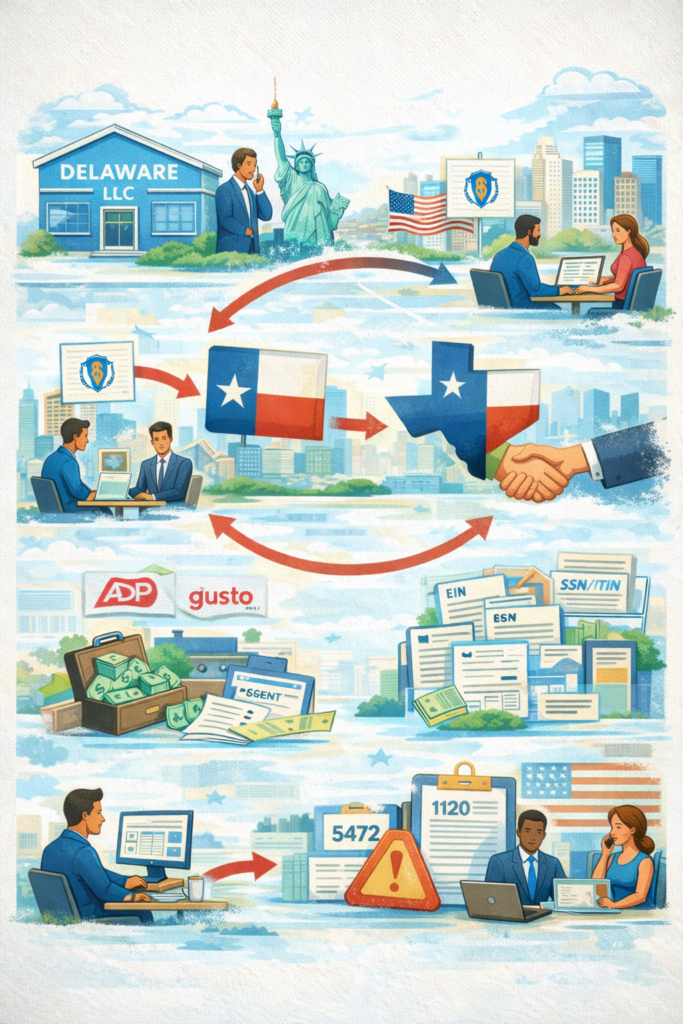

This FAQ is for the common situation where:

- you are a nonresident alien (not living in the U.S., not a U.S. tax resident),

- you formed a Wyoming LLC (single member),

- you may have an SSN from prior U.S. work, and

- you want to stay compliant—especially with Form 5472 + pro-forma Form 1120.

Important: This is educational content. Your exact filing package depends on how you use the LLC (U.S. customers, U.S. bank/merchant accounts, inventory/3PL, U.S. contractors/employees, etc.).

1) I’m a nonresident alien. Does a U.S. LLC automatically make me “a U.S. person”?

No. Forming a U.S. LLC does not automatically make you a U.S. tax resident or a U.S. person.

But a U.S. LLC can create U.S. filing obligations even when the owner is foreign and lives abroad—especially the foreign-owned disregarded entity reporting rules.

2) I’m a foreign owner of a single-member U.S. LLC. What do I have to file each year?

If your single-member LLC is foreign-owned and treated as a disregarded entity, the standard baseline compliance is:

- Form 5472 (Reportable Transactions with a Foreign Related Party)

- Pro-forma Form 1120 attached to Form 5472

- Maintain adequate books and records supporting the form

This package is commonly triggered when there are “reportable transactions” between the LLC and its foreign owner (or other related foreign parties). In practice, many foreign-owned SMLLCs will have reportable transactions because owners often fund the business, pay expenses, reimburse costs, etc.

Penalty risk: Form 5472 is a high-penalty form if missed or filed incorrectly. Treat it like a compliance priority.

3) If I have an SSN from years ago (when I worked in the U.S.), should it go on Form SS-4 for the EIN?

Yes. If you have a valid SSN, it should generally be used on Form SS-4 and the EIN application.

Why this matters:

- It often makes EIN issuance much faster/easier.

- The IRS can match the “responsible party” identity cleanly.

Key concept: Your SSN does not “expire.” If it’s yours, you use it.

4) Do I need to update the Wyoming Secretary of State to show I’m a foreign owner?

In most cases, no—you generally don’t have to file something with Wyoming just because you’re foreign.

