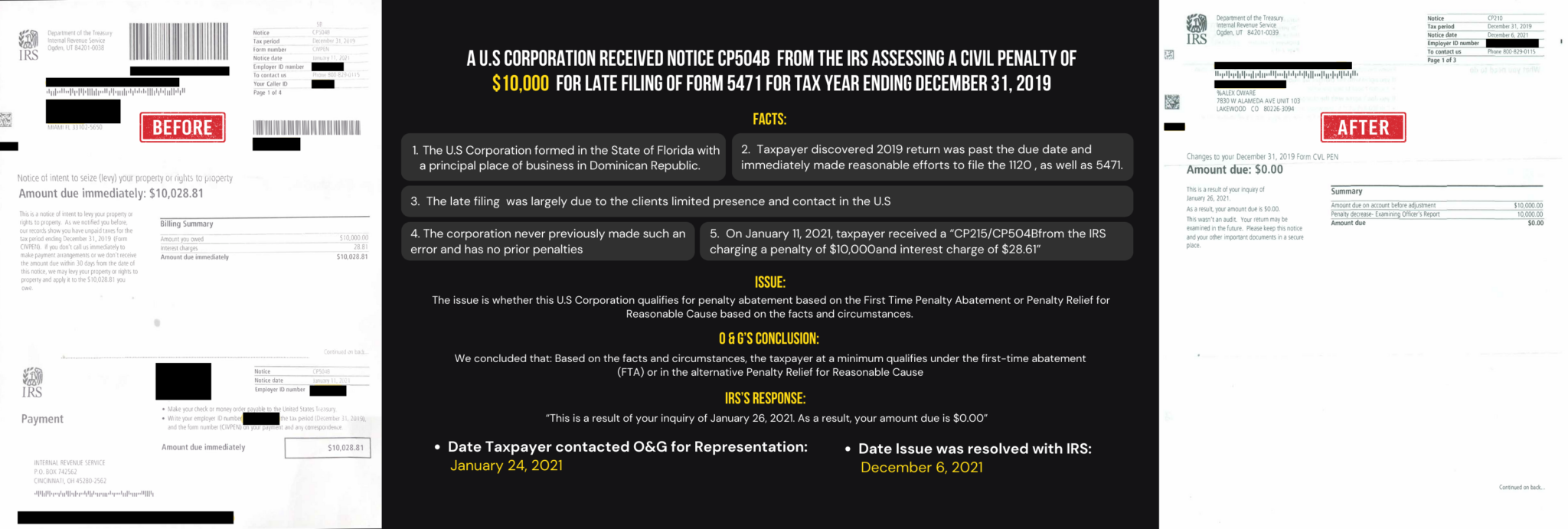

A U.S Corporation received Notice CP504B from the IRS assessing a civil penalty of $10,000 for late filing of Form 5471 For Tax Year Ending December 31, 2019

