FAQ: Understanding Form 673 and Its Role in U.S. Taxation for Citizens Employed Abroad

Navigating tax laws can be challenging, especially when it comes to working abroad. This article simplifies the complex tax concepts related to Form 673, which U.S. citizens employed abroad may use to discontinue income tax withholding from their wages. Using IRM 21.8.1.3.9 (10-01-2013), we will explain these concepts in a relatable and easy-to-understand manner, providing relevant examples to help illustrate the points.

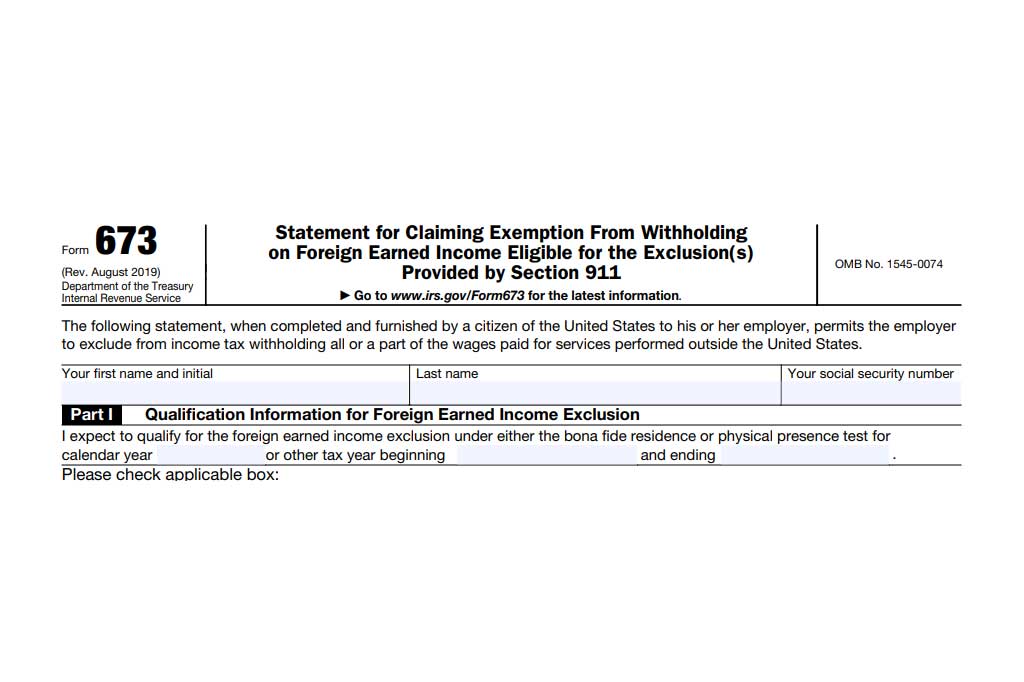

1. What is the purpose of Form 673?

Form 673, Statement for Claiming Benefit of IRC 911, is a document provided by the Internal Revenue Service (IRS) for U.S. citizens working abroad. Its main purpose is to allow qualifying individuals to stop the withholding of income tax from their wages.

2. Who needs to use Form 673?

Form 673 is exclusively for U.S. citizens or resident aliens who are employed outside the United States and meet the qualifications of IRC 911(d). It’s important to note that Form 673 can only be used by a U.S. citizen.

3. What is IRC 911(d) and who qualifies under this section?

IRC 911(d) refers to individuals who meet specific conditions related to their foreign residence or presence. For example, they must either meet the bona fide residence test, meaning they have established a genuine residence in a foreign country, or the physical presence test, which requires them to be physically present in a foreign country for a defined period.

4. How does Form 673 work?

An employee must file a signed statement, which includes a declaration under penalties of perjury, along with a current Form W-4. This declaration states they meet or will meet the qualifications of IRC 911(d) for the taxable year and that they are exempt from tax on the maximum foreign earned income exclusion amount of earned income for the year in question. Form W-4 must specify either the exempt status (and the taxable year for which the Form W-4 is effective) or the number of withholding allowances allowed, based on exemptions, deductions, and credits.

5. What happens once I file Form 673?

Once you submit Form 673, your U.S. employer will discontinue withholding income tax from your foreign-earned wages. However, they will continue to withhold tax from any wages you earn in the United States and any income exceeding the IRC 911 limitations.

6. What if I can’t submit Form 673?

If you’re unable to submit Form 673, a statement indicating that you will meet either the bona fide residence test or the physical presence test and provide the estimated housing cost exclusion can be accepted in lieu of Form 673.

7. What is IRC 3402(a) and how does it relate to Form 673?

IRC 3402(a) is a provision in the U.S. tax code that requires employers to withhold taxes from wages earned at the “source”. However, Form 673 allows an employer to discontinue withholding income tax for a qualifying U.S. citizen or resident alien employed abroad.

8. What is IRC 3401(a)(8)(A)?

IRC 3401(a)(8)(A) is another provision in the U.S. tax code that allows employees to file a signed statement declaring they meet or will meet the qualifications of IRC 911(d) for the taxable year. The statement should also confirm they are exempt from tax on the maximum foreign earned income exclusion amount for that year.

9. What information should be provided in Form W-4?

In conjunction with Form 673, a current Form W-4 should be submitted. This form should specify either the exempt status and the taxable year for which the Form W-4 is effective, or the number of withholding allowances based on exemptions, deductions (including the IRC 911 deduction), and credits.

10. Where do I submit Form 673?

Form 673 is not filed with the IRS but is instead provided to your U.S. employer. In case the IRS receives Forms 673, they will forward them to the employer.

Remember, while this FAQ simplifies complex tax law, it’s always recommended to consult with a tax professional or advisor when dealing with tax matters. The U.S. tax code can be intricate, and every individual’s tax situation is unique. This FAQ is a starting point for understanding your responsibilities as a U.S. citizen or resident alien working abroad.

***Disclaimer: This communication is not intended as tax advice, and no tax accountant -client relationship results**