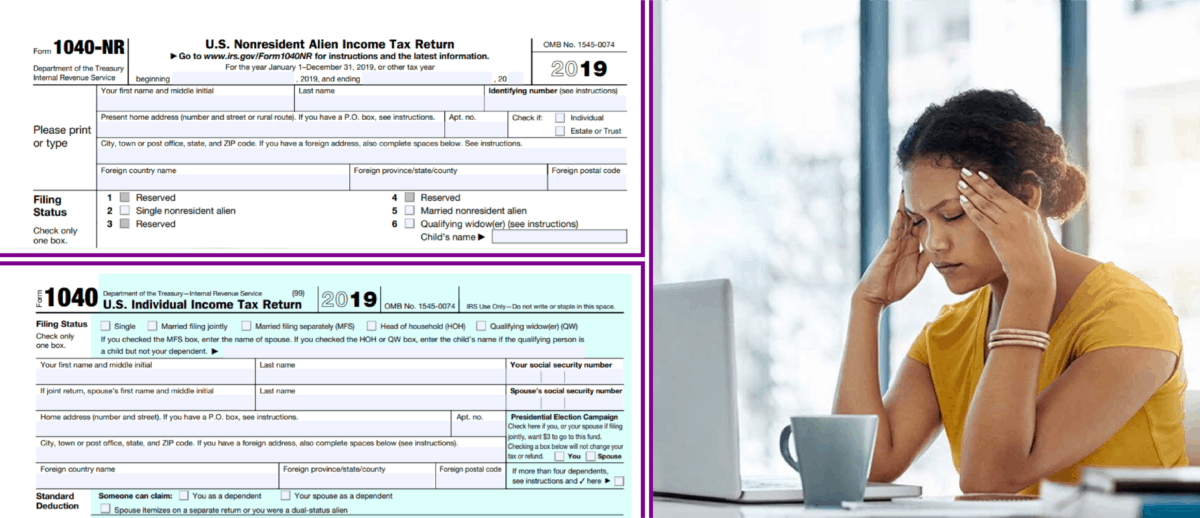

First Year Choice, 1040 NR & Dual Status Returns

QUESTION: I came to the US from India 9/23/2021 with H1-B Visa. I will be in US all of 2022 working.

How do I make the first year choice election?

ANSWER: You have the option of using the first year choice or filing form 1040NR for Tax Year 2021.

First Year Choice: The first year choice makes you a resident alien starting from the date you entered the US on H1-B, i.e 9/23/2021.

If you continue to stay in the U.S for a considerable amount of days in 2022, you may pass the substantial presence test for 2021, and if you do, you can make the first year election for Tax Year 2021

According to the IRS publication 519 – if you do not meet either the Green Card Test or the Substantial Presence Test, you can still choose to be treated as a US resident for part of 2021.

To make this choice, you must:

- Be present in the United States for at least 31 days in 2021, and

- Be present in the United States for at least 75% of the number of days beginning with the first day of the 31-day period and ending with the last day of the tax year 2021.

For purposes of this 75% requirement, you may treat up to 5 days of absence from the U.S. as days of presence in the U.S.

Based on the rules and qualifications outlined above, you may elect to be treated as a resident for 2021 because:

- You were in the U.S. for 31 consecutive days in 2021, and

-

You were in the U.S. at least 75% of the days from 9/23/2021 to 12/31/2021

There are 100 days between 9/23/2021 to 12/31/2021 and you stayed in the U.S for the entire 100 days, this means you have exceeded the 75% threshold.

-

You must wait until you have met the substantial presence test, which won’t happen until May 30 , 2022 (150 days present in the U.S.in 2022 + 33 days (100 days × 1/3 in 2021) = 183 days) before making your election to be treated as a part year resident for 2021.

**To successfully make the first-year choice election, you will have to meet the substantial present test in 2022 which wont happen for you until May 30, 2022. It is therefore advisable to file file an extension – Form 4868 on or before the due date of your tax return (this will be April 15, 2022 for tax year 2021) and wait until such time the substantial present test is met

-

Statement required to make the first-year choice for 2021.

You must attach a statement to Form 1040 or 1040-SR to make the first-year choice for 2021. The statement must contain your name and address and specify the following.

- That you are making the first-year choice for 2021.

- That you were not a resident in 2020.

- That you are a resident under the substantial presence test in 2022.

- The number of days of presence in the United States during 2022.

- The date or dates of your 31-day period of presence and the period of continuous presence in the United States during 2021.

- The date or dates of absence from the United States during 2021 that you are treating as days of presence.

-

The first year choice will make you a Dual-Status alien :

- Resident starting from 9/23/2021 , and

- Non-Resident before 9/23/2021

Unfortunately, filing as a Dual-Status Alien subjects you to the following restrictions:

- Standard Deduction – you can itemize deductions but you are not allowed to take the standard deduction.

- You cannot use the head of household filing status, or

- Married filing jointly

**For Tax Year 2018 Through Tax Year 2025, you can no longer claim personal exemptions for yourself, spouse, children or dependents – see TCJA

-

Joint Return – You cannot file a joint return if you are a nonresident unless you are married to a U.S. citizen or a resident alien and you choose to file jointly (MFJ).

If you are married to a U.S. citizen or a resident alien and you do not choose to file jointly, you must file Married Filing Separately.

Note that the Child and Dependent Care Credit as well as the Adoption Credit cannot be claimed by a married dual-status alien unless you file a joint return with a U.S. citizen or resident alien spouse.

The same provision applies to the Education Credits, Credit for the Elderly or Disabled, and the Earned Income Credit.

An unmarried dual-status alien must use the tax rates or bracket for single taxpayers

A married dual-status alien must generally use the tax rates applicable to married taxpayers filing separately.

Dual-Status restrictions do not apply if you and your spouse elect Under IRC Section 6013(g) or (h), to be taxed as full-year residents.

Electing To Be Taxed as Full Year Resident

A nonresident alien who is married to a US a citizen or resident alien of the United States at year end may elect to be treated as a resident for the entire tax year.

This includes situations where one spouse begins the year as a nonresident alien and ends the year as a resident alien, and the other spouse ends the year in nonresident status. Both taxpayers must have a valid SSN or ITIN.

IRC Section 6013(g) or (h) Election can be made even in cases where both sets of married couples were nonresident aliens for part of the calendar year, and the couples properly make multiple elections, i.e. (1) first year-choice Election, PLUS (2) 6013(g) or (h) Election to be treated as resident aliens for the entire taxable year.

To make this election taxpayers must file a joint return and attach a statement described in Treas.Reg.1.6013-6(a)(4).

Proceed with Caution: A nonresident alien married to a U.S. citizen or resident alien is taxed on worldwide income at the graduated tax rates same as a U.S. citizen or resident alien, if that person makes an election to be treated as a U.S. resident, files married filing jointly and discloses all worldwide income on the return.

Foreign tax credit can be used to offset U.S. taxes imposed on foreign source income.

Both spouses must make the election, which applies to the year made and all subsequent years until terminated.

Related Articles:

***Disclaimer: This communication is not intended as tax advice, and no tax accountant -client relationship results**