Wyoming (and many states) does not require you to publicly “convert” the LLC into a “foreign-owned LLC.” The state cares about:

- keeping the entity active (annual report/license fees),

- maintaining a registered agent,

- and basic entity compliance.

5) My LLC address on Wyoming records is a U.S. address (registered agent address). Is that a problem?

Usually not.

Many foreign founders use:

- a registered agent address,

- a mail forwarding address, or

- a U.S. business address service.

That does not automatically turn you into a U.S. tax resident and does not, by itself, change federal filing rules.

6) What does “maintain adequate books and records” mean for Form 5472?

In plain English, it means:

You should keep:

- a basic bookkeeping system (QuickBooks, Xero, Wave, spreadsheet—anything consistent)

- bank statements

- invoices you issued (sales)

- receipts/invoices you paid (expenses)

- documentation of owner funding (capital contributions)

- documentation of owner reimbursements or withdrawals

- records of any related-party payments (management fees, cost sharing, etc.)

Rule of thumb: If you put a number on Form 5472, you should be able to show where it came from in your books.

7) What other compliance items do I need besides Form 5472?

A) State compliance (Wyoming)

- Annual report / annual license tax (keep LLC “active”)

- Keep a registered agent paid and active

B) Federal compliance (EIN & responsible party)

- If the “responsible party” changes, file Form 8822-B (see Q11)

8) If my LLC was formed this year 2026, do I file Form 5472 this April 15, 2026?

Usually no, not for the same April if you formed it “recently.”

Your Form 5472 package is typically filed with the annual cycle for the year the LLC existed/operated. Practically:

- If formed in 2026, the first Form 5472 package is generally due in 2027 (aligned with the tax year and filing due date rules).

- If formed in 2025, first filing is generally due in 2026.

Important: Due dates can differ depending on facts (short years, elections, and whether there were reportable transactions). A quick review avoids missing an unexpected filing year.

9) I’m not making money yet. Do I still have to file Form 5472?

Possibly yes, because Form 5472 is not only about revenue—it’s about reportable transactions with foreign related parties.

Examples of reportable transactions:

- You wire money into the LLC to cover expenses (capital contribution)

- The LLC pays you back (reimbursement/distribution)

- The LLC pays a related foreign company (fees/costs)

- The foreign owner pays expenses on behalf of the LLC

Even “startup phase” activity can create reporting.

10) I used Incorporation service (or a formation service). Will they handle tax forms like 5472?

Typically no, unless there is a separate agreement or filing was bundled into the incorporation service—formation companies usually handle:

- entity formation,

- registered agent,

- sometimes EIN assistance.

They generally do not provide CPA-level tax compliance, Form 5472 strategy, or bookkeeping support.

11) What if the EIN “Responsible Party” changes later?

File Form 8822-B to update the IRS “Responsible Party.”

This is especially common when:

- the person who applied for the EIN leaves,

- ownership changes,

- you move from an individual owner to a foreign parent company,

- you switch management/control.

12) Do I need to do anything special because I’m a nonresident alien with an SSN?

The main “special” part is understanding the difference between:

- Identity (you have an SSN) vs

- Tax residency (you are still a nonresident alien)

Having an SSN does not automatically mean you file like a U.S. resident. It simply means you have a U.S. taxpayer identifier that the IRS recognizes.

13) What are the biggest traps foreign founders run into with foreign-owned single-member LLCs?

- Missing Form 5472 (and learning about the penalty the hard way)

- No bookkeeping—trying to “reconstruct” everything at filing time

- Treating owner funding like “income” instead of capital contribution/loan

- Ignoring state annual reports and letting the LLC fall out of good standing

- Not separating personal and business banking activity

- Confusion about BOI/FinCEN rules because the status can change rapidly

Quick Checklist: “Stay Compliant” Setup (Foreign-Owned SMLLC)

- Obtain EIN (SSN on SS-4 if you have one)

- Keep LLC active in Wyoming (annual report + registered agent)

- Separate bank account for the LLC

- Basic bookkeeping monthly (even if revenue is $0)

- Track owner funding and payments clearly

- Prepare for Form 5472 + pro-forma 1120 for the first applicable year

- Update IRS responsible party if it changes (Form 8822-B)

If you want a clean, low-stress plan for your foreign-owned Wyoming single-member LLC, book a compliance setup call here: https://oandgaccounting.com/appointment-booking-form/