California FTB Demand for Tax Return notices to Out-Of-State sellers: Deep dive into PL 86-272 and the concept of Doing Business in California

What Does an FTB “Demand for Tax Return” Notice Mean—and How Should You Respond?

Due to California’s lucrative market, extensive infrastructure, and geographic prominence, many remote or out of state sellers continue to take advantage of the opportunities that abounds in California, and most have been successful at it.

According to uschamber.com:

“Because of it’s large population and consistent, calm weather, California is an ideal destination for companies to conduct businesses.”

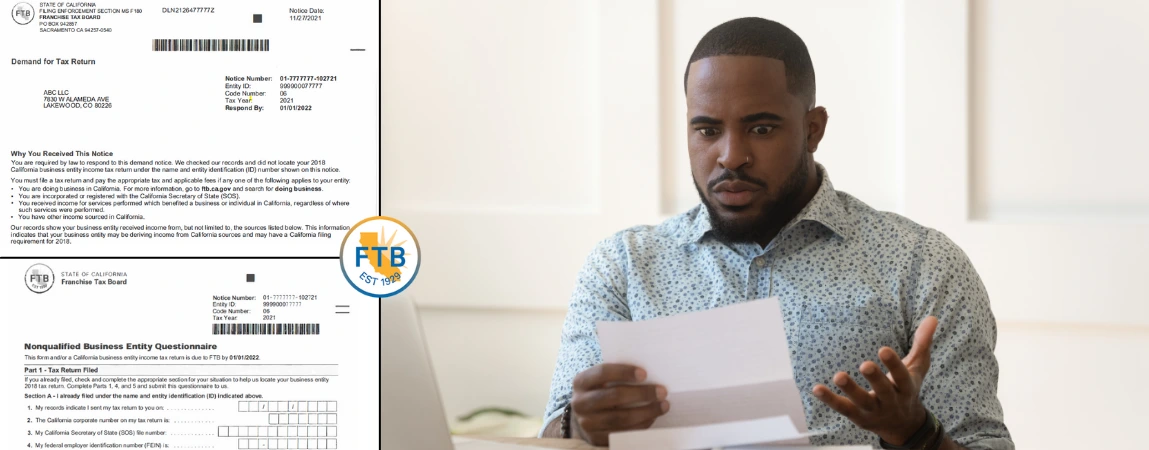

If your business sells to the California market, you may have received a Demand for Tax Return notice from the California Franchise Tax Board (FTB). These notices are legitimate and require your immediate attention.

So what does an FTB Demand for Tax Return notice mean, and how should you respond? Here are the answers to all your most important questions.

Why Am I Receiving This FTB Demand for Tax Return Notice?

FTB generally dispatches these notices based on information from the California Department of Tax and Fee Administration (CDTFA) when sellers register for sales tax account.

These FTB notices or letters are based on a presumption that the out-of-state seller may have other tax obligations and not just sale and use tax obligations . The FTB generally issues a letter notifying remote or out-of-state sellers of their Entity ID and their filing obligation.

Included with the “Demand for return (FTB 4684B ENS) letter, the FTB instructs these sellers to complete and submit a Nonqualified Business Entity questionnaire (FTB 4694 ENS).

The questionnaire includes a variety of questions which are designed to detect the possibility of Income or franchise tax nexus, and whether the seller is considered to be actively doing business or engaged in activities that are unprotected under Public Law 86-272. Such unprotected activities include maintaining inventory in California warehouses, fulfillment centers or even on consignment basis.

How Should I Respond to My Notice?

FTB sends these notices to either verify your California tax filing requirement or, more commonly, to request a missing tax return for a specific year. Whatever you do, never ignore an FTB notice or throw it away. You must take this seriously and act quickly to avoid any tax liabilities that could be imposed or assessed—as well as any related penalties and interest.

FTB generally provides at least a 30-day window for you to either respond or provide the missing return. In some cases, a simple phone call will resolve the issue. If you don’t think you’re obligated to file a California tax return, you may have to fill out the attached Non-Qualified Business Entity Questionnaire.

