Understanding Foreign Tax Credit for France’s CSG and CRDS

Understanding tax laws, especially those concerning foreign transactions, can be a challenging task for most taxpayers. This article aims to provide an easily comprehensible explanation of the foreign tax credits pertaining to France’s Contribution Sociale Generalisee (CSG) and Contribution au Remboursement de la Dette Sociate (CRDS), according to the IRM 21.8.1.4.3.1, updated on April 21, 2022.

Q1: What are the France’s CSG and CRDS Credits?

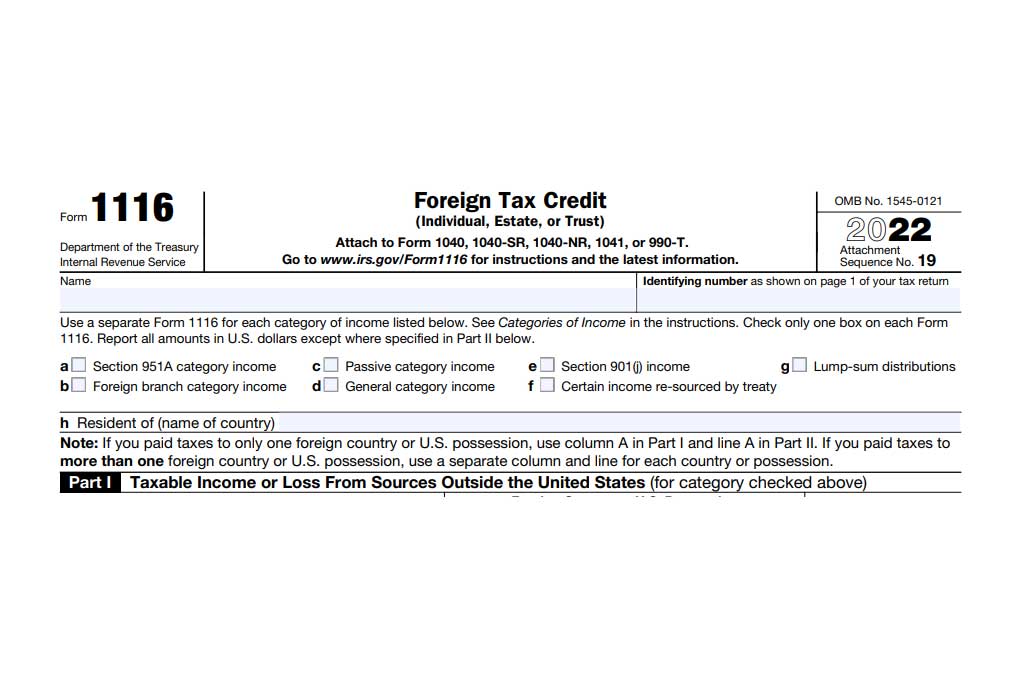

In an agreement between the United States and the French Republic, taxpayers can now claim a foreign tax credit for France’s Contribution Sociale Generalisee (CSG) and Contribution au Remboursement de la Dette Sociate (CRDS). However, it is vital to note that taxpayers must meet all requirements under the Internal Revenue Code (IRC) 901 to claim these credits.

Q2: Can a Credit be Claimed for Social Security Taxes Paid to a Foreign Country?

Generally, no deduction or credit is allowed for social security taxes paid or accrued to a foreign country with which the United States has a totalization agreement. Nevertheless, the CSG and CRDS taxes are not classified as social taxes covered by the totalization agreement between the U.S. and France. Therefore, taxpayers can claim a foreign tax credit for these taxes.

Q3: What If I Paid More Creditable Foreign Tax Than the Credit Claimed?

Taxpayers have a ten-year window to file a claim for a U.S. tax refund if they discover they paid or accrued more creditable foreign tax than the credit claimed. For additional information, refer to IRM 21.8.1.4.5.

This guide simplifies the complex tax concepts around France’s CSG and CRDS credits. However, each individual’s tax situation can vary widely. For advice tailored to your circumstances, consider consulting a tax professional experienced in international transactions and U.S. taxation policies.

***Disclaimer: This communication is not intended as tax advice, and no tax accountant -client relationship results**