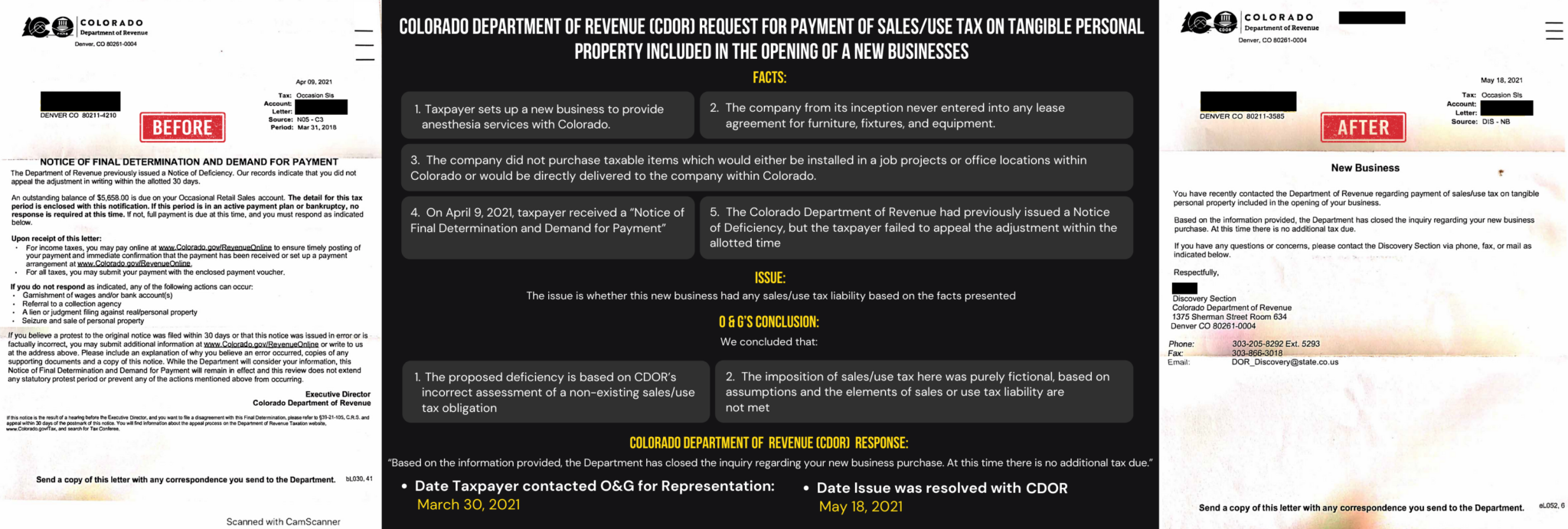

Colorado Department of Revenue (CDOR) request for payment of $5,658.00 Sales/Use tax on Tangible Personal Property included in the opening of a new business.

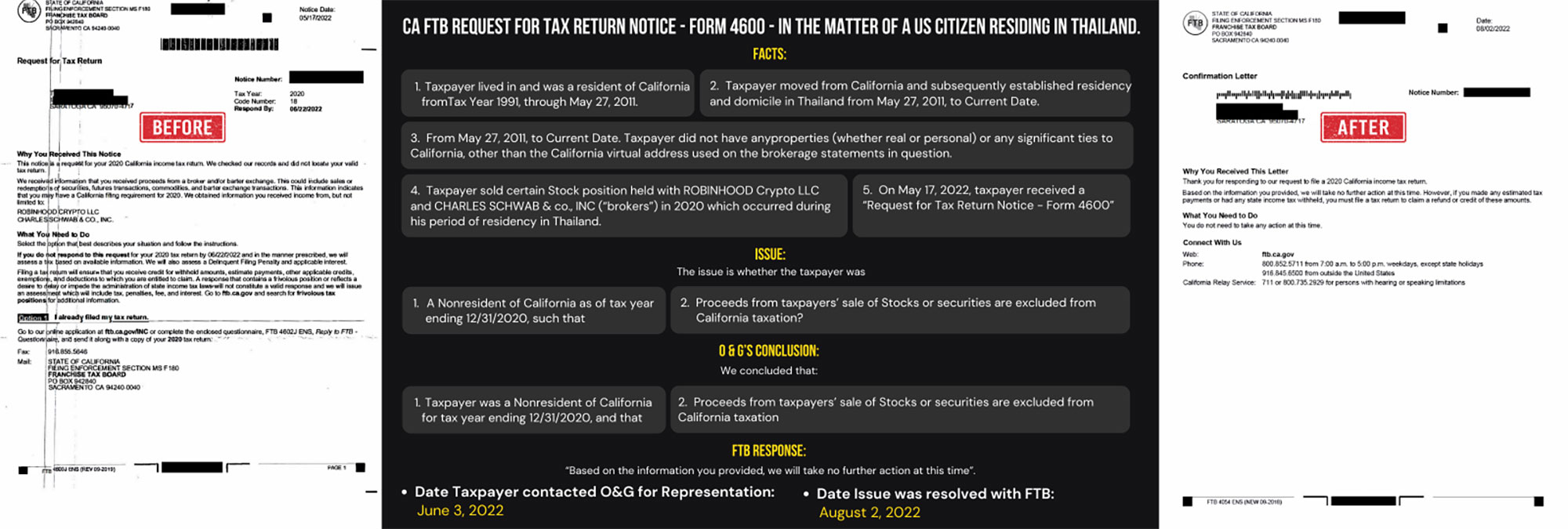

California FTB Request for Tax Return Notice – Form 4600 – In the matter of a US Citizen residing in Thailand.