Income Deferral to Boost College Financial Aid: What Works, What Doesn’t (and What Can Get You in Trouble)

“Can I structure my income so it doesn’t show up on my current-year return (or FAFSA) for a few years—without doing anything illegal?”

The short answer: you can plan, but there is no “magic” structure that lets you earn income and simply make it disappear for tax or aid purposes. Most “creative” methods run straight into long-standing tax doctrines like constructive receipt and the assignment of income doctrine.

Below is the practical, reusable breakdown.

Key concepts to know first

1) FAFSA does not use “this year’s” income

FAFSA generally uses prior-prior year tax information (a two-year lookback). For example, Federal Student Aid guidance notes that award year 2025–26 is based on 2023 tax year information.

So if your child starts college in Fall 2029, your planning window is often tied to tax years 2027 (and 2028) depending on which FAFSA cycle you’re targeting.

2) FAFSA has changed: fewer “untaxed income add-backs”

Starting with the FAFSA Simplification changes (2024–25 and forward), Federal Student Aid states that untaxed income items included in need analysis were reduced, and the list is now much narrower (e.g., certain IRA/retirement items, tax-exempt interest, foreign earned income exclusion, etc.).

This matters because older FAFSA strategies relied heavily on understanding which “untaxed income” items were added back in.

3) “Not in my bank account” does not mean “not taxable”

U.S. tax law looks at rights and control, not just where cash sits. Two doctrines drive this:

- Constructive receipt: income is taxable when it’s credited to you, set apart, or made available so you can draw on it (unless there are substantial restrictions).

- Assignment of income: you generally can’t avoid tax by directing income you earned to someone else. The Supreme Court’s classic example is Lucas v. Earl—the “you can’t assign the fruit to a different tree” concept.

FAQ

1) “Can I have clients pay an offshore company (or nominee company) so I don’t show income?”

If you are a U.S. citizen or U.S. tax resident, you’re generally taxed on worldwide income, and simply routing payments to an offshore entity doesn’t erase the income if you performed the work and control the arrangement.

Also, many “nominee director/nominee shareholder” setups collapse under basic audit logic: who did the work, who controlled the money, and who benefited?

If the structure is being used to conceal ownership or income, you’re drifting from planning into tax evasion risk (and potentially serious international reporting exposure). (This is exactly where “cheap offshore” advice usually blows up.)

2) “What if my friend’s company gets paid, and he pays me later?”

This is one of the most common “workarounds,” and it usually fails under constructive receipt and assignment of income.

- If the money is effectively yours (earned by you, for your services) and is merely being held by someone else, the IRS can treat it as your income anyway.

- Even if your friend books it as a liability (“we owe you”), that is basically admitting the money is owed to you.

Bottom line: moving the check to a different mailbox doesn’t change who earned it.

3) “Can I defer income legally for a few years?”

You can defer income only through legitimate deferral mechanisms that comply with the rules—and most have limits.

Common legal deferral paths:

- Qualified retirement plans (401(k), Solo 401(k), SEP, SIMPLE, defined benefit plans)

- HSA (if eligible)

- Timing strategies (where you legitimately control billing/payment timing and don’t trigger constructive receipt)

- Entity planning (sometimes)

But if your core goal is: “I want to earn $200,000 but have it not show up anywhere for FAFSA/taxes for 4 years,” that’s usually not realistic.

4) “What about a Nonqualified Deferred Compensation (NQDC) plan?”

NQDC can be real—but it’s not a casual DIY tool.

The IRS has extensive rules under IRC § 409A, and it applies in addition to older doctrines like constructive receipt and economic benefit.

If an arrangement fails §409A requirements, amounts can become currently includible in income, plus penalties/interest consequences.

This area is high-risk for closely held businesses and owner-employees unless it’s designed carefully.

5) “Will retirement contributions lower my FAFSA income?”

This is where people get surprised:

- Retirement account balances (401(k), pensions, annuities, etc.) are generally excluded from FAFSA assets.

- But FAFSA can still consider certain retirement-related items in the income side of the formula.

Under the FAFSA Simplification changes, the Department describes a reduced “untaxed income” set that still includes items like IRA deductions/payments, untaxed IRA distributions, and untaxed pension amounts.

So retirement planning can still help—just don’t assume “maxing retirement” automatically makes you look low-income for aid.

6) “Does using the Foreign Earned Income Exclusion help for financial aid?”

Often, no.

Federal Student Aid explicitly lists the foreign earned income exclusion as an “untaxed income” item still included in SAI calculations.

So even if FEIE reduces taxable income on your return, FAFSA can still treat that excluded amount as relevant to aid eligibility.

