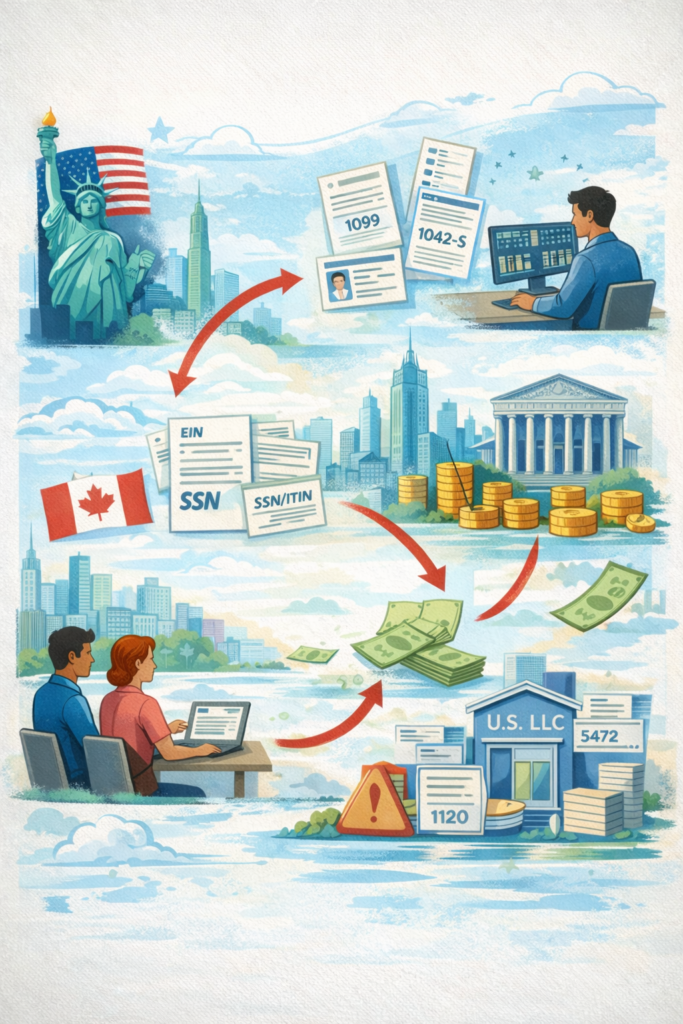

If you live outside the United States and want to trade U.S. futures (or other marketable securities) through a U.S. brokerage, you’ll run into the same three buckets of questions:

- Will the U.S. tax my trading profits?

- What forms and ID numbers will the brokerage demand (TIN/ITIN/EIN/W-8BEN)?

- If I form a U.S. LLC, what compliance filings can trigger big penalties if I miss them?

Key takeaways

- A U.S. LLC is usually not required just to trade. Most people consider an LLC for operational reasons (broker acceptance, banking, branding, segregation of assets), not because the LLC magically makes U.S. tax disappear.

- Many non-U.S. residents aren’t subject to U.S. tax on “capital gain-type” trading profits if they’re not effectively operating a U.S. trade/business and they’re not physically present in the U.S. long enough to trigger special rules.

- Brokerages often require a “TIN” for compliance/KYC reasons, and this may mean your home-country tax number (not necessarily a U.S. ITIN). The exact requirement varies by brokerage.

- If you form a foreign-owned, single-member U.S. LLC (a “disregarded entity”), you can create a U.S. filing obligation even when no U.S. tax is due – and missing it can trigger a $25,000 penalty.

FAQ 1) Do foreigners pay U.S. tax on futures trading profits?

Often no, but it depends on facts.

The two big U.S. tax “triggers” to watch

Trigger A: Physical presence (183-day rule).

If a nonresident alien is physically present in the U.S. for 183 days or more in the year, there’s a special rule that can tax certain gains at 30%.

Trigger B: Being treated as engaged in a U.S. trade or business (USTB), generating effectively connected income (ECI).

U.S. law includes a safe harbor that generally says a foreign person is not treated as engaged in a U.S. trade or business just because they trade stocks/securities/commodities for their own account, including through a resident broker/agent (with important limitations).

Practical translation:

If you live abroad, trade from abroad, and you don’t have a U.S. office/employees running the trading business, you’re often outside U.S. income tax on typical trading gains—but you still must follow broker documentation rules and your home-country tax rules.

FAQ 2) If the profits may not be taxed in the U.S., why is the brokerage asking for a “TIN”?

Because broker requirements aren’t the same thing as IRS tax liability.

Brokerages must follow KYC/AML/FATCA/withholding documentation rules. To document that you’re foreign, brokers typically require you to submit Form W-8 (most commonly W-8BEN for individuals, W-8BEN-E for entities).

