A practical FAQ for non-U.S. founders running service businesses from abroad (marketing agencies, consulting, online services)

This FAQ is for the common scenario where:

- you are a foreign individual (non-U.S. person / nonresident for U.S. tax purposes),

- you own a Florida single-member LLC,

- you provide services from outside the U.S. (marketing, consulting, online agency work),

- you may use U.S. freelancers/independent contractors, and

- you want to stay compliant without accidentally triggering extra U.S. tax exposure.

Important: This is general education, not legal advice. Your filing profile can change fast if you add U.S. employees, open an office, store inventory, or materially expand U.S. operations.

1) “Florida annual reports” — are those tax returns?

No. Florida’s annual report (filed on Sunbiz) is not a tax return.

It’s simply the state’s way of keeping your LLC “active” and in good standing.

Florida also does not impose a state personal income tax—so a foreign individual doesn’t file a “Florida income tax return” just because they have a Florida LLC.

2) If I’m foreign and provide services entirely from outside the U.S., do I file a U.S. income tax return?

Often, you may not owe U.S. federal income tax on your service income if the services are performed entirely outside the U.S. and you do not have a U.S. trade or business (USTB) / effectively connected income (ECI).

But here’s the key point many founders miss:

Even if you owe zero U.S. income tax, you can still have a U.S. filing requirement.

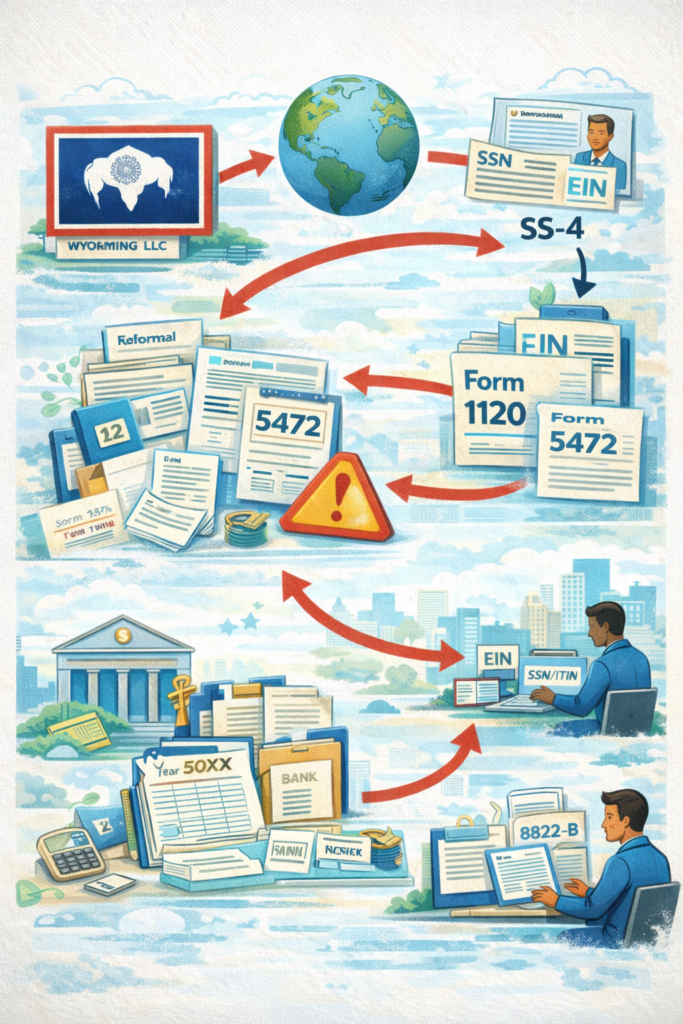

3) What do foreign-owned single-member LLCs usually have to file?

Most foreign-owned single-member U.S. LLCs (treated as disregarded entities) must file an information return package:

✅ Form 5472

✅ Pro-forma Form 1120 attached to the 5472

This is commonly described as “Form 5472 + pro-forma 1120.”

This package is about reportable transactions with foreign related parties (usually the foreign owner).

4) “I had no revenue.” Does that mean no Form 5472?

Not necessarily.

Form 5472 compliance is often triggered by related-party transactions, not revenue.

Examples that can trigger reportable transactions even when revenue is $0:

- you funded the LLC with startup money (capital contribution),

- you paid LLC expenses personally and the LLC reimbursed you,

- you took money out of the LLC (distribution),

- the LLC paid you or another related party for something.

Even the act of initially funding a newly formed LLC can create a reportable transaction.

5) “My LLC was formed late in the year.” Do I still need to file?

Possibly, yes—depending on whether there were any reportable transactions (funding, reimbursements, etc.).

Example: If the LLC formed on December 30 and you put money in to open the bank account or pay startup costs, that can still be a reportable transaction for that tax year.

6) If I use U.S. independent contractors, does that create U.S. tax nexus or ECI?

It depends on the facts. But a few practical guidelines:

Often lower risk:

- true freelancers with multiple clients,

- they set their own schedules,

- they use their own equipment,

- they are paid per project/commission/call,

- they don’t have authority to bind your company,

- they aren’t acting as your dependent agent in a way that effectively creates a U.S. business presence.

Higher risk (red flags):

- they function like employees in reality (set hours, close supervision),

- they negotiate and sign contracts for you,

- they regularly perform core revenue-producing services in the U.S.,

- you have U.S. employees, an office, or U.S. operational control.

Bottom line: Contractors alone do not automatically create ECI, but they can—if the arrangement looks like a U.S. operating footprint.

7) I previously had a U.S. employee (W-2). Does that change things?

Yes. A U.S. employee is a strong indicator you had a U.S. trade or business and potentially effectively connected income (ECI) during that period.

If you truly removed your U.S. operational footprint going forward (no employees, no office, no dependent agent activity, services performed abroad), your profile may shift back toward non-ECI treatment—but the facts must support it.

8) If I don’t want a state-by-state analysis, can I “just file 5472 + 1120”?

Filing 5472 + pro-forma 1120 addresses a major federal compliance requirement for foreign-owned disregarded entities.

However, it does not automatically resolve:

- state income/franchise tax exposure,

- states that source revenue based on “market” (where the customer benefits),

- situations where customers issue 1099s tied to a state,

- thresholds like economic nexus (which vary by state).

9) Why do people worry about California specifically?

California can be aggressive and has its own concepts around “doing business” and sourcing. In some cases, California looks at where the benefit of the service is received (market-based sourcing concepts can matter depending on entity type and facts).

If you have meaningful revenue from California customers, especially if:

- customers issue Forms 1099,

- your volume is significant,

- or your business activities are tightly tied to California markets,

…then a California analysis may be prudent.

10) What records do I need to support Form 5472?

At minimum, keep:

- bookkeeping (even simple),

- bank statements,

- invoices issued and paid,

- proof of owner contributions (wires, transfers),

- proof of distributions,

- contractor payments and agreements,

- any reimbursements between you and the LLC.

Rule of thumb: If an amount appears on the 5472, you should be able to trace it to the books and bank activity.

11) What’s the filing deadline?

In many cases, the package is due by April 15 (or the applicable corporate return due date rules, including extensions, depending on the year and facts).

A practical workflow:

- aim to deliver records to your preparer as early as possible

- file on time or extend properly if needed.

If you’re a foreign founder with a Florida single-member LLC and you want to stay compliant without over-filing, book a compliance review call here: https://oandgaccounting.com/appointment-booking-form/