These questionnaires can be complicated, however, and The FTB is often very aggressive when collecting taxes. As a result, many out-of-state sellers opt to just pay in order to avoid an audit or lengthy tax litigation. Others make a mistake when filling out the questionnaire, causing the FTB to make a determination that the seller has additional tax obligations, such as a franchise or income tax.

This is why it’s always wise to consult a licensed CPA, tax attorney or other tax professional before filing a tax return or completing the questionnaire. Otherwise, you could end up paying taxes you don’t actually owe.

To accurately respond to the notice, you or your accountant will have to understand the tax laws in California, what constitutes “doing business in California,” and whether federal laws such as the Interstate Commerce Clause and P.L. 86-272 offer any protection for your kind of business activities.

When Is a Remote or Out-Of-State Seller Considered to Be “Actively Doing Business” in California?

California’s franchise tax is imposed on every corporation that is “doing business” within California, whether or not it is incorporated, organized, qualified, or registered under California law.(Rev. & Tax. Code,1 § 23151, subd. (a).)

For tax years beginning on or after January 1, 2011, a person or business entity is considered to be “actively doing business in California” in California if they meet any of the following:

- Engage in any transaction for the purpose of financial gain within California

- Are organized or commercially domiciled in California

- Your California sales exceeds the thresh amount $637,252 (2021) or 25% of total sales

- Your California real and tangible personal property exceed exceeds the amount $63,726 (2021) or 25% of total property

- Your California payroll compensation exceeds the amount 63,726 (2021) or 25% of total payroll

A Corporation doing business in California is generally taxed at a greater of its California net income multiplied by the appropriate tax (8.84%) rate or the minimum franchise tax ($800)

S Corporation doing business in California generally taxed at a greater of its California net income multiplied by the appropriate tax rate (1.5%) or the minimum franchise tax ($800)

As you can see from the tax rates above, out of state sellers with higher volume of sales in California would prefer to pay the minimum franchise tax ($800), rather than pay tax on the net income imposed on entities doing business in California. This is where the P.L. 86–272 immunity or the protection becomes important.

How Does P.L. 86–272 Protect Out of State Sellers from Imposition of Tax on Net Income?

Congress enacted P.L. 86-272 to disallow a state net income tax on interstate commerce if the only in-state activity is the solicitation of orders of tangible personal property which are approved or rejected out-of-state. The statute defines net income tax as “any tax imposed on, or measured by, net income.” (15 U.S.C. § 383).

An out of state seller obtains no immunity under Pub.L. 86–272 if their activities exceed “mere solicitation”. The taxpayer is subject to California tax measured upon net income for the taxable year and its business income properly apportioned to California.

Additionally, when a state asserts its rights to tax an out-of-state seller within the states borders, we look to Public Law 86-272 and the Supreme Court’s decision in Wisconsin Dep’t. of Revenue v. William Wrigley, Jr., Co., 505 U.S. 214, 223 (1992).

In order to enjoy the immunity provided by P.L. 86–272, the business activities within the State of California must:

- consist of solicitation of orders;

- for the sale of tangible personal property;

- which orders must be sent outside of the State for approval or rejection; and

- which must be filled by shipment or delivery from points outside the State.

However, unless an exception applies, if an entity is considered to be doing business in California, the protections afforded by Pub.L. 86–272 do not protect out-of-state sellers from filing and paying taxes that are not measured upon net income – such as

- The minimum franchise tax

- Annual limited liability company tax

- The limited liability company fee

Can you help?

This may seem complicated. To help you understand things, we’ve created a flow chart (shown below) with a basic analysis of franchise and income tax obligations within California, as well as the constitutional protection guaranteed under P.L. 86-272.

Scroll to view complete flowchart. For more clarity review the flowchart on a desktop.

DISCLAIMER

Due to the complexity of Nexus and Income sourcing rules, this flowchart may include errors and omissions. You should consult a tax professional for individual advice regarding your own situation. This flowchart is not updated for changes in the tax laws and should not be relied upon for any purpose whatsoever.

