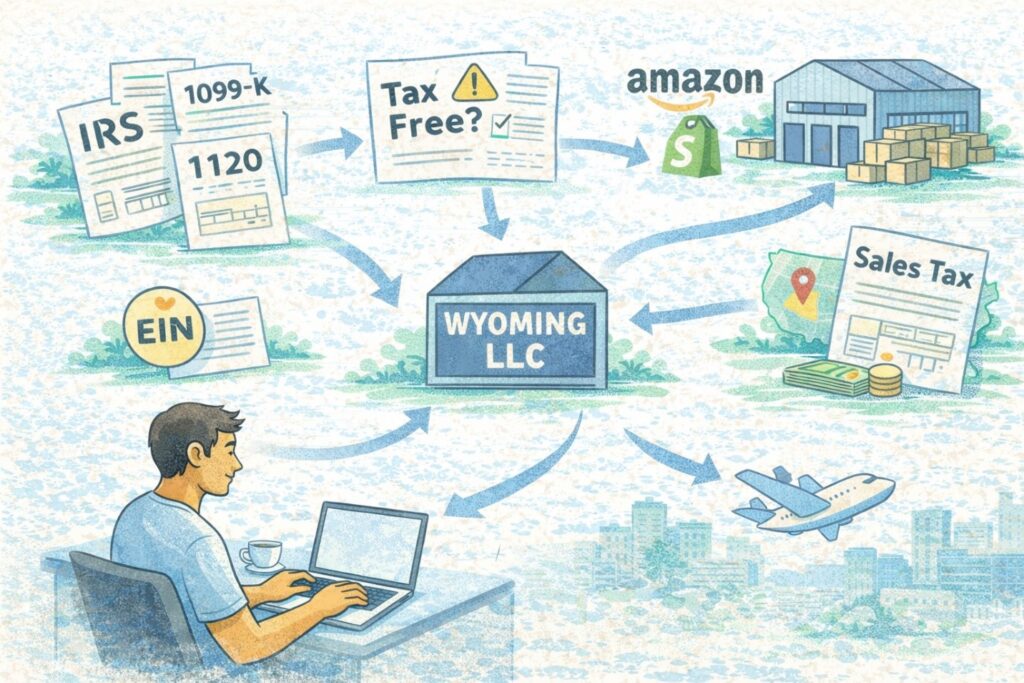

This FAQ is written for non-U.S. founders (e.g., living in Poland, the EU, the UK, Australia, etc.) who formed (or want to form) a Wyoming (or other U.S.) LLC to bill U.S. clients, run an online brand, use Stripe/Shopify/Amazon, or appear “U.S.-based”—while still doing the work outside the United States.

Important concept: “Tax-free” usually means no U.S. federal income tax because you’re not engaged in a U.S. trade or business and you have no effectively connected income (ECI). It does not mean “no filings” or “no compliance.”

1) Do I need a U.S. LLC, or can my foreign company just get an EIN?

Either can work, but founders often choose a U.S. LLC for practical reasons:

- Easier onboarding for U.S. payment processors, marketplaces, vendors, and U.S. customers

- Cleaner separation of U.S. sales operations (Amazon/Shopify) from non-U.S. operations

- Standardized U.S. documentation (Operating Agreement, EIN letter, etc.) commonly requested by banks and platforms

From a U.S. income tax standpoint, the key question is usually not “LLC vs foreign company,” but where the work happens, who performs it, and whether there’s U.S. presence.

2) How can a foreign owner keep a U.S. LLC “tax-free” for U.S. federal income tax?

For service businesses (market research, consulting, IT services, design, etc.), the core rule is:

- Services income is generally sourced to where the services are physically performed.

So if you perform the work entirely outside the U.S., that income is typically foreign-source, and a nonresident is often not subject to U.S. federal income tax on it (assuming no U.S. trade or business / ECI factors).

Common facts that can create U.S. tax exposure

Even if you’re foreign and the LLC is “just a vehicle,” U.S. tax risk rises if you have:

- U.S. employees or a dependent agent doing revenue-generating work

- A U.S. office (even a real one, or sometimes a functional “place of business”)

- You personally perform services while physically in the U.S. (even short trips can matter on the margin because place-of-performance drives sourcing for services)

- U.S. inventory / warehousing activity for goods (especially outside pure marketplace-and 3PL only models)

3) I’m a foreign-owned single-member LLC. What U.S. federal forms do I file every year?