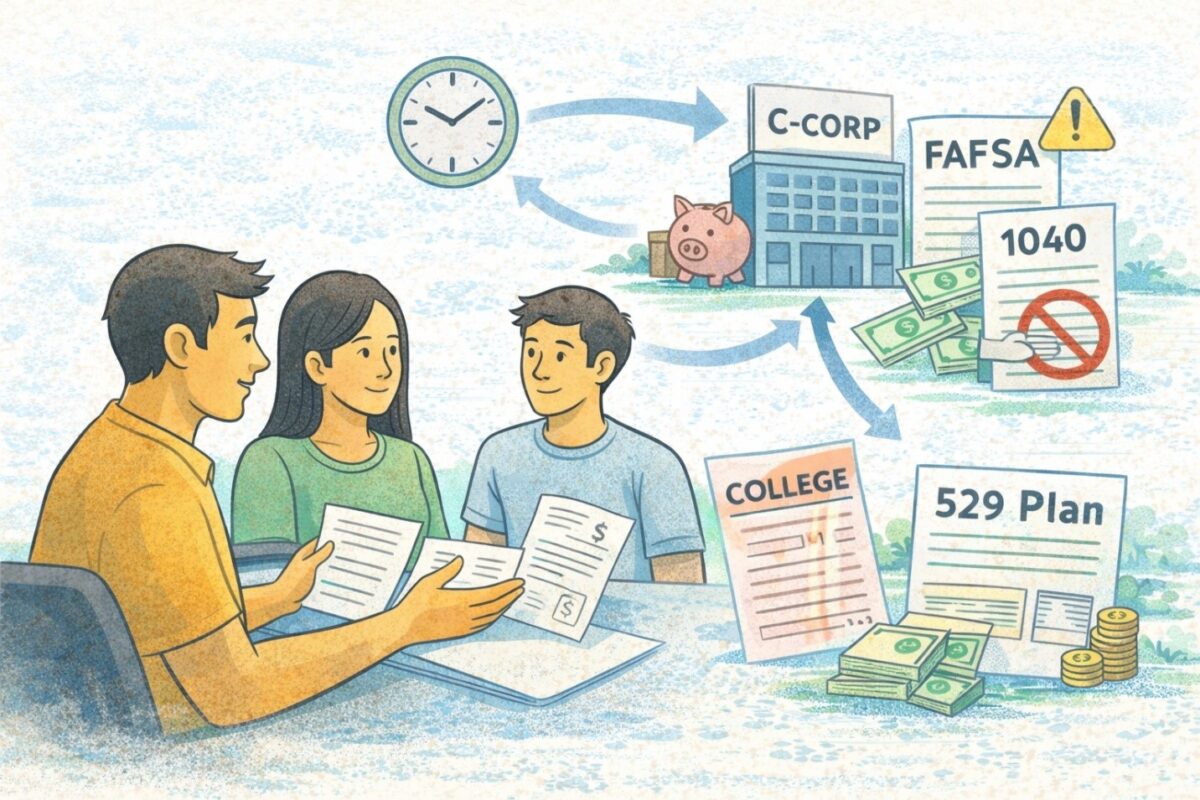

7) “Could a C-Corporation help me ‘park’ income (legally)?”

Sometimes, yes—but it’s not a universal win, and it must be evaluated carefully.

Why it can work (in plain English)

A C-Corp pays its own tax. Under IRC §11, the federal corporate income tax rate is generally 21%.

If you operate through a C-Corp, you might:

- Pay yourself a reasonable W-2 salary

- Leave additional profit in the corporation as after-tax retained earnings

That can reduce the amount that flows onto your personal return in a given year.

The big cautions

- Double-tax risk if you pull earnings as dividends later.

- The Accumulated Earnings Tax exists to discourage corporations from stockpiling earnings beyond the reasonable needs of the business to avoid shareholder tax. The IRS describes its purpose that way in its own internal guidance.

- Financial aid isn’t only federal FAFSA: many private schools use the CSS Profile, which can treat business ownership differently than FAFSA.

So yes, a C-Corp can be a planning tool, but it’s not “free deferral,” and you need to model it.

8) “Are 529 plans good or bad for financial aid?”

Usually good, if structured properly.

Recent FAFSA changes have been favorable for certain 529 scenarios (especially family planning involving grandparents/relatives), but treatment depends on who owns the account and which aid formula the school uses.

9) “Should I hire my kids?”

Hiring your kids can be a legitimate strategy in the right business with real work performed, proper payroll, and reasonable wages.

But for aid planning: wages paid to your kids can still affect the overall family aid picture (and each school’s formula can treat student income differently). This is a strategy to consider as part of a wider plan—not a magic switch.

10) “If my income drops later, can the school use my current situation instead of the old tax year?”

Sometimes, yes.

Financial aid offices can use professional judgment / special circumstances to adjust for a meaningful change (job loss, disability, etc.). But that is a school-by-school process and should never be relied on as your only plan.

***Disclaimer: This communication is not intended as tax advice, and no tax accountant/Attorney client relationship results**