Election and Revocation of Form 2555: A Step-by-Step Guide

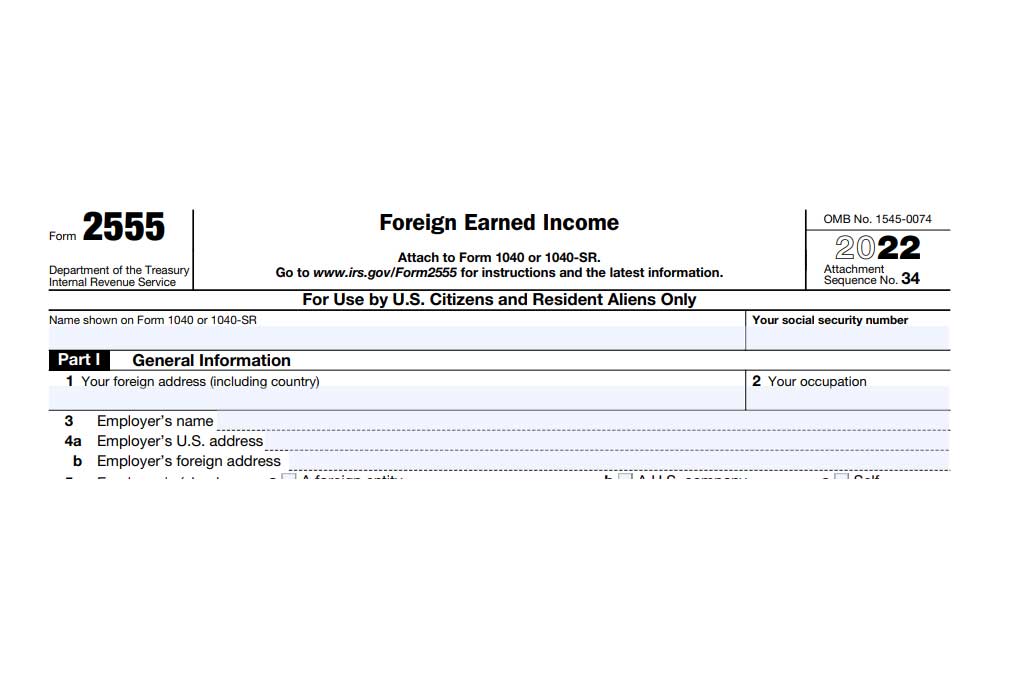

Understanding U.S. tax laws, specifically those related to international transactions, can seem overwhelming. However, with a clear explanation, they can become much more manageable. This article aims to demystify the tax rules surrounding the election and revocation of Form 2555, as set out in IRM 21.8.1.3.6 (as of 10-01-2019).

1. The Power of Choice and Its Lasting Impact

Once a taxpayer opts to exclude foreign earned income or housing amount on Form 2555, this election stays in effect for that year and all subsequent years. This is a crucial decision, as it has long-term implications for your tax filings.

2. Revoking Your Decision and Its Consequences

However, this decision is not irrevocable. A taxpayer can choose to reverse their earlier decision, but this action comes with its own consequences. Once a choice is revoked, a new election cannot be made before the sixth taxable year after the revocation without explicit consent from the IRS.

3. The IRS’s Role in Election Revocation

When a taxpayer submits an amended return revoking a Foreign Earned Income election, the IRS follows standard adjustment procedures. They make the requested adjustment and scrutinize the following years to ascertain if the Foreign Earned Income election was exercised. If it was, the taxpayer will receive written notice from the IRS that they might need to file corrected returns for those years.

To illustrate, consider a taxpayer who files a Form 1040X for tax year 2021, revoking the Foreign Earned Income election. If the IRS finds that the same taxpayer exercised the election in tax year 2022, they will adjust the tax for 2021 and advise the taxpayer that they may need to correct their return for 2022. This is because the Foreign Earned Income election was revoked in 2021, and a new election cannot be made before the sixth taxable year after the revocation without the IRS’s consent.

4. Seeking IRS Consent for Reelection

If a taxpayer wants to make a new election before the sixth taxable year after the revocation, they must request a Private Letter Ruling (PLR) from the IRS. This request must be submitted with the appropriate fee to the following address:

Associate Chief Counsel (International)

Internal Revenue Service

ATTN: CC:PA:LPD:DRU Room 5336

1111 Constitution Avenue

Washington, DC 20044

Remember to mark your package as: RULING REQUEST SUBMISSION. The first Revenue Procedure each year (currently Rev. Proc. 2020-4), published in the Internal Revenue Bulletin, includes the fee schedule.

Understanding these complex tax concepts can empower you to make informed decisions about your tax returns. Whether you choose to exclude foreign earned income or not, remember, your choice has lasting implications.

***Disclaimer: This communication is not intended as tax advice, and no tax accountant -client relationship results**