Reclamar Tratado Fiscal, Evitar Doble Tributación y Solicitar Exención de IVA – Formulario 6166 – Certificación de Residencia Fiscal en EE. UU.

Forma 6166 es su clave para garantizar que se le apliquen impuestos justos en un país extranjero y, en la mayoría de los casos, evitar la doble imposición o la retención obligatoria sobre el pago transferido desde un proveedor o pagador extranjero.

¿Qué es el Formulario 6166?

El formulario 6166 también se conoce como Certificación de Residencia Fiscal —y es justo lo que parece. El formulario 6166 certifica que, para efectos fiscales, usted es un residente de los Estados Unidos. ¿Por qué es importante? Lo abordaremos en un momento. Primero, permítanme presentarles... Formulario 8802.

¿Qué es el Formulario 8802?

El formulario 8802 es lo que debe completar al solicitar el Formulario 6166 de Certificación de Residencia Fiscal. Puede encontrarlo en Sitio web del IRS.

¿Por qué importa todo esto?

Cuando obtiene ingresos por servicios o vende bienes en un país extranjero, ese país puede exigir al pagador que retenga impuestos con base en los propios códigos tributarios del país extranjero. Debido a Tratados de Estados Unidos, Sin embargo, los residentes fiscales de EE. UU. pueden optar a tasas impositivas reducidas o estar exentos de impuestos en muchos países extranjeros. El Formulario 6166 de Certificación de Residencia Fiscal es la forma de demostrar a un país extranjero que se califica para dichos beneficios del tratado.

Entonces, ¿cuáles son exactamente esos beneficios del tratado?

Bueno, eso varía según el país. Pero además de obtener una tasa impositiva reducida o una exención fiscal, muchos países extranjeros también eximen del IVA (Impuesto al Valor Agregado). Como puede ver, el Formulario 6166 es una herramienta invaluable para reducir sus impuestos extranjeros y ahorrar dinero. Realmente vale la pena.

Vayamos al grano…

Para calificar para su Formulario 6166, debe presentar una declaración de impuestos de los EE. UU. en la mayoría de los casos para el año en el que solicita la residencia (y su declaración de impuestos no se puede presentar como una declaración de impuestos de no residente).

El Formulario 6166 (Certificación de Residencia Fiscal) solo tiene una vigencia de un año, por lo que deberá solicitarlo anualmente. El IRS recomienda enviar el Formulario 8802 a el menos 45 días antes de que necesite el Formulario 6166. Le recomendamos que lo solicite incluso antes.

PRECAUCIÓN: El plazo habitual para procesar estos formularios solía ser de 45 días, pero la pandemia de coronavirus ha generado retrasos significativos en el IRS. Su certificación se aprobará dentro de los 90 días posteriores a su presentación. También existe la posibilidad de retrasos significativos más allá de los 90 días si no completó correctamente los formularios 8802.

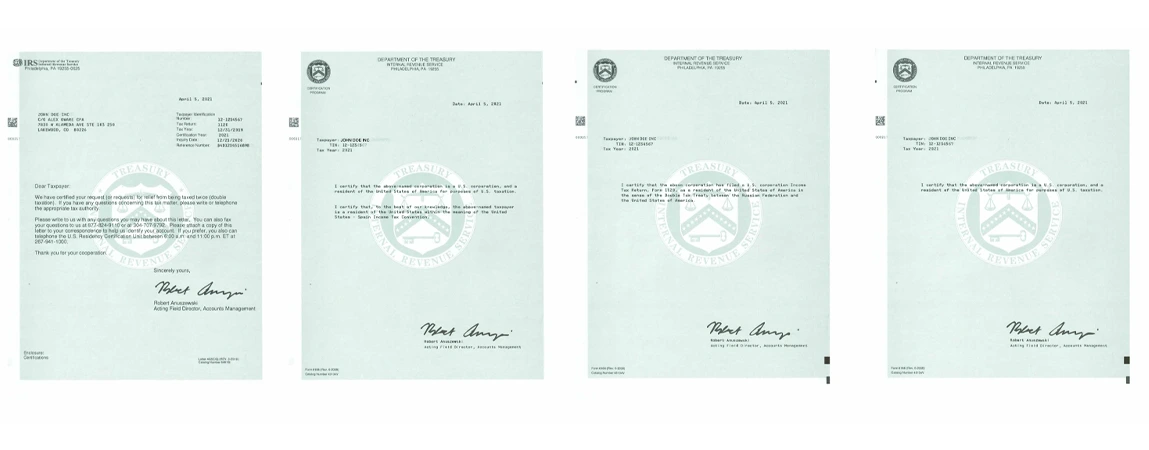

Si se cumplen todos los requisitos de certificación, se emitirá la Certificación de Residencia en EE. UU. correspondiente en el Formulario 6166, Membrete del Programa de Certificación. Haga clic en aquí para ver muestras de Año fiscal 2021 certificaciones

Certificación de residencia en EE. UU. para sociedades nacionales y extranjeras, incluidas las LLC de múltiples miembros de EE. UU.

Una sociedad colectiva constituida en Estados Unidos y otros países puede obtener un certificado de residencia mediante el Formulario 6166 en nombre de sus socios, presentando una solicitud de certificación mediante el Formulario 8802 al IRS. Por lo general, las sociedades colectivas de hecho y las sociedades colectivas extranjeras con ingresos de fuente estadounidense deben presentar la solicitud. Formulario 1065. El Formulario 6166 confirmará la presentación de dicho formulario e incluye los nombres de todos los socios que han presentado declaraciones de impuestos como residentes de EE. UU..

