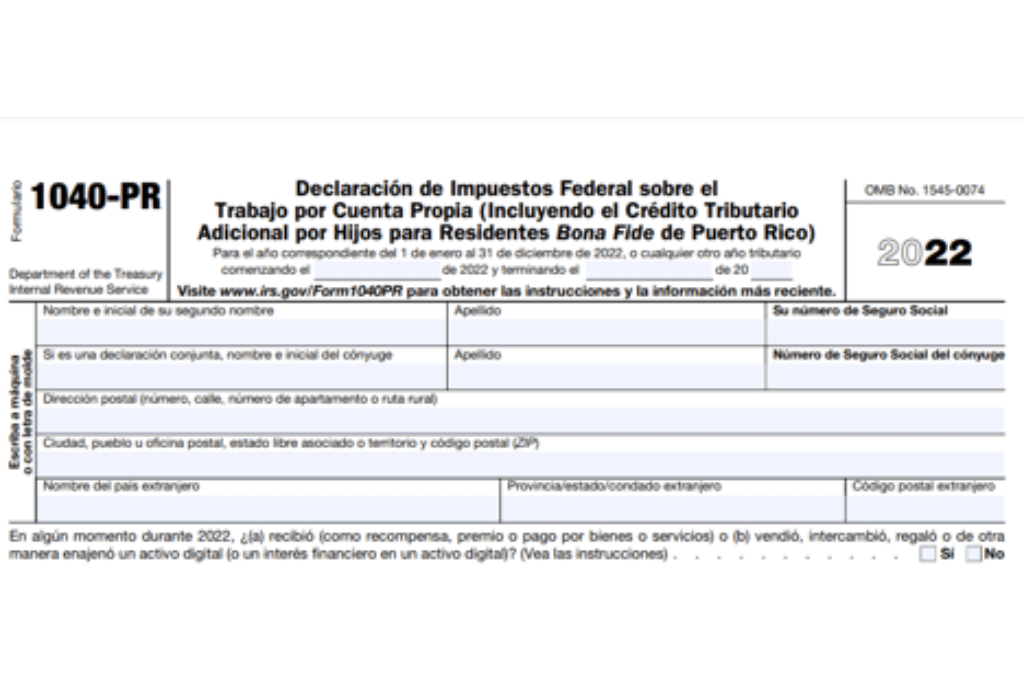

Understanding Form 1040-PR and 1040-SS

What is the purpose of Form 1040-PR and Form 1040-SS?

Form 1040-PR and Form 1040-SS are specifically for taxpayers who reside in Puerto Rico, Guam, American Samoa, the U.S. Virgin Islands, or the Commonwealth of the Northern Mariana Islands (CNMI). They are used to report net earnings from self-employment and pay self-employment taxes, pay any household employment taxes, claim excess social security tax withheld, pay any employee social security and Medicare tax on unreported tips or wages, claim the Refundable Child Tax Credit (only for qualified bona fide residents of Puerto Rico for 2021), claim the Additional Child Tax Credit (for years before and after 2021), report and pay the Additional Medicare Tax (IRM 21.8.1.5.5 (10-01-2022)).

1. What are the different parts of Form 1040-PR and Form 1040-SS?

Both forms consist of six parts:

- Part I: Total Tax and Credits

- Part II: Bona Fide Residents of Puerto Rico Claiming Additional Child Tax Credit

- Part III: Profit or Loss from Farming Section C

- Part IV: Profit or Loss From Business (Sole Proprietorship)

- Part V: Self-Employment Tax

- Part VI: Optional Method to Figure Net Earnings

Each part must be filled out for the primary and secondary taxpayer.

2. How do I claim the Refundable Child Tax Credit (RCTC)?

For tax year 2021 only, the Refundable Child Tax Credit (RCTC) is claimed directly on Form 1040-PR or Form 1040-SS. The RCTC is entered on Part I, Line 9 of these forms. Only bona fide residents of Puerto Rico with a qualifying child or children according to IRC § 24(c) and 152 (b)(3) can claim the RCTC on either form. The qualifying child or children must be U.S. citizens or U.S. nationals.

3. What should I do if the RCTC is claimed on my form?

When RCTC is claimed, the taxpayer’s city and U.S. Territory residence must be present on the document to verify residency in Puerto Rico. If not in Puerto Rico, the IRS will disallow the RCTC using letter 105C and formal claim rejection procedures.

4. What requirements must be met to claim the Refundable Child Tax Credit (RCTC)?

The taxpayer must be a bona fide resident of Puerto Rico, and the qualifying child or children must be U.S. citizens or U.S. nationals, unless such individuals are residents of the United States. If RCTC is claimed, the taxpayer’s city and U.S. Territory residence must be present on the document to verify residency in Puerto Rico.

5. Which filing statuses are available on Form 1040-PR or Form 1040-SS?

There are five filing statuses available:

- Single

- Married filing jointly

- Married filing separately

- Head of Household

- Qualifying Widow(er)

6. What information is required for claiming the Child Tax Credit?

Dependent information from Part 1, line 2, Qualifying Children, is used to compute the child tax credit. Schedule 8812 is not required, but you must include the qualifying child or children’s names, SSN, and relationship on the form. There must be at least one qualifying child for the RCTC.

7. What changes were made to Form 1040-PR and Form 1040-SS for the tax year 2020 and 2021?

For the tax year 2020, a new line 11 was added to enter the deferral of self-employment and household employment taxes as permitted by Section 2302 of the CARES Act (PL 116-136). For tax year 2021, line 11 was designated for the Credit for qualified sick and family leave wages.

8. Which resource should I refer to for specific guidelines about these forms?

The instruction booklets for Form 1040-PR and Form 1040-SS contain the specific guidelines. Do not use Publication 17 for these forms. They provide the most accurate and relevant instructions.

9. What happens if the Tax Identification Number (TIN) of a dependent is missing?

In such cases, the IRS will correspond with the taxpayer to perfect a return when the TIN of the dependent is missing. It’s crucial to ensure all necessary details are correctly filled in to avoid delays or complications with your tax return.

10. Who can claim the Additional Child Tax Credit on Form 1040-PR and Form 1040-SS?

Only qualified bona fide residents of Puerto Rico can claim the Additional Child Tax Credit for years before and after 2021. Bona fide residents of other U.S. territories cannot claim the RCTC on an income tax return filed with the United States, but may claim RCTC on an income tax return filed with the territory.

11. How are self-employment taxes handled for individuals residing in U.S. territories?

While the income tax rules are coordinated for an individual who is a bona fide resident of a territory, individuals are still subject to U.S. self-employment tax, and this tax is payable to the IRS. The self-employment taxes are reported and paid through Form 1040-PR and Form 1040-SS.

These FAQs offer a simplified understanding of complex tax forms. However, they should not replace official IRS documentation or professional tax advice. For more specific information, consider consulting a tax professional or reaching out to the IRS directly.

***Disclaimer: This communication is not intended as tax advice, and no tax accountant -client relationship results**