Foreign Owned Multiple Member LLC (Partnerships)

Required Forms to file:

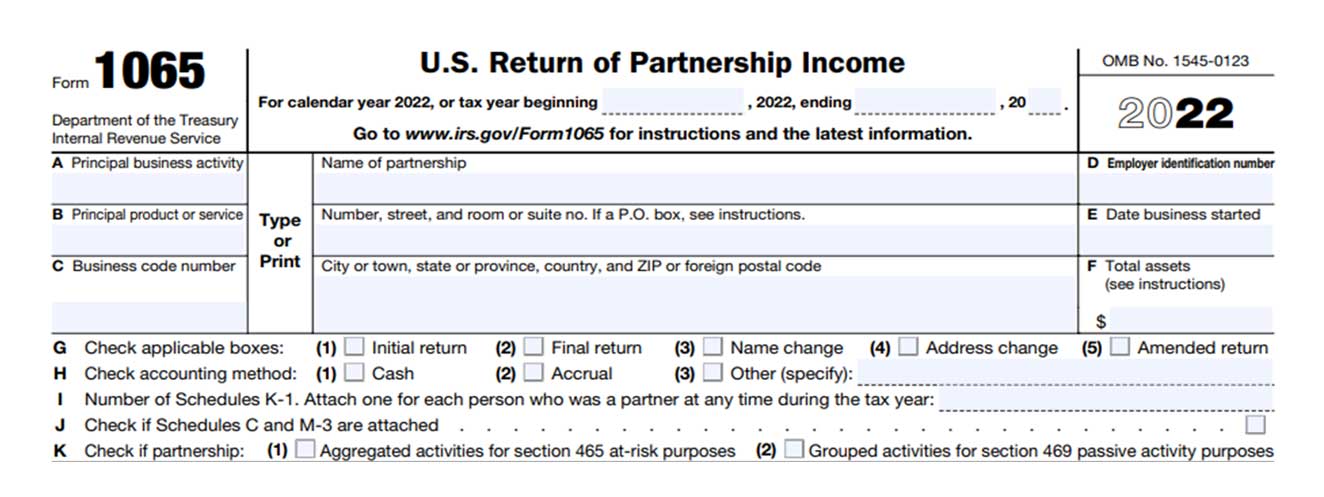

Form 1065, K-1, K-2, and K-3

Form 1065, K-1, K-2, and K-3

Starting Rate Or Base Rate: $1000

WHAT’S INCLUDED IN THE BASE RATE

- $1000 up to 4 partners

- Base Price applies only to partnerships with Gross Revenue (GR) between $0 - $120K

- Base price assumes all partners are foreign partners and there are NO U.S partners involved

RATES INCREASES WHEN GR EXCEEDS $0 - $120K

- $1,100 For Gross Revenue (GR) between $120.1K - $600K up to 4 partners

- $1,350 For Gross Revenue (GR) between $600.1K - $1.2M up to 4 partners

- $1,650 For Gross Revenue (GR) between $1.21M - $2.4M up to 4 partners

- $1,950 For Gross Revenue (GR) between $2.41M - $3.6M up to 4 partners

- $2,500 For Gross Revenue (GR) between $2.41M - $3.6M up to 4 partners

- Price increases by $250 per additional partner – after the 4th partner

- Price increases by $500 per additional state tax return

OTHER COMPLEX ISSUES THAT MAY INCREASE YOUR FEES

- Pricing above does not include 5471 required when U.S partnership have ownership in a foreign company.

- If the partnership has 5471 or FBAR requirements in addition to the normal tax returns, please contact us directly for pricing

- If the partnership has Effectively Connected Income and required to attached form 8804, 8805 and 8813, please contact us directly for pricing

- If the partnership has 1042/1042-S requirement because an FDAP income was paid out to a foreign person, please contact us directly for pricing

IMPORTANT DUE DATES

- Due Date for a calendar year Taxpayer is March 15, 2024

- Extended Due Date for a calendar year Taxpayer is September 16, 2024

- If you won't be ready to file your tax return by Tax Day, complete form 7004, granting you the ability to delay filing a completed return until September 16, 2024