En el formulario 6166, el IRS informará al agente de retención que se comunique directamente con la sociedad colectiva para proporcionar información sobre la asignación de los ingresos de fuente extranjera específicos al socio estadounidense indicado. Si una sociedad colectiva extranjera con socios estadounidenses no está obligada a presentar el Formulario 1065, el Formulario 6166 confirmará dicha situación y contendrá la misma información sobre sus socios estadounidenses.

Certificación de residencia en EE. UU. para corporaciones S…

Un Corporación S Puede presentar el Formulario 8802 y obtener un certificado de residencia (Formulario 6166) de forma similar a la de una sociedad, como se explicó anteriormente. El Formulario 6166 confirma la presentación de una declaración informativa., Formulario 1120S, como se requiere para una corporación S, e incluye una lista de accionistas que presentaron declaraciones como residentes de EE. UU.

Certificación de residencia en EE. UU. para sociedades de responsabilidad limitada (LLC) unipersonales de propiedad estadounidense.

Un residente de los EE. UU. que sea propietario único de una LLC u otra entidad que no se considera una entidad separada de su propietario para fines fiscales de los EE. UU. puede presentar un Formulario 8802 para obtener un Formulario 6166 que establezca que la LLC u otra entidad es una sucursal, división o unidad comercial de su propietario único y que dicho miembro único ha presentado una declaración de impuestos como residente de los Estados Unidos.

Certificación de residencia en EE. UU. para sociedades de responsabilidad limitada (LLC) unipersonales estadounidenses de propiedad extranjera.

Una LLC unipersonal, de propiedad extranjera o estadounidense, que no se considera una entidad separada de su propietario no es una persona estadounidense y tampoco está sujeta a impuestos. El IRS no certificará que la LLC sea residente de Estados Unidos. Sin embargo, sí puede certificar que el propietario único de la LLC sea residente de Estados Unidos.

El IRS publicó El IRS lanzó la Asistencia Técnica Internacional (ITA), que aclaró que una LLC de un solo propietario es una entidad no considerada, independiente de su propietario, a efectos del impuesto federal sobre la renta; la LLC no es una persona a efectos de los tratados fiscales estadounidenses. El IRS también declaró que los ingresos de una LLC de un solo propietario tributan en manos de este, y no en las de la LLC. La LLC no está sujeta a impuestos según lo dispuesto en los tratados fiscales estadounidenses, ni siquiera bajo la legislación nacional. Por lo tanto, una LLC propiedad de una persona extranjera no puede certificar que es residente de Estados Unidos.

A empresa unipersonal de propiedad extranjera LLC, como su nombre lo indica, es cualquier LLC de un solo miembro propiedad de una persona que no es un residente de EE. UU.. es decir, extranjero no residente. Por lo tanto, un extranjero no residente No puede certificar ni a su LLC de un solo miembro ni a sí mismo como residente de EE. UU. La residencia, en el sentido de las diversas disposiciones de los tratados fiscales, generalmente se determina en función de la residencia de una persona o empresa. domicilio, residencia, ciudadanía, lugar de gestión, lugar de constitución, o cualquier otro criterio de naturaleza similar.

Si necesita detalles específicos del tratado para países específicos, puede encontrarlos publicados en el Sitio web del IRS. O siéntete libre de Contáctanos. ¡Estamos aquí para ayudarte! Obviamente, esto es solo un vistazo rápido a los formularios 6166 y 8802.

Hay mucho más que esto, y por eso estamos aquí. Nos encantaría ayudarle a comprender las complejidades del Formulario 6166, desde identificar cuántas copias necesita hasta agilizar sus solicitudes para años futuros. Simplemente contáctenos y háganos llegar cualquier pregunta que tenga. ¡Esperamos poder ayudarle! Vamos a hablar.

Si necesita servicios profesionales de contabilidad, le recomendamos visitar nuestra subsidiaria, Servicios URSA LLC. Nos especializamos en mantener sus finanzas en orden para que usted pueda concentrarse en el crecimiento de su negocio. No se preocupe, seguiremos aquí para atender todas sus necesidades fiscales. Visita URSA Services LLC ¡¡¡Hoy para aprender más!!!

Artículos relacionados:

- Cómo presentar los formularios 5472 y 1120 para una LLC de un solo miembro de propiedad extranjera

- Tratado fiscal entre EE. UU. e India (F-1 y J-1) (estudiantes y aprendices de negocios)

- ¿Qué formularios deben presentar las sociedades de responsabilidad limitada (LLC) unipersonales de propiedad extranjera?

- 7 preguntas frecuentes sobre las LLC estadounidenses de propiedad extranjera respondidas por un contador público

- Vendedores extranjeros de Amazon, impuestos en EE. UU. y presentación de informes 1099-K

- Las 12 preguntas más importantes sobre las LLC estadounidenses respondidas por un contador público

- Ejemplos de certificaciones de residencia en EE. UU. – Formulario 6166

- 15 preguntas frecuentes sobre la expatriación, el formulario 8854 y el impuesto de salida (respondidas por un contador público)

- Formularios y presentación de solicitudes para sociedades multimiembro de propiedad extranjera (LLC) | Análisis del caso de una sociedad estadounidense de propiedad australiana

- ¿Qué formularios de impuestos deben presentar las LLC multimiembro de propiedad extranjera en Estados Unidos?

Reserva una consulta paga

Sí, reserva mi espacio

***Descargo de responsabilidad: Esta comunicación no pretende ser asesoramiento fiscal y no genera ninguna relación entre un asesor fiscal y un abogado.**

VER – Corporación C: Solicitud de Certificación de Residencia en EE. UU. 2023, Formulario 8802/6166

VER – Corporación C: Solicitud de Certificación de Residencia en EE. UU. 2023, Formulario 8802/6166