When Are Foreign-Owned Single-Member LLCs Exempt From Filing Form 5472?

When Are Foreign-Owned Single-Member LLCs Exempt From Filing Form 5472?

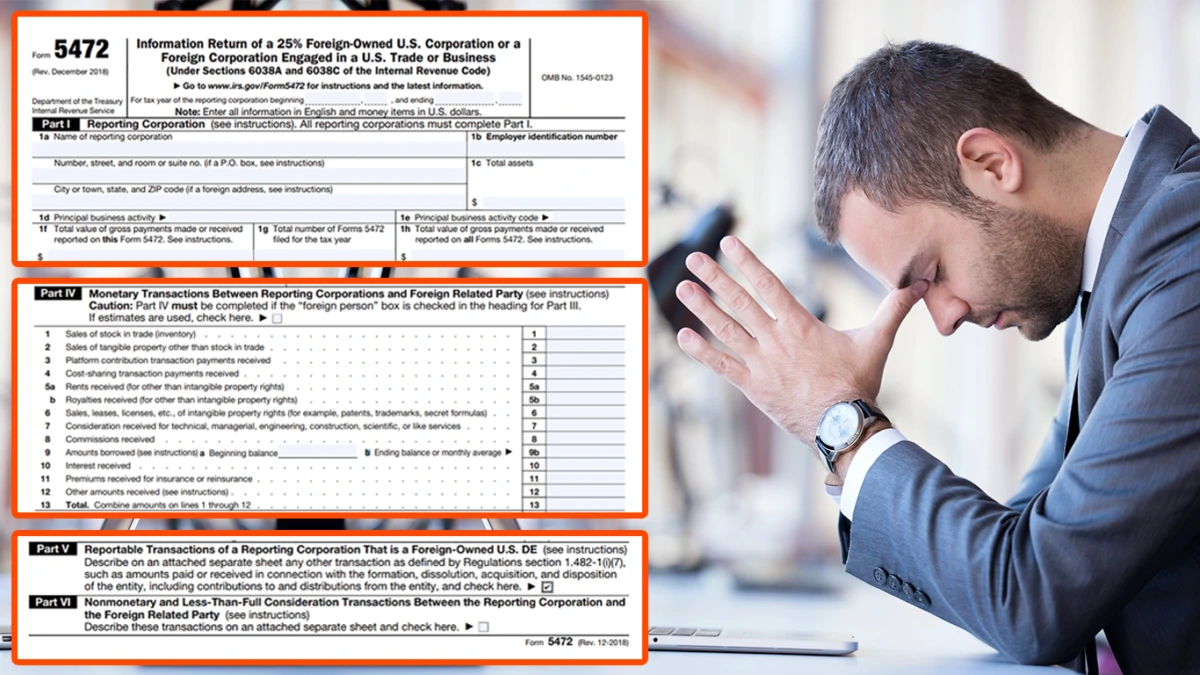

In one of my previous articles, What Forms Do Foreign-Owned Single Member LLCs Have to File?, I stated that:

“All foreign-owned single-member LLCs are required to … File Form 5472, if there have been any ‘reportable transactions’ during the previous tax year. Formation and dissolution filings are considered to be reportable transactions.”

Recently, I received an email from a reader who thought that this section might be misleading. They pointed out that according to the IRS document” Instructions for Form 5472 (Rev. December 2019)…

A reporting corporation is not required to file Form 5472 if any of the following apply. It had no reportable transactions of the types listed in Parts IV and VI of the form…

…And since formation and dissolution filings are listed in Part V, not in Parts IV or VI, they are not considered reportable transactions. Thus, if the transactions of an LLC only consist of formation and dissolution filings, that LLC would not be required to file Form 5472.

So, was my previous article incorrect? No. The exemption listed above (in my opinion) is not applicable to foreign-owned single-member LLCs.

Let me explain why that is…

First off, IRS instructions or publications like the one cited above are extremely useful resources for illustrating certain complex tax issues and procedures. They’re usually great for breaking the tax code down into layman’s terms and clearing things up for confused taxpayers. (And you should certainly follow those instructions, but with great caution and scrutiny).

However, these IRS instructions and publications are generally not authoritative sources of federal tax law and not binding on the IRS itself or the U.S. Tax Court. “Taxpayers who rely on them exclusively do so at their own peril”– see Caterpillar Tractor Co. v. United States, 589 F.2d 1040 (1978).

A number of court cases involving taxpayers and the Commissioner of Internal Revenue (C.I.R.) have consistently emphasized this fact. For example:

- Mohamed v. C.I.R., T.C. Memo. 2012-152 (2012), the court stated that: “Authoritative sources of federal tax law are in the statutes, regulations, and judicial decisions and not in such informal publications as form instructions.”

- Zimmerman v. C.I.R., 71 T.C. 367, 371 (1978), the court stated that:“Taxpayers must look to authoritative sources of federal tax law such as statutes, regulations, and judicial decisions and not to informal publications provided by the IRS.”

- McNealy v. C.I.R., T.C. Summary Opinion 2014-14,the court quoting earlier decisions emphasized that: “Informal IRS publications are not authoritative sources of federal tax law; rather, applicable statutes, regulations, and judicial decisions constitute the authoritative sources of law that inform the Tax Court’s decisions.”

