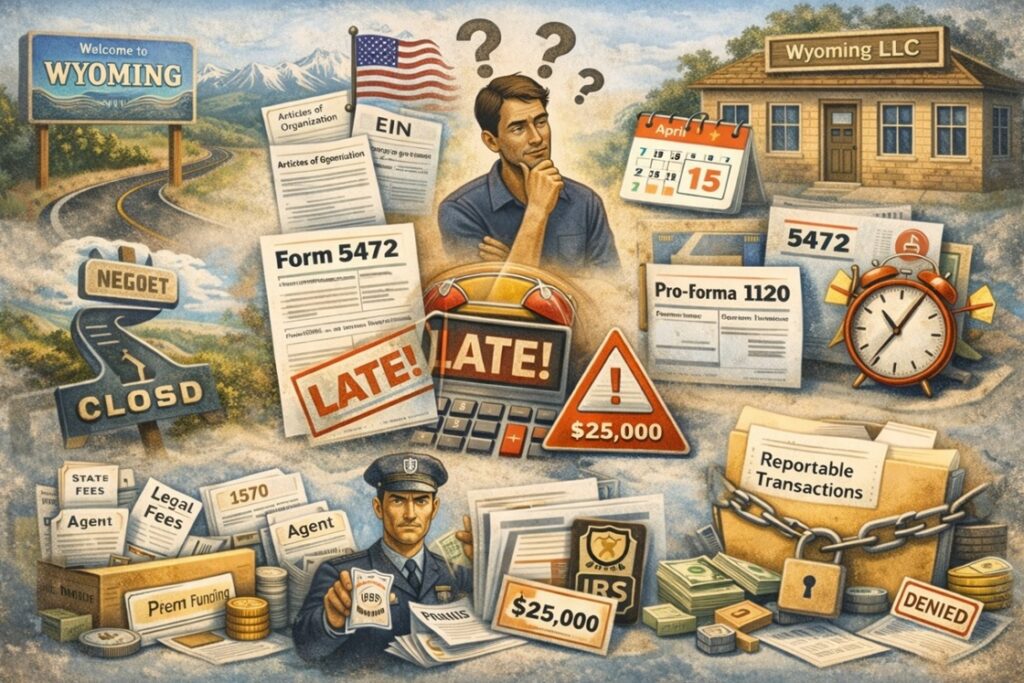

Formed a Wyoming LLC as a non-U.S. resident and had “no activity”? Learn why you may still need to file Form 5472 + pro-forma Form 1120, what counts as a reportable transaction (even with $0 revenue), late-filing penalty risks, and how to fix a missed year.

Who this FAQ is for

- This guide is written for foreign (non-U.S.) owners—especially nonresident individuals—who:

- formed a single-member U.S. LLC (often Wyoming/Delaware/New Mexico), and

- believe they had “no activity” (no sales, no invoices, no Stripe/PayPal), and

- later discovered they may still need to file Form 5472 + pro-forma Form 1120.

This is educational content, not individualized tax advice. Small facts (ownership, elections, additional members, U.S. presence, etc.) can change outcomes.

1) I formed my LLC late in the year and did “nothing.” Do I still need to file?

Often, yes. A foreign-owned U.S. disregarded entity (a single-member LLC owned by a foreign person, with no corporate election) is required to file Form 5472 attached to a pro-forma Form 1120 by the due date (including extensions), even though it usually has no U.S. income tax return filing requirement on its own. Why? Because the IRS treats the entity as a “reporting corporation” for limited reporting/recordkeeping purposes under IRC §6038A.

2) What does “no activity” actually mean for Form 5472 purposes?

“No activity” is not the same as “no reportable transactions.” Even if you had:

- $0 revenue

- no customers

- no contracts

- no U.S. bank account

You may still have reportable transactions if you paid for formation-related costs or funded the LLC.

Common “first-year” reportable transactions (even with $0 sales):

- state filing fees (e.g., Articles of Organization)

- registered agent fees

- legal/accounting fees to form or maintain the entity

- business address/virtual mailbox fees

- initial funding / capital contribution (even small amounts)

3) What if my first bank deposit happened in the next year?

This is a very common timeline:

- LLC formed in Year 1 (late in the year)

- bank account funded in Year 2 (spring/summer)

In that scenario, you may have:

- Year 1 filing: report formation-related costs/contributions (in Year 1)

- Year 2 filing: report the bank funding/capital contribution (and any other related-party transactions in Year 2)

4) When is Form 5472 + pro-forma Form 1120 due?

Form 5472 is filed as an attachment to the reporting corporation’s Proforma 1120, due by the return due date (including extensions). For many calendar-year foreign-owned single-member LLCs using a pro-forma Form 1120, the practical filing deadline is commonly discussed as April 15 (with extension available).

5) I missed the deadline. Should I file now or wait and “hope” nothing happens?

If you want the conservative, professional answer: file as soon as possible. Reason: the biggest practical problem with missing Form 5472 isn’t just “late.” It’s that the IRS can assess significant penalties for failure to file correctly and on time. Filing late does not guarantee a penalty—but not filing at all leaves you with no compliance position if the IRS ever asks questions.

6) What is the penalty for not filing Form 5472?

The IRS instructions state:

- $25,000 penalty for failing to file Form 5472 when due (and as required).

- Additional penalties can apply if you ignore an IRS notice demanding the missing 5472. The IRS penalty page explains an added continuation penalty after notice periods, and notes there is no maximum in some scenarios.

- Also, penalties can apply for failure to maintain required records.

7) If I file late, can I request penalty relief?

Sometimes, yes—but it depends. The IRS can consider relief when a taxpayer shows reasonable cause and timely responds to notices. Penalty relief is not automatic, and results vary by facts and presentation. Best practice approach:

- File the delinquent forms correctly.

- Keep proof of filing/submission.

- If a penalty notice arrives, respond promptly with a clear, factual reasonable-cause explanation and supporting documents.

8) “The IRS is mysterious—some people get lucky.” Is that a strategy?

No. It’s true that enforcement can feel inconsistent. But compliance is not about luck; it’s about reducing avoidable risk:

- penalties

- future filing issues

- complications if you sell/close the entity

In cross-border compliance, being proactive is usually cheaper than reacting to a notice.

9) Can I just close the LLC and walk away?

Closing the LLC at the state level doesn’t automatically erase federal reporting exposure for prior years. If the LLC existed and had reportable transactions, the reporting obligation can still exist for that year—even if the entity is later dissolved.

10) What information do I need to file correctly?

For a typical foreign-owned single-member LLC filing pro-forma 1120 + 5472, you generally need:

- LLC legal name + EIN (if any)

- formation date + state of formation

- foreign owner details

- the list of reportable transactions (amounts + descriptions), such as:

- formation/legal/registered agent fees

- capital contributions

- owner draws/distributions

- payments to/from related parties (if any)

- basic books/records supporting those amounts

11) Quick myths (and the truth)

- Myth: “No revenue means no U.S. filing.”

- Truth: You can still have reportable transactions (formation costs, initial funding) requiring Form 5472.

- Myth: “I’m foreign, so the IRS can’t penalize me.”

- Truth: The IRS can assess penalties; collection may be harder across borders, but the penalty exposure is real.

- Myth: “Form 5472 is a tax return.”

- Truth: It’s primarily an information return reporting related-party transactions.

If you’re a foreign owner who missed (or may miss) Form 5472 + pro-forma Form 1120, the cleanest path is usually: file correctly, file ASAP, and document your position.

To book a paid consultation or start the filing process with a CPA & tax attorney team, use our appointment form:

https://oandgaccounting.com/appointment-booking-form/