FAQ: Understanding Your Options for Claiming Foreign Tax Credit

The Foreign Tax Credit (FTC) offers relief to U.S. taxpayers who face double taxation on their foreign income. This FAQ, adapted from the Internal Revenue Manual (IRM) 21.8.1.4.4 (10-01-2022), simplifies complex tax concepts and provides examples to help taxpayers understand their options better.

1. What is the Foreign Tax Credit?

The Foreign Tax Credit is a provision of the US tax law that allows US taxpayers to either deduct the amount of qualified foreign income taxes paid or accrued from their taxable income, or claim it as a credit against their US income tax. It’s designed to prevent or mitigate double taxation, which occurs when the same income is taxed by both the US and a foreign country.

2. How do I choose between taking a Deduction or a Credit?

Each tax year, you have the choice of electing to: a. Take the amount of any qualified foreign income taxes paid or accrued as a Foreign Tax Credit against your U.S. income tax, or b. Deduct the foreign taxes on Schedule A of your Form 1040.

Generally, you must treat all foreign taxes paid or accrued in the same tax year in the same manner. It’s worth noting that specific tax codes (namely IRC 901(m)(6), IRC 901(k)(7), IRC 901(l)(4), IRC 901(j)(3), and IRC 908(b)) allow a deduction for taxes that cannot be claimed as a credit.

3. Can I change my election?

Yes, you can change your election. If you initially chose to claim a deduction for foreign income taxes paid or accrued, you can change this to claiming a credit at any time within 10 years from the due date for filing the return for the tax year for which the claim for credit is made.

However, if you initially claimed a credit and wish to change it to a deduction, the period for changing your election is 3 years from the time the original return was filed. This is outlined in IRC 901(a), IRC 6511(a) and (d), and Treas. Reg. §1.901-1(d).

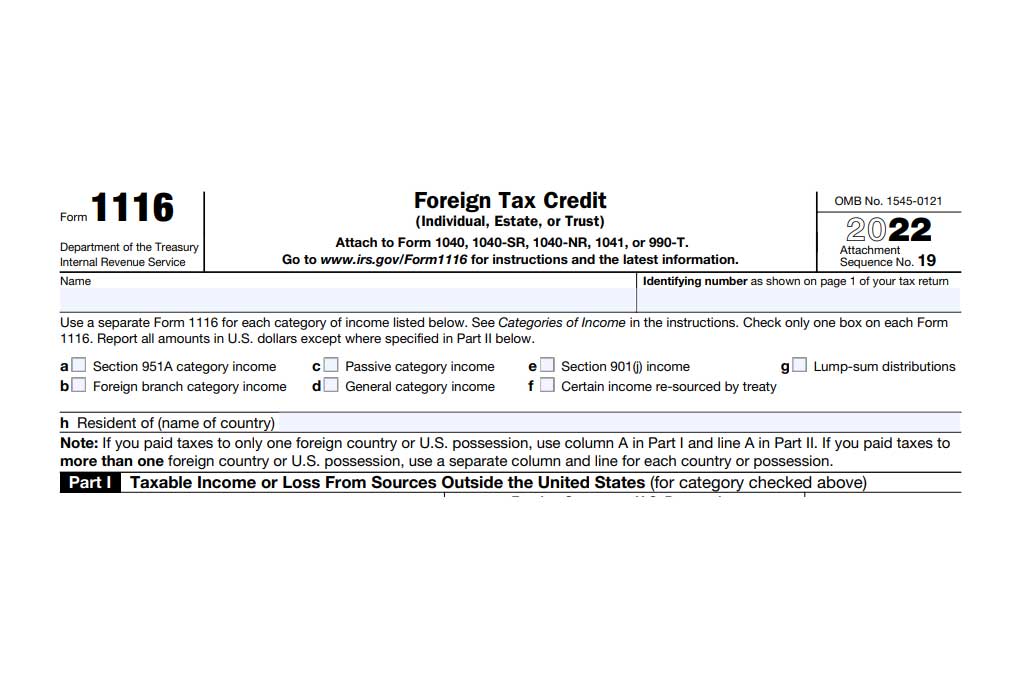

4. How do I file a claim or an amended return?

If you’re changing no other election, you may file a claim or an amended return for credit or for a refund of U.S. income taxes.

Remember, if you’ve claimed foreign taxes as a deduction on Schedule A of Form 1040, you’re not required to complete Form 1116. If you’ve taken a Form 2555 exclusion, your foreign taxes available for the credit will be prorated.

5. Are there any exclusions?

Yes, there are. A credit or a deduction for foreign taxes paid on income excluded under the foreign earned income exclusion or the foreign housing exclusion cannot be taken.

We hope this article has made the complex subject of Foreign Tax Credits a little easier to understand. As always, ensure you consult with a local tax professional to understand how these rules apply to your specific circumstances.

***Disclaimer: This communication is not intended as tax advice, and no tax accountant -client relationship results**