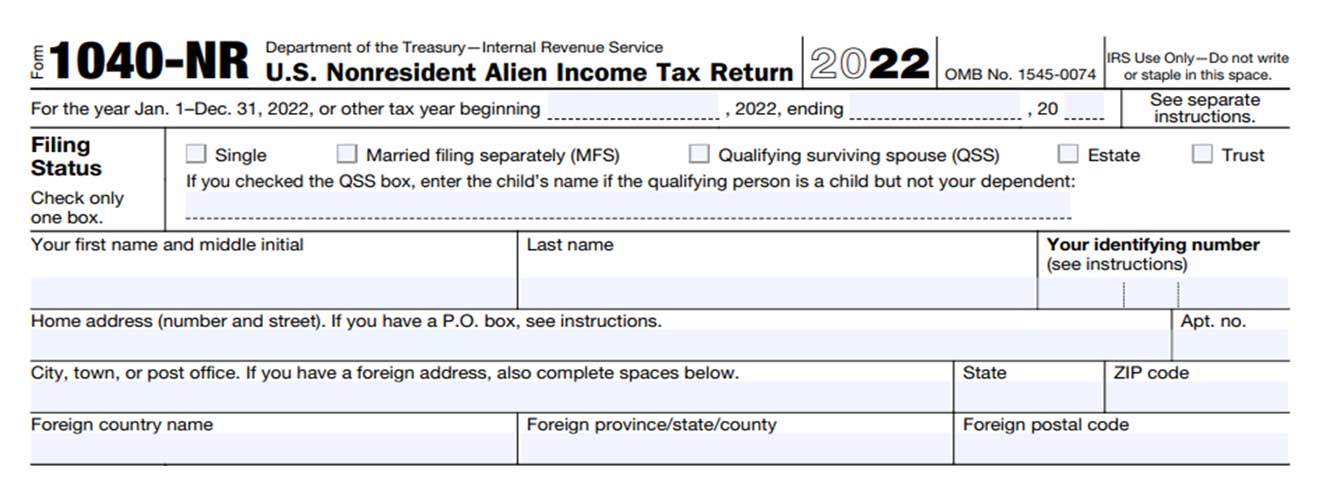

Form 1040NR & 1 Schedule E – Real Estate And Rentals

Form 1040-NR

Form 1040-NR

Starting Rate Or Base Rate: $500

IMPORTANT DUE DATES FOR NONRESIDENTS ALIENS WITH U.S SOURCE WAGES

- Due Date for Nonresident Alien (NRA) with U.S wage income is April 15, 2024.

- Payment Due Date is April 15, 2024.

- Extended Due Date October 15, 2024

- Note that an extension to file is not an extension to pay.

- If you won't be ready to file your tax return by Tax Day, complete form 4868, granting you the ability to delay filing a completed return until October 15, 2024

WHAT’S INCLUDED IN THE BASE RATE

- Base Rate includes Form 1040-NR and all related schedules and attachment

- It also include form 8843 or 8833 – if applicable

- Price increases by $250 per additional Schedule B, C, E or D.

- The minimum rate stated above DOES NOT include ITIN Applications.

- If a taxpayer needs an ITIN, an additional fee of $500 will charged.

- Schedule C and E Filers MUST have an accurate financial statement such as profit and loss prior to engaging our firm.

IMPORTANT DUE DATES FOR NONRESIDENTS ALIENS WITHOUT U.S SOURCE WAGES

- Due Date for all other NRA with U.S. taxable income is June 17, 2024

- Payment Date for all other NRA with U.S. taxable income is June 17, 2024

- Extended Due Date for all other NRA with U.S. taxable income is December 16, 2024

- If you won't be ready to file your tax return by June 17, complete form 4868, granting you the ability to delay filing a completed return until December 16, 2024

- Note that an extension to file is not an extension to pay