- Dorsey v. C.I.R., T.C. Memo. 2006-50 (2006) the court stated that: “Administrative guidance set forth in an informal IRS publication is not an authoritative source of federal tax law and does not bind the government.”

From the various judicial decisions referenced above, we know with certainty that the following types of guidance are binding with regard tofederal tax law:

- Internal Revenue Code (“I.R.C”)

- Treasury Regulations

- Judicial Decisions or Case Laws

The list above is not all inclusive, this article from The Tax Adviser provides a much comprehensive review of binding and non-binding documents or guidance available.

So in order to understand what’s truly required for foreign-owned single-member LLCs, we have to take a look at the actual statutes and regulations in question.In this case, that would be Code of Federal Regulations (CFR) Title 26, Section 1.6038A-2.

Section 1.6038A-2 provides both the requirement and the exception to filing Form 5472. It states that:

“A reportable transaction is any transaction of the types listed in paragraphs (b)(3) and (4) of this section.”

For foreign-owned single-member LLCs, one of the most relevant part is 1.6038A-2(b)(3), which says that:

“If the related party is a foreign person, the reporting corporation must set forth on Form 5472 the dollar amounts of all reportable transactions for which monetary consideration (including U.S. and foreign currency) was the sole consideration paid or received during the taxable year of the reporting corporation. The total amount of such transactions, as well as the separate amounts for each type of transaction described below, and, to the extent the form may prescribe, any further description, categorization, or listing of transactions within these types, must be reported on Form 5472, in the manner the form or its instructions may prescribe.”

It then goes on to list the types of transactions this applies to, which includes the following:

“(xi) With respect to an entity that is a reporting corporation as a result of being treated as a corporation under § 301.7701-2(c)(2)(vi) of this chapter, any other transaction as defined by § 1.482-1(i)(7), such as amounts paid or received in connection with the formation, dissolution, acquisition and disposition of the entity, including contributions to and distributions from the entity.”

According to Form 5472 instructions, these transactions should be entered on Part V of Form 5472. Part V is for foreign-owned disregarded entities that had any other transaction as defined by Section 1.482-1(i)(7) not already entered in Part IV.

So you see, Part V merely serves as an extension for whatever did not fit into Part IV. Therefore, failure to complete Part V may be construed as a failure to complete Part IV as well.

The exception quoted from Instructions for Form 5472 at the start of this article appears in CFR Section 1.6038A-2, specifically in 1.6038A-2(e)(1). Here’s the relevant part:

“A reporting corporation is not required to file Form 5472 if it has no transactions of the types listed in paragraphs (b) (3) and (4) of this section during the taxable year with any related party.”

But since formation and dissolution filings are listed as reportable transactions in 1.6038A-2(b)(3)(xi) (cited above), foreign-owned single-member LLCs are not fully exempted from filing Form 5472. They are required to report them in Part V of Form 5472.

Failure to do so may result in a penalty. The preamble to the Final Regulation contains the following introductory information to Foreign Owners:

“First, it was and remains the intent of the Treasury Department and the IRS that the generally applicable exceptions to the requirements of section 6038A should not apply to a domestic disregarded entity that is wholly owned by a foreign person.”

It is also important to note that Treas. Regs. Section 1.6038A-2(b)(3)(xi) adds to the list of additional reporting requirements treasury intended to capture, and to ensure that Foreign-Owned Single Member LLC’s report all transactions with foreign related parties.

I understand this all may seem a bit confusing, tax is LAW and interpretations may vary, but I maintain what I said in my previous article:

- All foreign-owned single-member LLCs are required to file Form 5472 if they have had any reportable transactions during the previous tax year.

- Formation and dissolution filings are indeed reportable transactions.

For example, let’s say you form a foreign-owned single-member LLC in Tax Year 2020, and you personally pay for LLC formation or organization costs. That money you paid on behalf of the LLC is considered a reportable transaction, you must report it on Form 5472, Part V.

It may sound harsh or funny, but it is worth mentioning that the LLC did not form itself, there is always a sponsor (whether individual or an entity) behind the formation of this entity, and such sponsor will always have to pay something to form the LLC.

For a deeper understanding of how these regulations work, be sure to check out the examples in the Final Regulation T.D. 9796 yourself.

Of course, these laws are very complex. If you’d like some professional help from a qualified CPA, I’d be happy to lend a hand.

Just contact me, and I’ll see to it that you’re abiding by the U.S. tax code, reporting what you need to report, and saving every dollar you can within the limits of the law.

Click here to schedule a consultation.

If you’re in need of professional bookkeeping services, we recommend visiting our subsidiary, URSA Services LLC. They specialize in keeping your finances in order so you can focus on growing your business. Don’t worry, we’ll still be here to handle all your tax needs. Visit URSA Services LLC today to learn more!!

Related Articles:

***Disclaimer: This communication is not intended as tax advice, and no tax accountant -client relationship results**

2 thoughts on “When Are Foreign-Owned Single-Member LLCs Exempt From Filing Form 5472?”

Comments are closed.