Form 8898 Explained: Your Guide to Bona Fide Residence in U.S. Possessions

Frequently Asked Questions (FAQs)

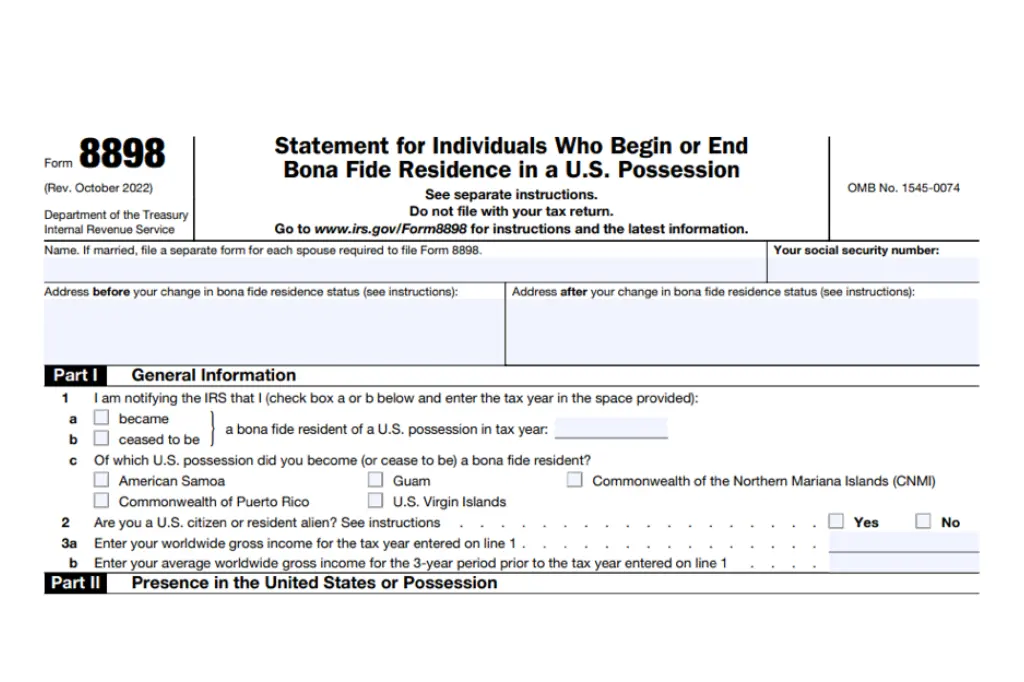

1. What is Form 8898?

Form 8898, Statement for Individuals Who Begin or End Bona Fide Residence in a U.S. Possession, was established by the American Jobs Creation Act of 2004 (see IRC 937(c)). This form is used to inform the Internal Revenue Service (IRS) when an individual becomes or ceases to be a bona fide resident of a U.S. Possession.

2. Who should file Form 8898?

Starting from the tax year 2011, Form 8898 must be filed by individuals who:

- Have a worldwide gross income exceeding $75,000.00 in the tax year, and

- Meet one of the following conditions:

- They assert for U.S. tax purposes that they became a bona fide resident of a U.S. territory after a year in which they filed a U.S. tax return as a citizen or resident of the U.S.

- As a U.S. citizen or resident, they claim for U.S. tax purposes that they ceased being a bona fide resident of a U.S. territory after a year in which they filed a tax return as a bona fide resident of that territory.

- They assert for U.S. tax purposes that they became a bona fide resident of Puerto Rico or American Samoa after a year in which they had to file a tax return as a bona fide resident of the U.S. Virgin Islands, Guam, or the CNMI.

3. What happens if I don’t file Form 8898 when required to do so?

A penalty of $1,000 may be levied if you don’t file a required Form 8898 or fail to provide the necessary information. For more information, see IRM 20.1.9.18, IRC 6688 -Reporting for Residents of U.S. Possessions (U.S. Territories).

4. Where should I send my completed Form 8898?

You should send your Form 8898 to the Philadelphia Campus. If the form is received elsewhere, it will be routed to the Low Income Housing Team at:

Philadelphia Campus 2970 Market St. Mail Stop 4-E08.142 Philadelphia, PA 19104.

5. Can you give me an example of when I would need to file Form 8898?

Sure! Let’s say you’re a U.S. citizen who’s been living in the mainland U.S. and, in the middle of 2022, you move to Guam, where you become a bona fide resident. Since your gross income for 2022 exceeds $75,000, you will need to file Form 8898 with your tax return to notify the IRS of your change in residence status.

Example 2:John, a U.S. citizen, lived in the United States for many years before moving to Guam in 2021. During that year, his worldwide gross income exceeded $75,000. He filed his 2020 U.S. tax return as a resident of the United States. In 2021, he took a position for U.S. tax purposes that he became a bona fide resident of Guam. In this situation, John would need to file Form 8898 to notify the IRS of his change in residence status.

Example:Let’s take John Doe as an example. John, a U.S. citizen, moved to Puerto Rico in 2023 and had a worldwide gross income exceeding $75,000.00 that year. For U.S. tax purposes, he claims that he became a bona fide resident of Puerto Rico after filing his 2022 tax return as a U.S. citizen. In this scenario, John would need to file Form 8898 to inform the IRS of his change in residence.

6. I ceased to be a bona fide resident of a U.S. territory. Do I need to file Form 8898?

Yes, if you were a bona fide resident of a U.S. territory and your worldwide gross income exceeds $75,000, you would need to file Form 8898 with your tax return to inform the IRS that you’re no longer a bona fide resident of that U.S. territory.

7. What does it mean to be a bona fide resident of a U.S. territory?

As a bona fide resident of a U.S. territory, you have substantial presence, a domicile, and economic relations in that territory. For example, if you moved from Texas to Puerto Rico and set up a permanent home, work, and community connections there, you’d likely be considered a bona fide resident of Puerto Rico.

8. Can I be a bona fide resident of more than one U.S. territory?

No, you can’t claim bona fide residence in more than one U.S. territory or the U.S. and a U.S. territory for any tax year. You’re either a bona fide resident of a U.S. territory or the U.S., but not both.

Source: IRM 21.8.1.5.3 (10-01-2014)

We hope this FAQ guide has helped clarify the complexities surrounding Form 8898 and bona fide residence in U.S. possessions. If you need further assistance, consider consulting a tax professional with experience in international transactions and U.S. taxation policies.

***Disclaimer: This communication is not intended as tax advice, and no tax accountant -client relationship results**