Navigating Late Filed IRC 911 Exclusions: A Comprehensive FAQ guide for Taxpayers

(Source: 21.8.1.3.7 (10-01-2019))

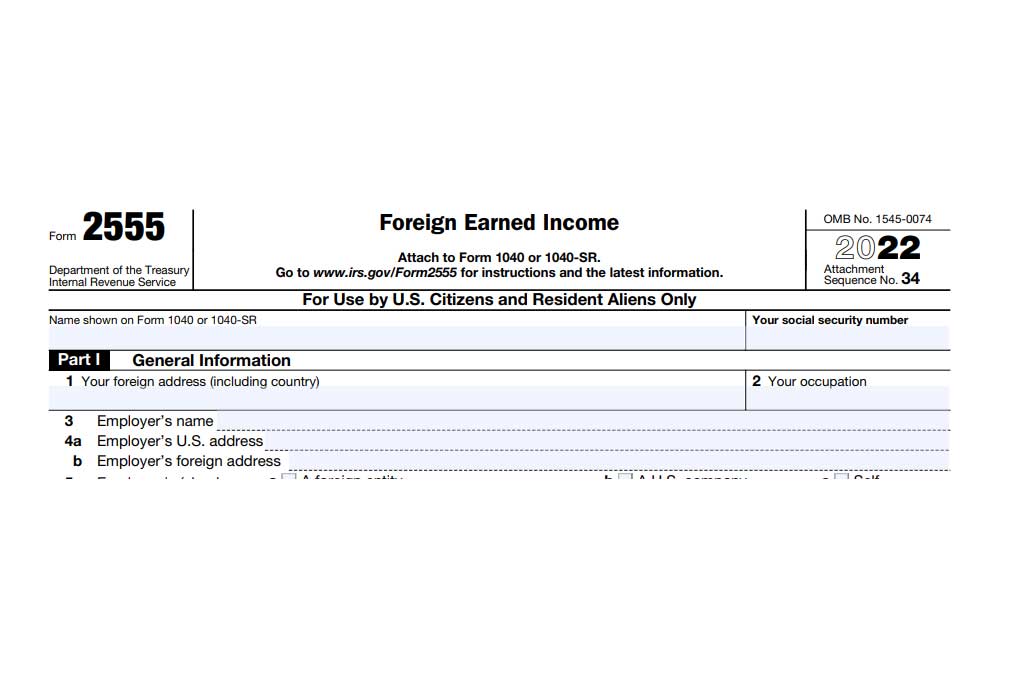

If you’re a United States citizen or resident earning income abroad, understanding the foreign earned income exclusion under IRC 911 can be essential for your tax planning. In this article, we present a comprehensive FAQ that explains late filed IRC 911 Exclusions in a clear and relatable manner for taxpayers.

1. What is the Foreign Earned Income Exclusion?

The Foreign Earned Income Exclusion under IRC 911 allows US citizens or residents to exclude a portion of their foreign income from their US taxable income, provided they meet certain conditions and limitations. For more detailed information, refer to IRS Publication 54.

2. When can I claim the Foreign Earned Income Exclusion?

You can claim the foreign earned income exclusion (Form 2555) if you:

- File your tax return on time, including any extensions,

- Amend a timely filed return, or

- File a late return within 1 year from the original due date (without considering any extensions).

3. Can I claim the exclusion on prior year returns?

Yes, you can claim the exclusion on prior year returns not mentioned above if you have a Private Letter Ruling (PLR) under Treasury Regulation § 301.9100-3.

4. When do I not need a PLR to claim the exclusion on prior year returns?

You don’t need a PLR in the following situations:

- If you owe no federal income tax after considering the exclusion, and you file Form 1040 with Form 2555 (or a comparable form) either before or after the IRS discovers that you failed to elect the exclusion.

- If you owe federal income tax after considering the exclusion, and there is no IRS discovery that you failed to make a timely election. In this case, write at the top of the first page of Form 1040: “Filed Pursuant to Treasury Regulation §1.911-7(a)(2)(i)(D)“.

5. What if I owe tax and the IRS discovers my failure to make a timely election?

If you owe federal income tax and the IRS discovers that you didn’t timely elect the exclusion, the following steps will be taken:

- The IRS will correspond with you and advise that you must request a PLR from Associate Chief Counsel, International, under Treas. Reg. 301.9100-3.

- The IRS will advise you on the procedure to obtain the PLR (see IRM 21.8.1.3.6 for additional information).

- Once you secure a PLR, you must provide a copy before the foreign earned income exclusion election is allowed.

Understanding these rules will help you maximize your foreign earned income exclusion and stay in compliance with the IRS. Always consult with a tax professional to understand how these rules apply to your specific situation.

***Disclaimer: This communication is not intended as tax advice, and no tax accountant -client relationship results**