Understanding the Foreign Tax Credit: An FAQ Guide for Taxpayers

Foreign taxes can add an extra layer of complexity to your tax situation. However, the Internal Revenue Service (IRS) provides a way for eligible taxpayers to offset these costs through what is known as the Foreign Tax Credit. Here, we will break down the complex regulations around this topic into digestible bits of information, helping you better understand this tax benefit.

According to the Internal Revenue Manual (IRM) 21.8.1.4.2, updated on October 1, 2022, the Foreign Tax Credit is a non-refundable credit available to eligible taxpayers who have paid or accrued foreign income taxes during the tax year.

What is the Foreign Tax Credit?

The Foreign Tax Credit is a nonrefundable credit that eligible taxpayers can claim for foreign income taxes paid or accrued during the tax year. This credit applies to taxes paid to:

- Foreign countries

- U.S. territories

- Political subdivisions (e.g., city, state, or province) of the foreign country or U.S. territory. (See Publication 570 for more information)

Important Points to Remember About the Foreign Tax Credit

- It is a nonrefundable credit, meaning it can only reduce your tax liability to zero; it cannot generate a refund.

- Foreign income taxes generally cannot be claimed as a deduction in the same year on Schedule A if you claim the Foreign Tax Credit.

Choosing Between the Foreign Tax Credit and a Deduction

If you choose not to claim a credit for foreign taxes, you may claim a deduction on Schedule A for foreign income tax paid or accrued, as per IRC 164(a)(3). However, you cannot claim the Foreign Tax Credit for foreign income taxes paid on income excluded under the foreign earned income exclusion or the foreign housing exclusion (IRC 911).

Filing Requirements for the Foreign Tax Credit

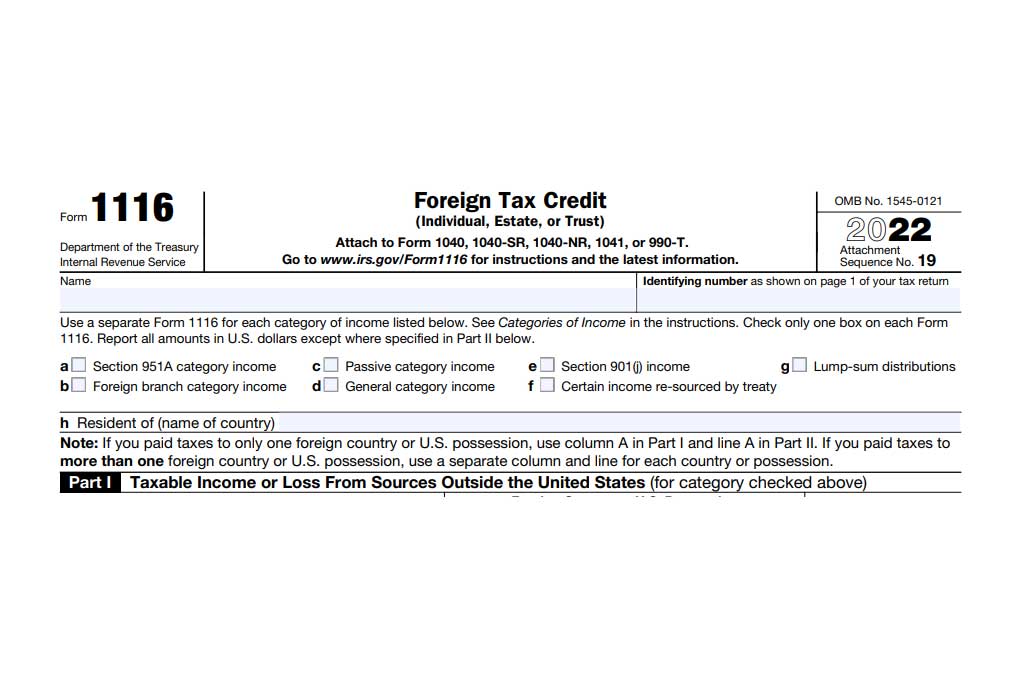

To claim the Foreign Tax Credit, you must generally file Form 1116, unless one of the following exceptions applies:

- You meet the requirements for exemption from the foreign tax limit discussed in Publication 514 and choose exemption from the Foreign Tax Credit limit. In this case, you do not file Form 1116 and instead enter foreign taxes paid directly on Form 1040, line 31.

- You are a shareholder of a controlled foreign corporation and choose to be taxed at corporate rates on the income you must include from that corporation. In this situation, you would use Form 1118 to claim the Foreign Tax Credit.

- You paid income taxes to the U.S. Virgin Islands. In this case, you must use Form 8689, Allocation of Individual Income Tax to the Virgin Islands.

Amending Your U.S. Income Tax Return for Foreign Tax Refunds

If the amount you claimed as a Foreign Tax Credit is later refunded by the foreign country, you must amend your U.S. income tax return to include the refunded amount. You will owe debit interest from the date the refund is received from the foreign country to the payment date, plus any interest received from the foreign country. See IRM 20.2.10.3.2 for more information on interest on adjustments to the Foreign Tax Credit.

In conclusion, the Foreign Tax Credit can provide a significant tax benefit for taxpayers with foreign income. However, navigating the regulations can be challenging. Therefore, it’s important to familiarize yourself with the rules or consider consulting with a local tax professional to ensure accurate reporting.

***Disclaimer: This communication is not intended as tax advice, and no tax accountant -client relationship results**