Navigating the Period of Limitation for the Foreign Tax Credit

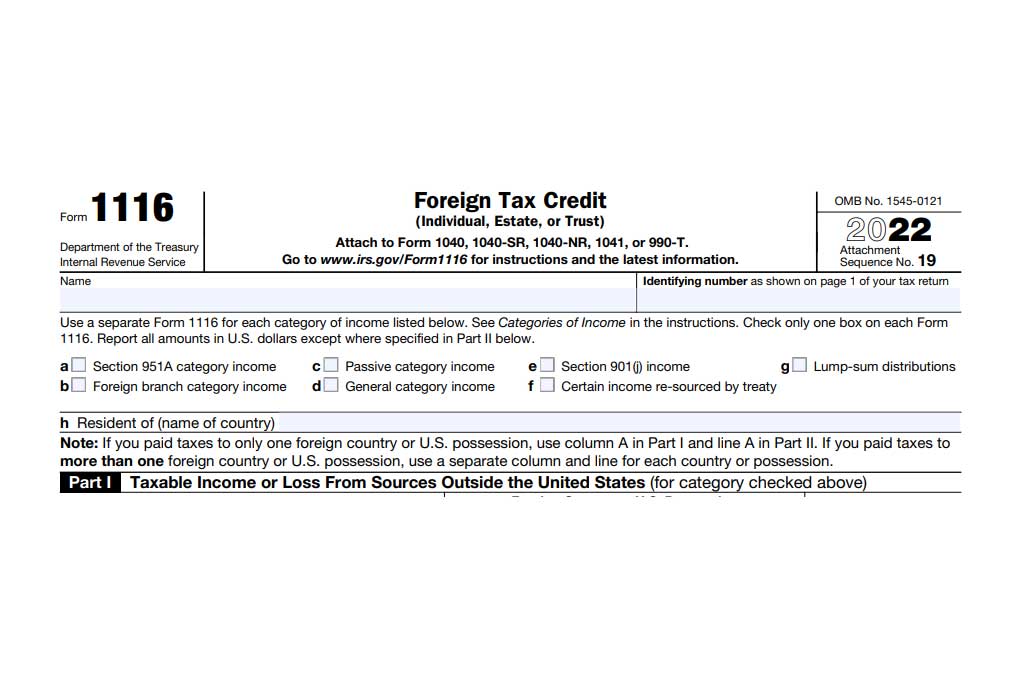

For U.S. taxpayers with foreign income, understanding the guidelines around the Foreign Tax Credit (FTC) can be daunting. This FAQ, drawing from IRM 21.8.1.4.5 (10-01-2022), simplifies these complex tax concepts and provides illustrative examples for a better grasp.

What is the period of limitation for the Foreign Tax Credit?

The period of limitation refers to the time window during which a taxpayer can file a claim for a refund of U.S. tax. For the FTC, this period is ten years. It applies to a year when the taxpayer has to pay or accrue a larger foreign tax than the one originally claimed as a credit. This term is further detailed in Statute IRM 25.6.1.10.2.8.4, Foreign Tax Credit.

What does the 10-year limitation period cover?

The 10-year limitation period applies to:

- A claim for refund based on the correction of mathematical errors in figuring the FTC.

- The discovery of qualified foreign taxes that were not originally reported on the return.

- Any other changes to the size of the credit, including corrections to the FTC limitation or a taxpayer’s decision to claim a credit for taxes rather than a deduction.

When does the 10-year limitation period start?

The 10-year period begins from the due date of the return (without considering any extension for filing the return) for the year in which the foreign tax expense is paid or accrued. Note that this limitation period for claiming a refund should not be confused with the ten-year carryover and one-year carryback periods. For more on carryback and carryover, see IRM 21.8.1.4.7.

Where can I find detailed information on FTC Carryback claims?

For comprehensive information on FTC Carryback claims, refer to IRM 21.5.9.5.12.7, Carryback of Foreign Tax Credit (FTC).

What is the period of limitation for refunds due to deductions of foreign income taxes?

The standard three-year period of limitation applies for refunds attributable to deductions of foreign income taxes reported on Schedule A.

By understanding the period of limitation for the Foreign Tax Credit, taxpayers can ensure they claim their rightful credits and refunds within the appropriate timeframe.

***Disclaimer: This communication is not intended as tax advice, and no tax accountant -client relationship results**