Navigating Waiver of Time Requirements for Foreign Earned Income Exclusion: An Easy-to-Understand FAQ Guide

FAQ 1: What is the Waiver of Time Requirements?

The waiver of time requirements allows certain taxpayers to exclude their foreign earned income from U.S. taxation, even if they didn’t meet the minimum time requirements under the bona fide residence or physical presence test due to war, civil unrest, or similar adverse conditions in the foreign country. The Internal Revenue Code (IRC) Section 911(d)(4) governs this waiver.

FAQ 2: Who qualifies for the Waiver of Time Requirements?

Taxpayers who qualify for the waiver must be able to show that they reasonably could have expected to meet the minimum time requirements if they had not been required to leave the foreign country due to adverse conditions.

FAQ 3: How do I claim the Waiver of Time Requirements?

To claim the waiver, you need to:

- Submit a statement with your tax return explaining that you expected to meet the applicable time requirements, but the conditions in the foreign country prevented you from the normal conduct of business, and

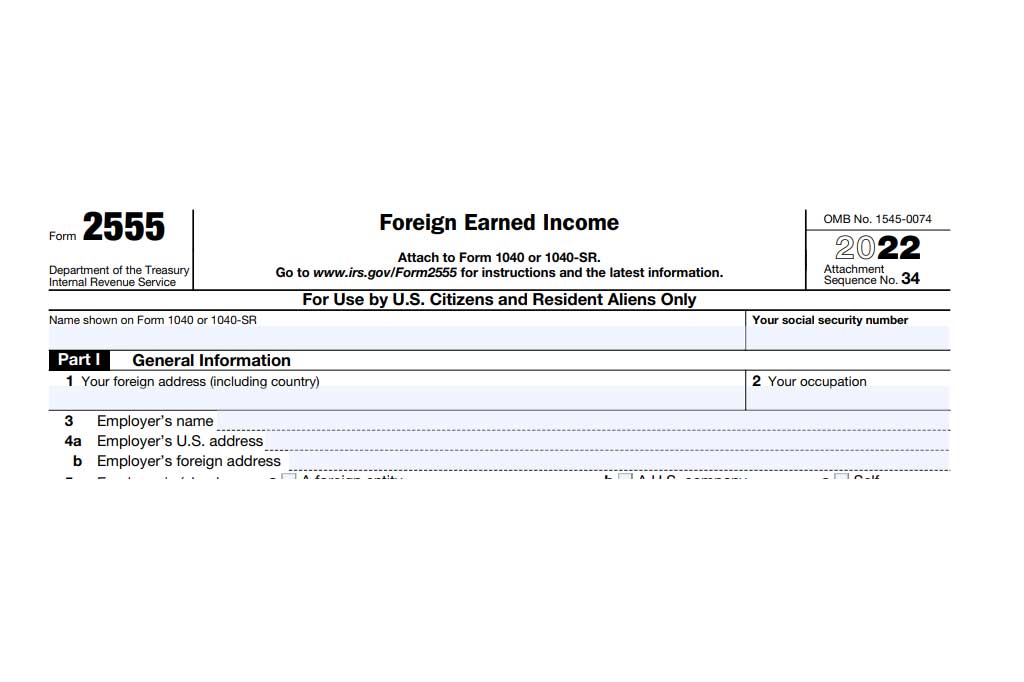

- Write “Claiming Waiver” in the top margin on page 1 of Form 2555.

FAQ 4: What if I don’t have documentation to prove my intent to meet the physical presence time requirement?

If you don’t have the documentation to prove your intent, you must provide a statement with a complete explanation. If the IRS determines that you meet the waiver based on your statement, they will allow the election.

FAQ 5: What countries and dates were eligible for the IRC 911(d)(4) waiver in recent years?

The IRS issues a Revenue Procedure each year to list the countries and dates eligible for the IRC 911(d)(4) waiver. For instance, for the tax year 2019, individuals who left the Democratic Republic of the Congo on or after January 13, 2019, or Haiti on or after February 14, 2019, are treated as qualified individuals with respect to meeting IRC 911.

Example 1: Suppose you are a U.S. taxpayer working in the Democratic Republic of the Congo. You arrived there on September 1, 2018, intending to work for an entire year. However, due to escalating civil unrest, you were forced to leave on December 14, 2018.

According to the IRS’s published list, the Democratic Republic of the Congo qualifies for the waiver for taxpayers who had to leave on or after December 14, 2018. So, even though you were not physically present for a whole year, you could apply for a waiver of the minimum time requirement, citing the conditions in the country that compelled you to leave early.

Example 2: John, a U.S. taxpayer, was working in Ethiopia and had to leave the country on November 10, 2021, due to civil unrest. He had established residency in Ethiopia on January 1, 2021. Based on the IRS’s published list of countries and dates, Ethiopia qualifies for the waiver for the 2021 tax year with a departure date of November 5, 2021. John can claim the waiver by submitting a statement with his tax return explaining his expectation to meet the time requirements if not for the civil unrest and writing “Claiming Waiver” on page 1 of Form 2555.

FAQ6: Can I claim the waiver if I established residency or was first physically present in the foreign country after the specified departure date?

No, individuals who establish residency or are first physically present in the foreign country after the date prescribed by the Secretary are not treated as qualified individuals under IRC 911.

FAQ 7: How do the COVID-19 pandemic-related waivers work?

The IRS issued Rev. Proc. 2020-27, which granted a waiver of time requirements globally as of February 1, 2020. The period covered by this revenue procedure ended on July 15, 2020. For purposes of IRC section 911, an individual who left China on or after December 1, 2019, or another foreign country on or after February 1, 2020, but on or before July 15, 2020, is treated as a qualified individual if they can establish a reasonable expectation that they would have met the requirements of IRC 911(d)(1) but for the COVID-19 Emergency. Individuals were instructed to write “COVID-19 Emergency Relief” in the top margin of page 1 of the 2020 Form 2555 when claiming the waiver.

Source: IRM 21.8.1.3.3 (06-09-2022)

***Disclaimer: This communication is not intended as tax advice, and no tax accountant -client relationship results**