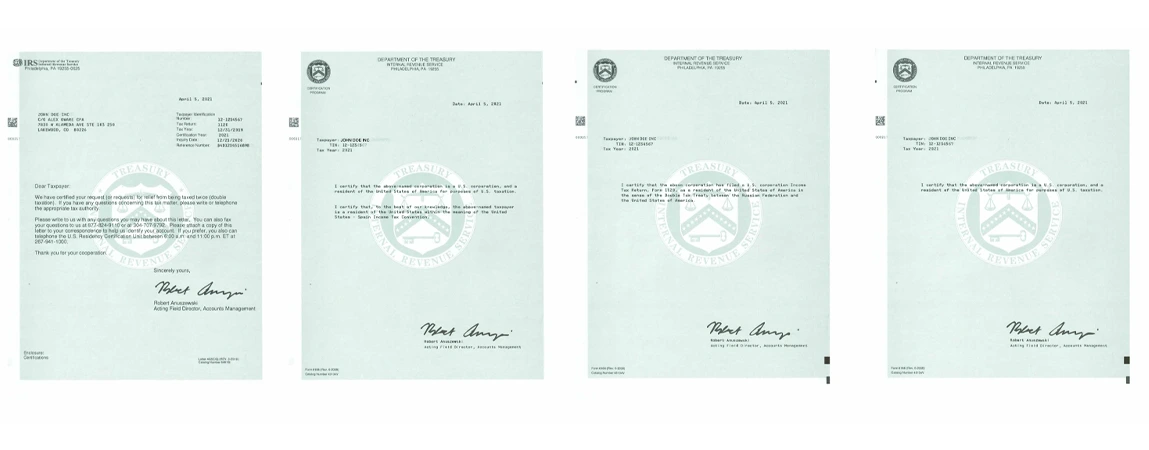

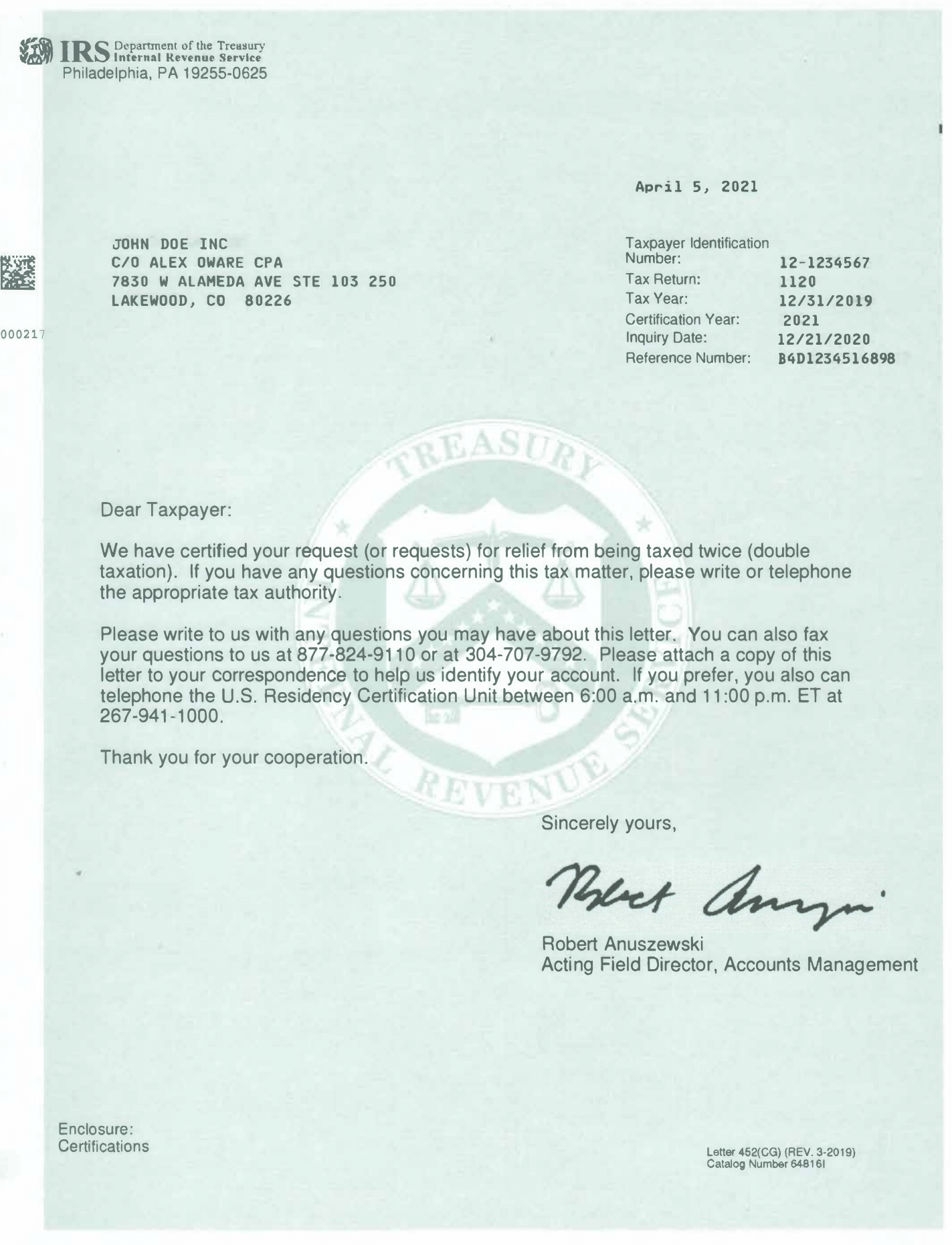

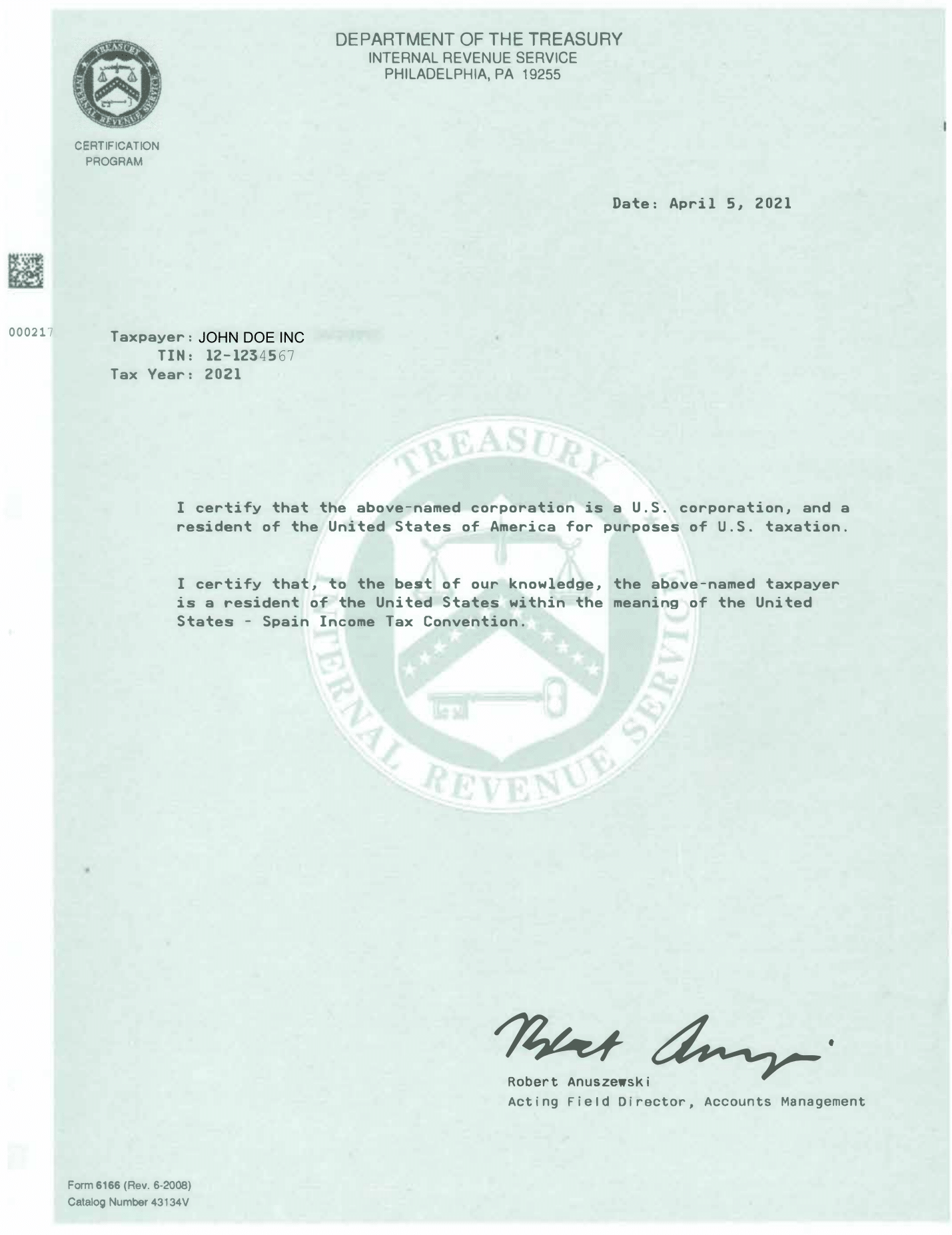

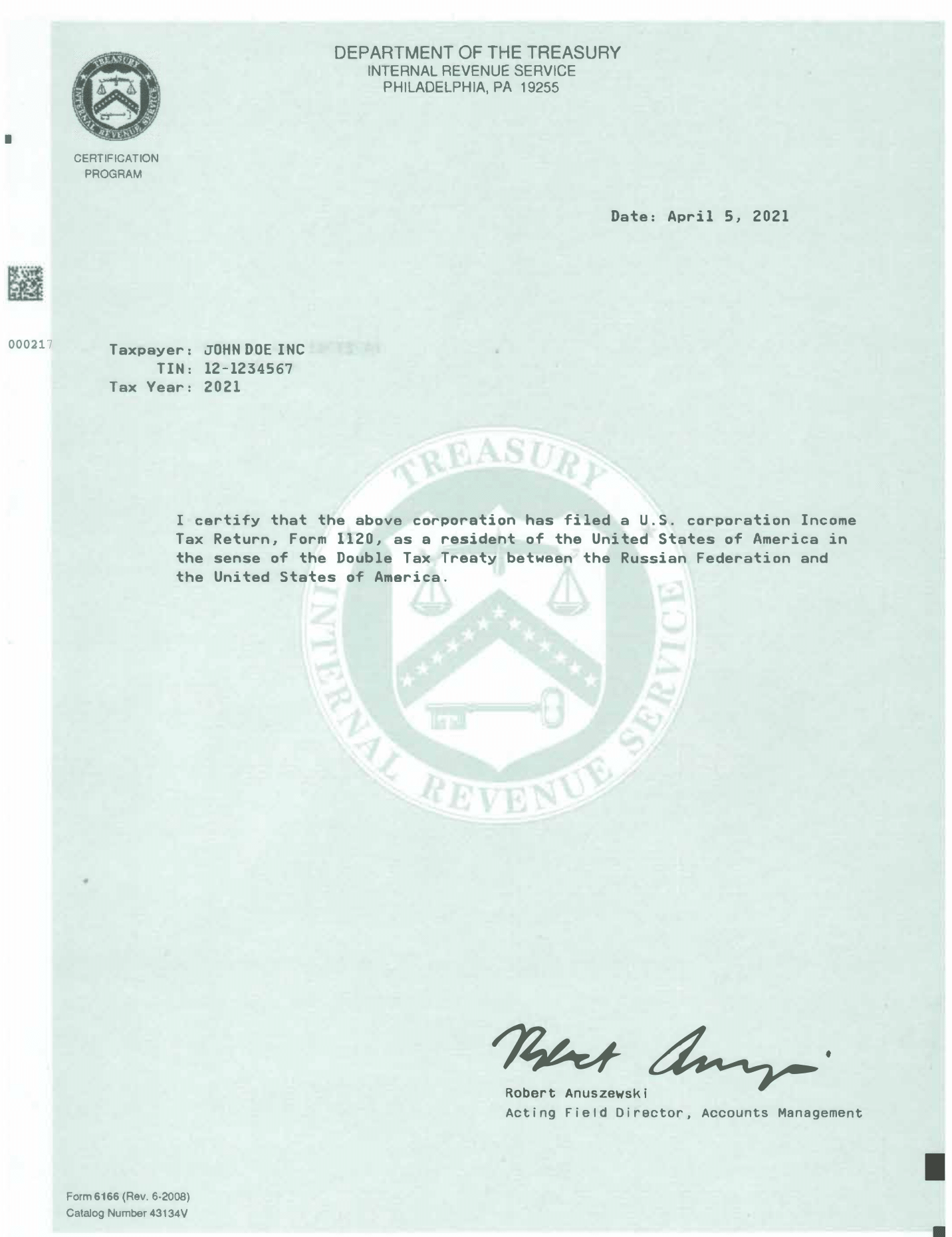

Samples of U.S. Residency Certifications – Form 6166

on 04/9/2021 at 2:21 pm

Related Articles:

- How to File Forms 5472 and 1120 for a Foreign-Owned Single Member LLC

- USA – INDIA F-1 & J-1 Tax Treaty (Students & Business Apprentice)

- What Forms Do Foreign-Owned Single Member LLCs Have to File?

