Do You Need an ITIN for Your Non-Resident Alien/Foreign Spouse If You’re “Married Filing Separately?”

Recently, I received this question:

“I married a Non-Resident Alien this year, she is not interested in filing jointly, therefore I’ll have to file as ‘Married Filing Separately’.

Another issue is that my foreign spouse does not have an ITIN or SSN. Can I still file as Married Filing Separately ?

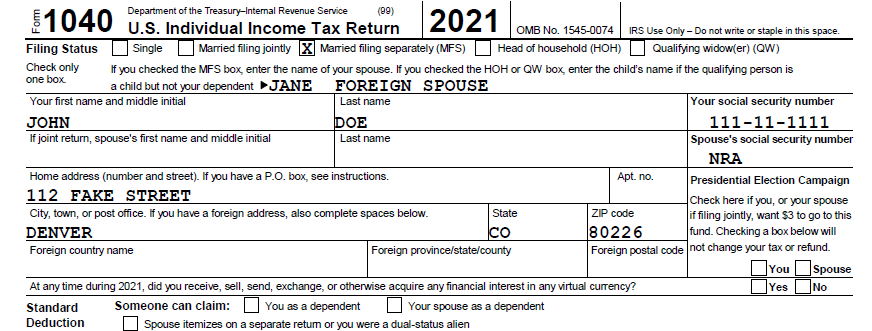

The simple answer is yes—you can. You are not required to have an ITIN or SSN for your Non-Resident or Foreign spouse when filing as Married Filing Separately. In your case, all you have to do is write “NRA” where your spouse’s ITIN or SSN would normally go.

You can find the instructions for this in the latest version of the IRS Publication 17. On page 24, it says:

“If your spouse doesn’t have and isn’t required to have an SSN or ITIN, enter‘NRA’ in the space for your spouse’s SSN.”

The instruction above will generally work for paper filing; however, some tax preparation software’s — such as Taxact — will allow you to e-file as Married Filing Separately without your spouse’s SSN or ITIN.

Every year, I successfully e-file tax returns for my clients even when their spouses don’t have an ITIN or SSN.

If you’d like some help with your tax return, I’d be happy to lend a hand. As a licensed CPA, I’ve helped countless taxpayers across the world file their US taxes and optimize their financial strategies.

Just contact me, and I can:

- Gather and review all the necessary documents

- Prepare your tax forms

- E-file or mail on your behalf

…so you can focus on other things.

I look forward to hearing from you!

Click here to get in touch today.

If you’re in need of professional bookkeeping services, we recommend visiting our subsidiary, URSA Services LLC. They specialize in keeping your finances in order so you can focus on growing your business. Don’t worry, we’ll still be here to handle all your tax needs. Visit URSA Services LLC today to learn more!!

***Disclaimer: This communication is not intended as tax advice, and no tax accountant -client relationship results**