Can You Still Claim an Education Tax Credit Even Without Form 1098-T?

Every tax season, countless U.S. students file their tax returns in hopes of claiming their IRS education credits. In some cases, they find that they’re missing a crucial document: Form 1098-T. The IRS may even deny their claim for education credits because of this.

So what are you supposed to do if you never received Form 1098-T at all? Don’t panic. I’m here to help.

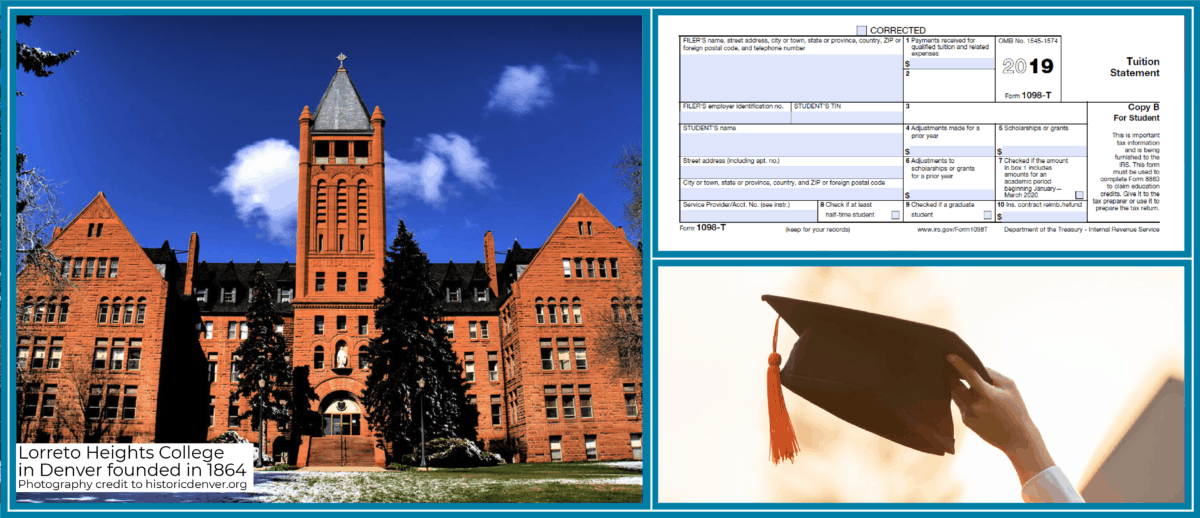

What is Form 1098-T —and what if I never received one?

Form 1098-T is a form your school sends both you and the IRS to show:

- Payments received for qualified tuition and related expenses

- Scholarships or grants received

- Tuition billed by educational institution

You can use it to calculate the credit you (or your parents) can claim on a tax return.

The two tax credits available are the American opportunity tax credit (AOTC) and the lifetime learning credit (LLC). The AOTC and LLC each have different qualifications for eligibility, but either can provide a maximum annual credit of $2,500 per year – income limitations may apply

So what if your school never sent you Form 1098-T? Are you just out of luck—and maybe a whole heap of money?

No! Form 1098-T is an information return and will not affect your ability to claim an education credit so long as the school is a qualified education institution and the student meets the criteria. But many students without the right advice in their corner will end up paying the proposed tax assessed anyway.

I’ve come across several cases where IRS arbitrarily denies taxpayers their education credits because they did not have Form 1098-T. In most cases, taxpayers are afraid of being harassed by the IRS and will pay the taxes being assessed by the agency even when they are not required to pay to get the IRS off their back.

But even if the IRS denies your education credit for not having Form 1098-T, you don’t necessarily have to agree and pay. According to the IRS itself – see FAQ 19 & 20, you can still claim an education credit if:

- The student and/or the person claiming the student as a dependent meets all the requirements to claim the credit

- The student can prove that they were enrolled at an eligible school

- They have records of their payments of qualified tuition and other related expenses

There are several possible reasons your school might not have issued you a Form 1098-T. A classic example would be an F-1 student who became a resident alien for tax purposes but failed to notify his school of such changes. An F-1 visa holder may not receive 1098-T due to the failure to report their current tax or residency status to the school, but the absence of 1098-T should not be a basis for denying a credit on a U.S. resident tax return.

But whatever the reason, don’t panic. You can still get that education tax credit.

Here’s how to claim your tax credits even if you never received Form 1098-T:

Records, records, records. Without a Form 1098-T, you’ll need some records that:

- Shows tuition receipts and transcripts to verify enrollment in an accredited colleges, universities, and vocational schools

- Shows proof of payment of expenditures via cancelled check or electronic funds payment confirmation, credit card statement, or paid receipt from the institution

Once you know you have those, go ahead and claim the education credit you qualify for on your tax return. Then, if the IRS contacts you regarding your claim for the education credit, you might have to send copies of your records to them.

Once it’s clear that you’re eligible—with or without Form 1098-T—you should be able to receive your education credit.

And that’s it! It really is that simple. So don’t let a denial notice from the IRS scare you into paying more than you’re obligated.

If you’d like some help dealing with the situation, I’d be happy to help. I’ve helped people get their education credit in the past, even when the IRS was stonewalling them. Just let me know, and I’ll make sure you get what you’re entitled to…

Contact me, and let’s talk.

***Disclaimer: This communication is not intended as tax advice, and no tax accountant -client relationship results**