Foreign Taxes That Cannot Be Claimed as a Credit

While the Foreign Tax Credit (FTC) can be an essential tool for U.S. taxpayers with foreign income, it’s crucial to understand that not all foreign taxes are eligible for this credit. This article aims to shed light on the types of foreign taxes that can’t be claimed for the FTC. The information is sourced from the IRS Internal Revenue Manual (IRM) 21.8.1.4.3, updated on October 1, 2015.

What Foreign Taxes Can’t Be Claimed for Credit?

Let’s delve into the specifics of foreign taxes that can’t be claimed for credit under the FTC:

- Taxes Not Legally Owed: If you’ve paid taxes to a foreign country that you don’t legally owe, including amounts eligible for refund by the foreign country, you can’t claim these as a credit.

- Taxes Paid to Certain Countries: Taxes imposed by and paid to certain countries are not eligible for the FTC. These include countries designated by the U.S. Secretary of State as having repeatedly supported acts of international terrorism, countries with which the U.S. does not have diplomatic relations, and countries whose governments the United States does not recognize.

- Subsidized Taxes: If you’ve paid a foreign tax that is returned to you, a related person, or a party to the transaction generating the tax, in the form of a subsidy, this tax cannot be claimed for credit.

- Taxes Attributable to Excluded Income: Taxes related to income excluded from sources within U.S. territories are not eligible for the FTC.

- Taxes Withheld from Dividends and Other Income: If you’ve paid taxes withheld from dividends and other income from property, and certain minimum holding period requirements are not met, you can’t claim these for credit.

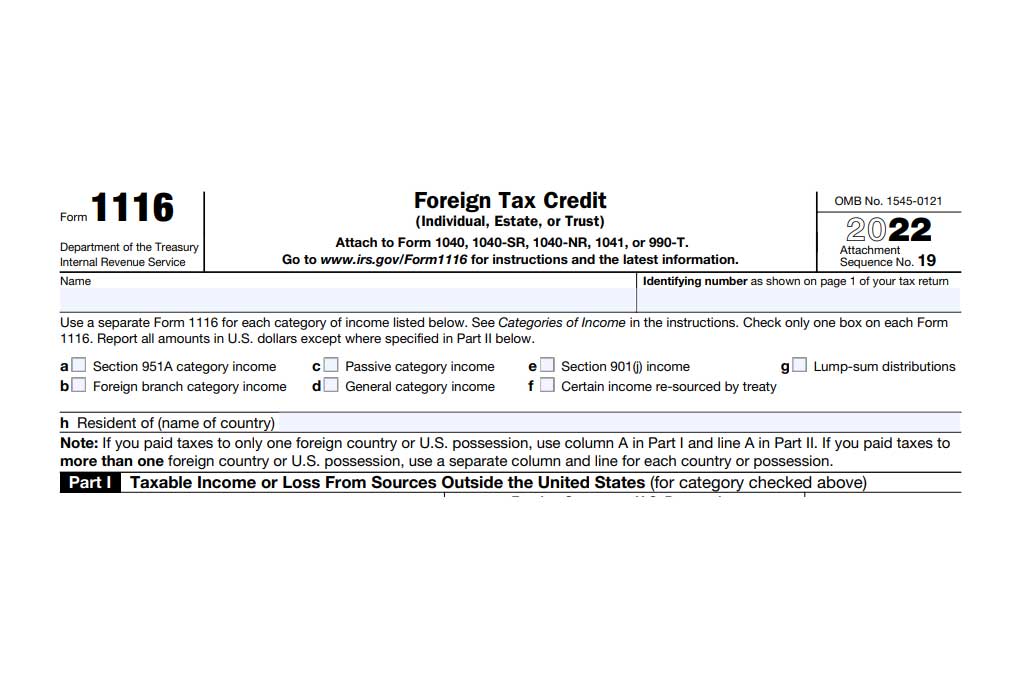

- Other Designated Taxes: There are other taxes designated in the Instructions to Form 1116 that are not eligible for the FTC.

Specific Case: Mexico’s IETU

On January 1, 2008, Mexico adopted the “impuesto empresarial a tasa unica” (IETU), which was repealed effective January 1, 2014. The IRS has stated that it will not challenge that the IETU is an income tax eligible for the Foreign Tax Credit under Article 24(1) of the Income Tax Treaty between the United States and Mexico.

Understanding these exclusions can help you navigate the complexities of the FTC and ensure that you claim the right foreign taxes. Remember, each taxpayer’s situation is unique, and this guide provides a broad overview. For a more personalized understanding of your tax situation, it’s always advisable to consult with a tax professional.

***Disclaimer: This communication is not intended as tax advice, and no tax accountant -client relationship results**