This flowchart was prepared for the sole purposes of illustrating how PL 86-272 affects remote sellers and their requirement to file Income, and/or franchise tax returns in CA, therefore Sales and Use Tax are out of scope.

Are you a remote, or out-of-state seller of Tangible Personal property or Inventories?

NO

Out of scope for the purpose of this illustration because the protection afforded by P.L 86-272 do not apply to Entities Incorporated in CA or Persons Domiciled/Residing in CA

YES

1. Remote seller is considered to be Actively Doing Business in CA

2. Activities listed are generally unprotected under Public Law 86-272

3. Remote seller is required to file and pay taxes measured on net income

—A C Corp pays GREATER of its California (1) net income multiplied by the appropriate tax (8.84%) rate or (2) the minimum franchise tax ($800)

—An S Corp pays GREATER of its California (1) net income multiplied by the appropriate tax rate (1.5%) or (2) the minimum franchise tax ($800)

—An LLC Pays both the(1) Annual LLC tax ($800), AND (2) The LLC fee ( Depends on CA Income)

—Sole Proprietors or self employed remote sellers will file a personal return CA 540NR

NO

Does the entity or the remote seller In-State activities in CA

1. Consist of In-State in-state recruitment, training, and evaluation of sales Reps,

2. In-State use of hotels and homes for sales-related meetings, for

3. The purpose of soliciting orders or facilitating requests for purchases, of

4. Tangible personal property such as , products, inventories etc, where

5. Orders are sent outside CA for approval, and where

6. The goods are delivered from out-of-state?

The limited examples above can be found in a Landmark Supreme Court Case – Wisconsin Dept. of Revenue v. William Wrigley, Jr., Co., 505 US 214 (1992)

**For a comprehensive list of what constitutes solicitation and protected activities- see page 7

YES TO ALL OF THE ABOVE & MORE

Is the entity or the remote seller engaged in activities that are not considered as either solicitation of orders or ancillary? such as

1. Maintaining inventory via consigment or fulfillment centers

2. In-state replacement of inventories

3. In-state storage and supply of inventories, etc.

The limited examples above can be found in a Landmark Supreme Court Case – Wisconsin Dept. of Revenue v. William Wrigley, Jr., Co., 505 US 214 (1992)

**For a comprehensive list of what goes beyond solicitation and unprotected see page 5 & 6

YES

Do you own an internet website, advertise online and where CA customers places orders via phone, fax or email and where the products are shipped from out-of-state to California?

YES

For 2021, Does your:

1.CA Sales Exceed $637,252 or 25% of total sales?

2. CA Real and Tangible personal property Exceed $63,726 or 25% of total property?

3. CA Payroll Exceed $63,726 or 25% of total payroll?

NO

1. Remote seller is not considered to be actively doing business in CA

2. Activity is protected under Public Law 86-272

3.Remote seller not subject to the CA Minimum Franchise Tax

YES

1. Remote seller is considered to be Actively Doing Business in CA

2. Activities listed are generally protected under Public Law 86-272

3. However, Remote seller is required to file and pay the Minimum Franchise Tax

–For C & S corp the tax is $800

–For LLCs, the tax includes the (1) Anuual LLC Tax, and (2) the LLC Fee

YES

If you’d like more assistance, I’d be happy to help. As a licensed CPA, I’ve helped countless businesses and individuals address whether or not they have income tax obligations or are otherwise protected under P.L. 86-272.

Just contact me, and I’ll get right back to you.

If you’re in need of professional bookkeeping services, we recommend visiting our subsidiary, URSA Services LLC. They specialize in keeping your finances in order so you can focus on growing your business. Don’t worry, we’ll still be here to handle all your tax needs. Visit URSA Services LLC today to learn more!!

Book a paid consultation

Yes, Book My Slot

***Disclaimer: This communication is not intended as tax advice, and no tax accountant -client relationship results**