Understanding the Foreign Tax Credit: FAQ Guide

Source: IRM 21.8.1.4 (10-28-2013)

As a US citizen or resident alien, you’re required to report worldwide income from all sources, even if you live outside the United States. This often leads to paying taxes on the same income in both the US and the foreign country where it’s earned. To avoid this double taxation, the US tax code provides a relief mechanism called the Foreign Tax Credit. In this FAQ, we’ll break down the complexities of the Foreign Tax Credit and answer common questions to help you understand this essential tax provision.

Q1: What is the Foreign Tax Credit?

The Foreign Tax Credit, allowed under Internal Revenue Code (IRC) 901, is a tax credit for income, war profits, and excess profits tax paid or accrued during the taxable year to a foreign country or a U.S. Possession (also referred to as a U.S. Territory). Additionally, under IRC § 903, a Foreign Tax Credit is allowed for foreign levies imposed instead of an income tax otherwise creditable under IRC 901.

Q2: What U.S. territories are included in the Foreign Tax Credit?

For individuals claiming a Foreign Tax Credit on Form 1116, the U.S. territories typically include American Samoa and Puerto Rico. However, special rules apply to Guam, The Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands. For more information, you can refer to IRS Publication 570.

Q3: Why is the Foreign Tax Credit important?

As a U.S. citizen or resident alien, you’re required to report worldwide income from all sources, regardless of where you live. Generally, you must pay a tax on the foreign income to the country or countries from which this income is derived. The Foreign Tax Credit is designed to minimize the occurrence of such income being subject to tax by both the United States and the foreign country – in essence, it helps minimize or avoid double taxation.

For instance, imagine you are a U.S. citizen working in Country A. You earn income in Country A and pay taxes to their government. As you’re also required to report this income to the U.S., the FTC allows you to offset the taxes you paid in Country A against your U.S. tax liabilities, thereby minimizing or avoiding double taxation.

Q4: How do I claim the Foreign Tax Credit?

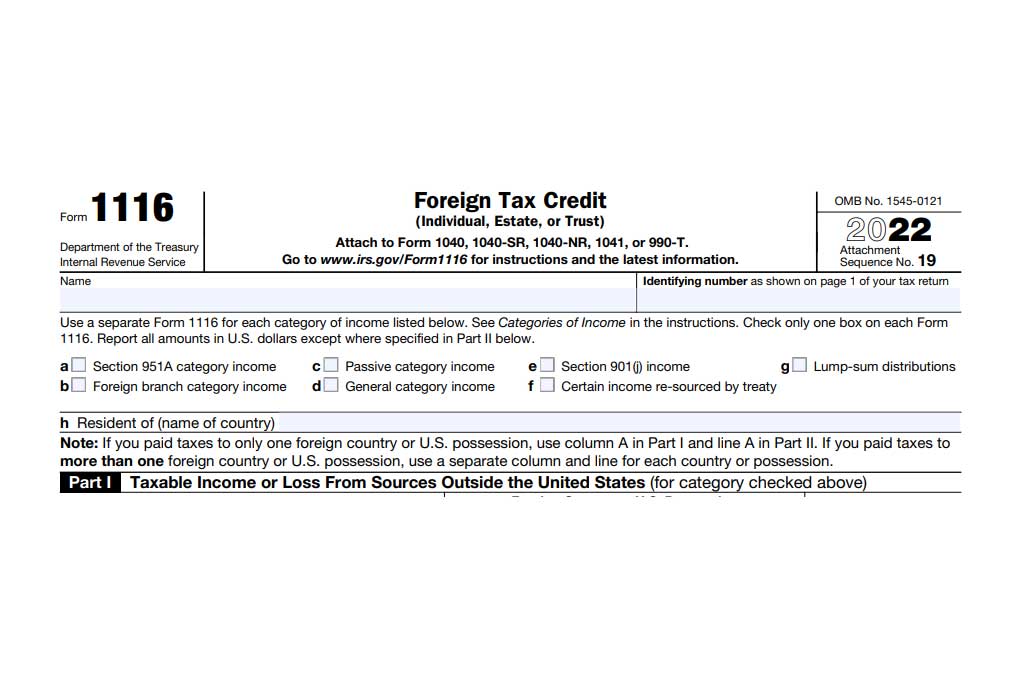

To claim the Foreign Tax Credit, you need to complete Form 1116 (Foreign Tax Credit for Individuals, Estates, or Trusts) and attach it to your federal income tax return. Detailed instructions for Form 1116 can be found on the IRS website, and Publication 514 provides comprehensive information on the credit.

Example: John, a US citizen, lives and works in Germany, earning $80,000 in 2022. He pays income tax on this amount to the German government. When filing his US tax return, John must report his worldwide income, including his earnings in Germany. To avoid double taxation, John can claim the Foreign Tax Credit on Form 1116, reducing his US tax liability on his German income.

Q5: Where can I find more detailed information on the Foreign Tax Credit?

Publication 514, Foreign Tax Credit for Individuals, and the instructions for Form 1116, Foreign Tax Credit (Individual, Estate, or Trust), provide comprehensive information on this credit.

Understanding the Foreign Tax Credit can make a significant difference in your tax situation, especially if you have foreign income. While this guide provides a solid foundation, consulting with a tax professional can ensure that you’re maximizing your benefits under the law.

***Disclaimer: This communication is not intended as tax advice, and no tax accountant -client relationship results**