- 7 Common Questions about Foreign-Owned U.S. LLCs Answered—by a CPA

- Amazon Foreign Sellers, US Taxation and 1099-K Reporting

- The 12 Most Important Questions about U.S. LLCs Answered—by a CPA

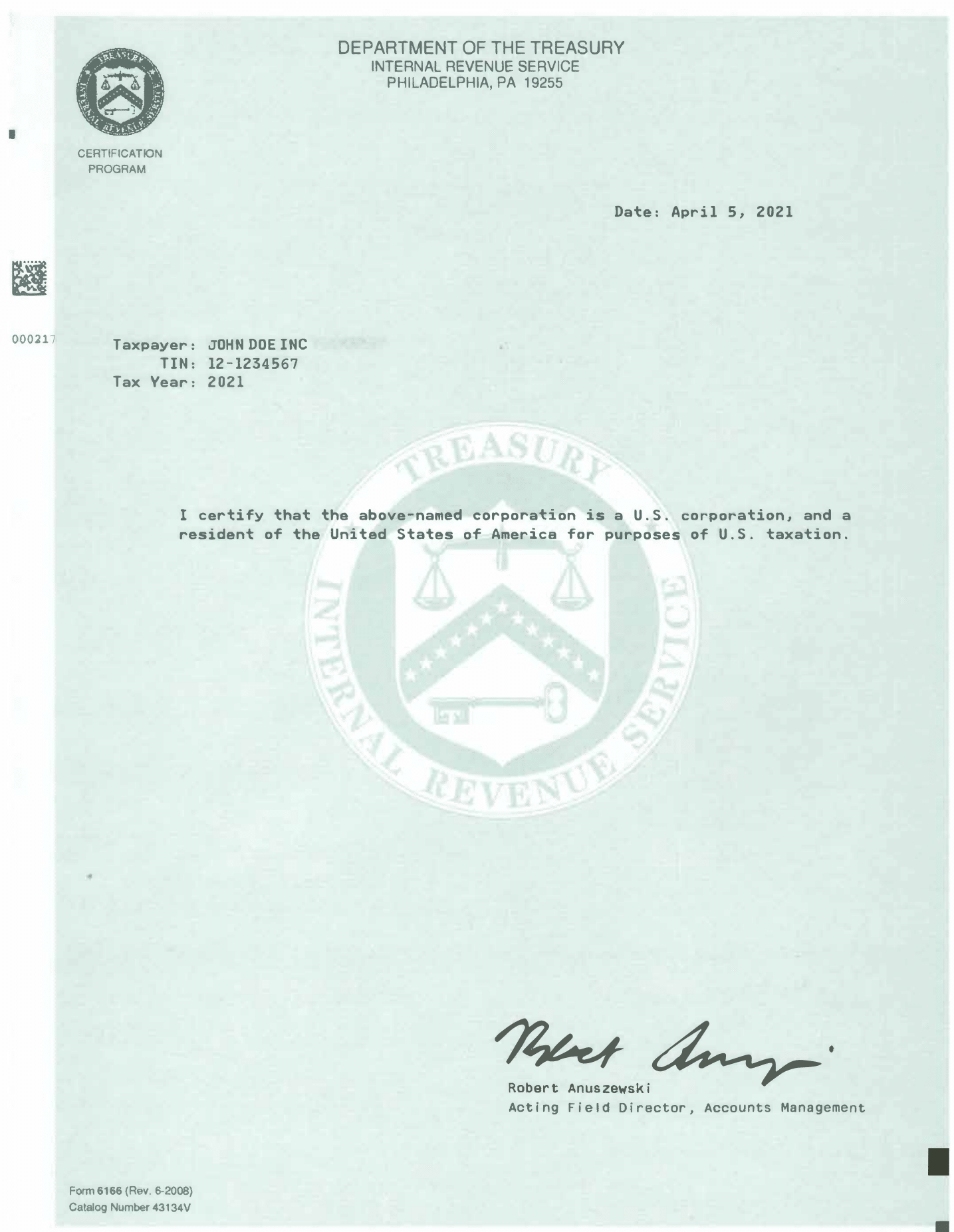

- Claim Tax Treaty, Avoid Double Taxation and Request VAT Exemption – Form 6166 – Certification of U.S. Tax Residency

- 15 Common Questions About Expatriation, Form 8854, and the Exit Tax—Answered by a CPA

- Forms and Filing for Foreign-Owned LLC Multi-Member Partnerships | Exploring a Case from an Australian-Owned U.S. Partnership

- Which Tax Forms Do Foreign-Owned U.S. Multi-Member LLCs Have to File?

***Disclaimer: This communication is not intended as tax advice, and no tax accountant -client relationship results**

WATCH – C-Corporation: Applying for 2023 U.S Residency Certification Form 8802/6166

WATCH – C-Corporation: Applying for 2023 U.S Residency Certification Form 8802/6166