Navigating the Foreign Earned Income Exclusion: A Comprehensive FAQ Guide

1. What is the Foreign Earned Income Exclusion?

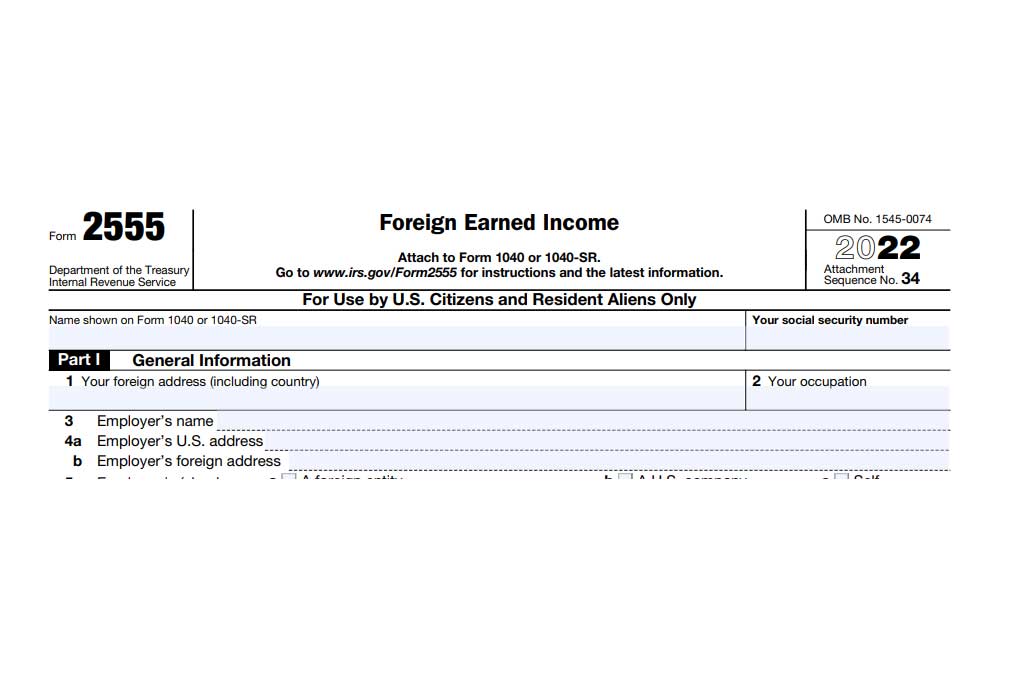

The Foreign Earned Income Exclusion allows qualifying U.S. taxpayers to exclude a certain amount of their foreign earned income from their gross income for tax purposes. This can help reduce the overall tax liability for individuals working and earning income in a foreign country.

2. What are the requirements for qualifying for the Foreign Earned Income Exclusion?

To qualify for the Foreign Earned Income Exclusion, you must meet the following requirements:

3. Who is considered a qualified individual for the Foreign Earned Income Exclusion?

A qualified individual is a U.S. citizen or resident alien who has a tax home in a foreign country and meets either the Bona Fide Residence Test or the Physical Presence Test.

4. Can individuals residing in U.S. territories qualify for the Foreign Earned Income Exclusion?

No, individuals residing in U.S. territories do not qualify for the Foreign Earned Income Exclusion. However, they may qualify for the Territory Exclusion under IRC 931.(See IRM 21.8.1.10.2 for more details).

5. Is income paid by the U.S. government to its employees considered foreign earned income for the exclusion?

For purposes of the foreign earned income exclusion, foreign earned income does not include any amount paid by the United States or any of its agencies to its employees, whether from appropriated or non-appropriated funds. Payments to employees of non-appropriated fund activities may include:

- Armed forces post exchanges

- Officers and enlisted personnel clubs

- Post and station theaters

- Embassy commissaries

Employees of U.S. government agencies generally do not qualify for the exclusion. However, amounts paid by the United States or its agencies to persons who are not their employees may qualify for exclusion or deduction.

6. What is considered “foreign earned income”?

Foreign earned income includes amounts paid for personal services rendered in a foreign country, such as wages, salaries, commissions, bonuses, and professional fees. However, it does not include amounts paid by the United States or its agencies to their employees.

7. What factors are considered in determining a taxpayer’s tax home?

A taxpayer’s tax home is generally the area of their main place of business, employment, or post of duty. It is the place where the taxpayer is permanently or indefinitely engaged in work as an employee or as a self-employed individual.

The IRS considers the following factors when determining a taxpayer’s tax home:

- The tax home is in the general area of the taxpayer’s main place of business, employment or post of duty, regardless of where the taxpayer maintains his or her family home.

- The tax home is the place where the taxpayer is permanently or indefinitely engaged in work as an employee or as a self-employed individual.

- The tax home, for taxpayers who do not have a regular or main place of business because of the nature of their work, is considered to be where they regularly live

8. How do I know if I qualify as a bona fide resident of a foreign country?

To qualify as a bona fide resident of a foreign country, you must meet certain criteria. Some key factors include:

- Being a U.S. citizen or resident alien who is a citizen or national of a country with an income tax treaty and a nondiscrimination clause with the U.S.

- Having a tax home in a foreign country

- Being a bona fide resident of a foreign country or countries for an uninterrupted period that includes a full taxable year

- Earning income for personal services rendered in a foreign country

9. What factors are considered in determining if a taxpayer qualifies for the Foreign Earned Income Exclusion due to physical presence in a foreign country?

To meet the physical presence test, you must be a U.S. citizen or resident alien physically present in a foreign country or countries for at least 330 full days during any period of 12 consecutive months. Note that the 330 days need not be consecutive and can include vacation time spent on foreign soil.

10. What is considered a “full day” for the Physical Presence Test?

A “full day” is a continuous period of 24 hours starting at midnight and ending with the following midnight.

11. Do the 330 full days for the Physical Presence Test need to be consecutive?

No, the 330 full days do not need to be consecutive. They may be interrupted by periods during which the taxpayer is not present in a foreign country, such as a brief visit to the United States.

12. How do vacations affect the Physical Presence Test?

Vacation time spent on foreign soil can be included in the 330 full days of presence in a foreign country.

13. Can income earned while working on offshore oil rigs in territorial waters of a foreign country qualify for the foreign earned income exclusion?

If you work on offshore oil rigs in territorial waters of a foreign country and meet the bona fide residence or physical presence tests, your income may qualify for the foreign earned income exclusion.

By understanding the concepts and requirements related to the Foreign Earned Income Exclusion, taxpayers can make informed decisions about their tax obligations when living and working abroad.

Source: IRM 21.8.1.2.16.3 (10-01-2018)

***Disclaimer: This communication is not intended as tax advice, and no tax accountant -client relationship results**