Understanding the Housing Exclusion and Deduction for U.S. Taxpayers Living Abroad

Source: 21.8.1.3.5 (10-01-2012)

As U.S. taxpayers earning income abroad, it’s important to understand your options when it comes to housing exclusions and deductions. The following guide explains these complex tax concepts in simple terms, making them accessible to everyone, regardless of their familiarity with tax laws.

What are the Housing Exclusion and Deduction?

Qualified individuals can choose to claim the housing exclusion or the housing deduction, in addition to the foreign earned income exclusion. In simpler terms, if you earn income from a foreign source and have housing expenses, you might be able to deduct or exclude these costs from your taxable income.

The Housing Exclusion applies to amounts paid with employer-provided funds, while the Housing Deduction applies to amounts paid with self-employment earnings.

Example: Samantha, a U.S. citizen, works in Spain for a U.S. employer. Her employer provides her with a housing allowance as part of her compensation. Samantha can choose to claim the housing exclusion for the employer-provided housing allowance. Additionally, if Samantha has self-employment income and pays for housing expenses out of that income, she can choose to claim the housing deduction for those expenses.

How do I make the initial election?

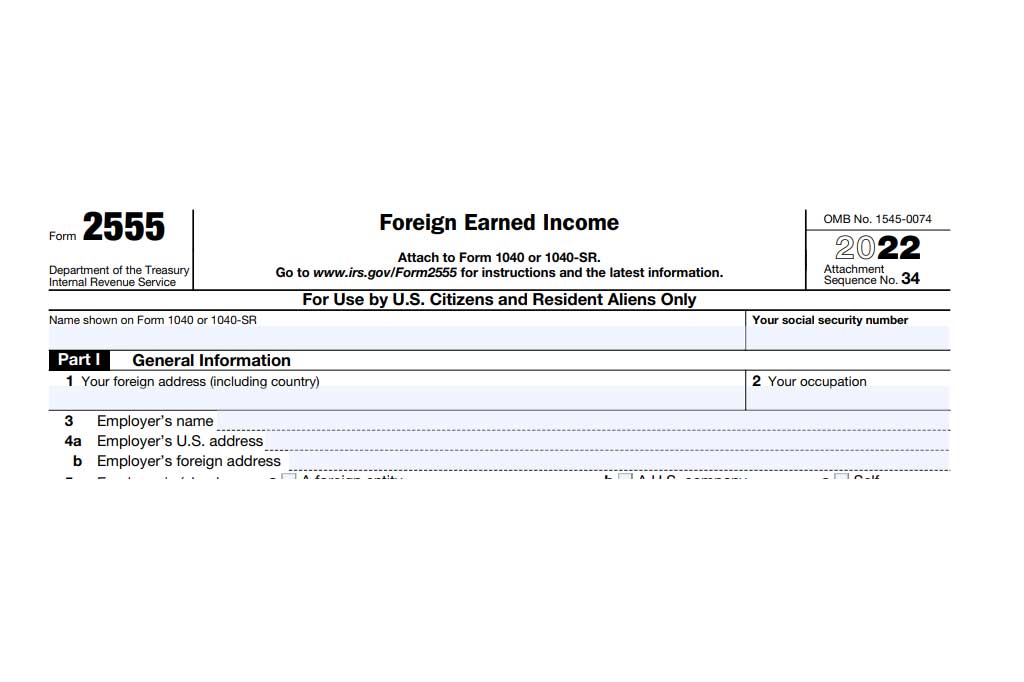

You can claim either of these benefits by filing Form 2555, which can be submitted in one of three ways:

- With a return filed on time (including any extensions).

- With a return amending a previously filed return on time.

- With a late-filed return (without taking any extensions into account) that is filed within one year from the original due date of the return.

What changes did the Tax Increase Prevention and Reconciliation Act of 2005 (TIPRA) introduce?

Effective for tax periods beginning on or after January 1, 2006, TIPRA brought some changes to IRC 911, which regulates these benefits. The key changes include:

- The calculation of the base housing amount (line 32 of Form 2555) is now tied to the maximum foreign earned income exclusion. This amount equals 16% of the exclusion amount (computed daily), multiplied by the number of days in the qualifying period within the tax period.

- The amount of qualified housing expenses is capped at 30% of the maximum foreign earned income exclusion (computed daily) for the calendar year in which the individual’s taxable year begins. This amount is multiplied by the number of days within the applicable period. However, adjustments to this percentage can be made based on geographic differences in foreign housing costs relative to housing costs in the U.S.

To see a comprehensive list of adjusted limitations on housing expenses, you can refer to the Form 2555 instructions here.

Please remember, these adjusted limitations on housing expenses are subject to change annually.

Understanding these tax benefits can help you make the most of your income while living abroad. If you have further questions or need additional clarification, consider consulting with a tax professional or the IRS directly.

***Disclaimer: This communication is not intended as tax advice, and no tax accountant -client relationship results**