If your LLC is a single-member LLC owned by a non-U.S. person (and treated as a disregarded entity), the common annual compliance package is:

Form 5472 + Pro-Forma Form 1120 (information reporting)

- The IRS requires this to report “reportable transactions” between the LLC and its foreign owner (e.g., owner funding, reimbursements, owner payments, etc.).

- Failure to file can trigger a $25,000 penalty (and additional penalties can apply if the failure continues after IRS notice).

- The IRS instructions specifically address foreign-owned U.S. disregarded entities, including how to file and how to label the return.

Key reality: Even if the LLC has little/no revenue, you may still have reportable transactions (like initial capital contributions or owner-paid expenses), which can still require filing.

4) Is there really “nothing new as of January 1”? What about BOI (Corporate Transparency Act)?

A lot of founders heard “new rules” and were thinking about BOI reporting under the Corporate Transparency Act.

Here’s the current landscape as of 2025–2026 guidance from FinCEN:

- FinCEN issued an interim final rule revising BOI reporting so that entities created in the United States (formerly “domestic reporting companies”) are now exempt from BOI reporting requirements.

- Foreign entities that register to do business in the U.S. may still be within the reporting definition (subject to exemptions and deadlines).

Takeaway: If your structure is an Entity whether LLC or Corporation formed in the U.S., BOI reporting does not apply to you.

5) What must I do to keep my Wyoming LLC in good standing?

Wyoming compliance is mostly administrative:

- File the Wyoming annual report / license tax on the required schedule (Wyoming ties the due date to the anniversary month of formation and has a minimum tax component).

- Maintain a valid registered agent in Wyoming.

- Keep basic company records (Operating Agreement, ownership records, bookkeeping).

6) Do I need to worry about “nexus thresholds” if I sell services (market research, consulting)?

Usually, sales tax nexus discussions focus on taxable sales of goods (and some taxable services). Many professional services are not subject to sales tax in most states, but states vary.

Also note: states can have income/franchise tax “doing business” thresholds even without physical presence, depending on sales levels and the specific state rules.

Example: California “doing business” threshold (income/franchise tax concept)

California uses bright-line “doing business” thresholds (including a sales factor threshold that is adjusted periodically).

If you have meaningful California customer revenue, this is the type of rule you’d monitor (even if you never set foot in CA).

7) I’m adding an Amazon goods business. Does that change my tax situation?

It can—mostly because selling goods introduces:

- Sales tax considerations (economic nexus, marketplace rules)

- Potential inventory / warehousing nexus issues

- More complex bookkeeping (COGS, inventory, fees, returns)

If I sell only through Amazon, do I still deal with sales tax?

In many cases, Amazon is a marketplace facilitator and will calculate, collect, and remit state sales tax for marketplace transactions where required.

However:

- If you also sell on Shopify/your own site, those sales may be your responsibility.

- Some states still impose registration or filing expectations even when tax is collected by the marketplace (rules vary).

“Economic nexus” thresholds: why you can’t rely on one number

The classic Wayfair model started with thresholds like $100,000 sales or 200 transactions (South Dakota’s law).

But thresholds differ by state and many states have changed or removed transaction-count tests over time.

Bottom line: treat sales tax as state-by-state.

8) Can one LLC do multiple business lines (services + goods)?

Yes. A single LLC can operate multiple lines of business. Your tax “business code” is generally about your principal activity, not a legal limitation on what the entity may do.

What matters more is clean:

- bookkeeping by product line (optional but smart),

- documentation,

- and watching for new U.S. presence risk factors as you scale.

9) Can I freely travel to the U.S. without “breaking” my tax-free status?

From a tax perspective, the key risk is performing services while physically in the U.S. because services are sourced to where performed.

From an immigration/work authorization perspective, travel rules are separate and fact-specific—so don’t treat tax guidance as immigration clearance.

10) If I want to close my LLC, what does a clean shutdown look like?

A clean closure is usually a three-track checklist:

- File final federal information returns (Form 5472 + pro-forma 1120) for the final year as required.

- Dissolve/cancel the LLC with the state (Wyoming).

- Notify the IRS to close the business account associated with the EIN (the IRS generally doesn’t “cancel” an EIN, but you can request the account be closed).

Timing tip: dissolving at year-end can reduce the chance you’ll need multiple years of filings, depending on facts.

If you want a clear, written compliance plan tailored to your facts (services vs goods, Amazon vs Shopify, travel, state thresholds, and “tax-free” risk flags), book a paid consultation here:

https://oandgaccounting.com/appointment-booking-form/