Many brokers also ask for a TIN on the application. Depending on the broker, “TIN” can mean:

- your foreign tax identifying number (home-country tax number), and/or

- a U.S. TIN (SSN or ITIN), especially if you claim treaty benefits or the broker insists on it.

The IRS’s W-8BEN instructions discuss when a foreign tax identifying number (FTIN) is required (often tied to treaty benefit claims and documentation completeness).

Bottom line: Even when you owe no U.S. tax, the broker may still require a TIN to open/maintain the account.

FAQ 3) Do I need an ITIN to open a U.S. brokerage account?

Not always. Some brokerages accept foreign clients with only:

- passport/ID,

- proof of foreign address, and

- a properly completed W-8BEN (plus sometimes a foreign TIN).

Other brokerages insist on a U.S. TIN (ITIN/SSN). That’s a business decision by the brokerage.

Can a foreign person get an ITIN just because a broker wants one?

ITINs are generally issued when you have a U.S. tax filing/reporting need, unless you qualify for an exception.

One common exception category is when a third party (like a bank) needs an ITIN for information reporting/withholding. The W-7 instructions describe situations such as opening certain interest-bearing accounts, where you may need a letter from the financial institution to support the ITIN application.

Reality check: In practice, getting an ITIN “just for investing/trading” can be difficult unless you fit an exception and the institution provides the required documentation.

FAQ 4) W-8BEN vs W-8BEN-E vs W-9: which one applies?

If you’re opening the account as an individual

Usually W-8BEN (individual foreign status certificate).

If you’re opening the account as a foreign entity

Usually W-8BEN-E (entities).

If you’re a U.S. person

Usually W-9 (not W-8).

Important: Don’t “guess” or misstate residency/tax status on these forms. Incorrect certifications can create account closure risk and legal exposure.

FAQ 5) If I form a U.S. single-member LLC, will that make me “U.S. taxable”?

Not automatically.

A U.S. LLC can exist while the owner remains foreign and the activity remains outside the U.S. In that case, the key tax question is still:

Are you engaged in a U.S. trade or business, or triggering other U.S. tax rules?

Also, the trading safe harbor in the U.S. tax code is focused on whether trading activities create a USTB/ECI in the first place.

However: A U.S. LLC can create compliance filings even when the income is not taxed.

FAQ 6) If I form a foreign-owned, single-member U.S. LLC, what U.S. filings are required?

This is the part many people underestimate.

A foreign-owned U.S. disregarded entity typically has an IRS information reporting requirement:

- Form 5472 attached to a pro-forma Form 1120 (even if no U.S. tax is due).

What’s the penalty if I miss it?

The Form 5472 instructions state a $25,000 penalty for failure to file or for filing an incomplete/incorrect return (with additional rules for continued failure).

Forming the LLC may move you from “maybe no U.S. filing” to “you must file the right paperwork or risk a very expensive penalty.”

FAQ 7) Will I receive a U.S. tax form like 1099 or 1042-S?

It depends on how the broker classifies you and what income is reportable.

- U.S. persons commonly receive 1099 forms.

- Foreign persons often receive Form 1042-S for U.S. source income subject to withholding/reporting.

If withholding happens correctly at the broker level, many foreign clients don’t need to file a U.S. return just to “true up,” unless they’re claiming a refund or fixing an incorrect withholding.

FAQ 8) Does giving someone Power of Attorney to manage the account change the tax result?

Usually, the tax reporting follows the beneficial owner (the person/entity who owns the account and the income).

But giving someone authority to trade can create non-tax risks (fiduciary duty, disputes, platform policy issues). If the manager is in the U.S. and is effectively operating a business from the U.S., that can also complicate the “USTB/ECI” analysis.

If you’re doing anything involving:

- a U.S.-based discretionary manager,

- a U.S. office,

- employees/agents executing strategy from the U.S.,

get proper advice before assuming the “no U.S. tax” result.

FAQ 9) I’m Canadian. Are U.S. LLCs “good” for Canada?

This FAQ can’t replace Canada-side advice, but here’s the common issue:

A U.S. LLC that is “disregarded” for U.S. tax purposes may be treated differently under Canadian tax rules, creating mismatches in timing/character and potentially higher Canadian complexity. This is why cross-border setups often require both U.S. and Canadian tax review.

FAQ 10) Checklist: what to verify before spending money to form an LLC

- Broker acceptance rules

- Will they open for non-U.S. residents?

- Do they require a U.S. TIN (ITIN/SSN) or will a foreign TIN work?

- Funding rules

- Will they accept wires from your country? From fintechs? From business accounts?

- If using a U.S. LLC

- State annual compliance (annual report/registered agent)

- IRS filing: pro-forma 1120 + 5472 and understand the $25,000 penalty risk.

- Home-country taxation

- Your residence country typically taxes worldwide income.

If you’re a non-U.S. resident trading U.S. markets and you want confident compliance—without overpaying or creating unnecessary filing exposure—schedule a consultation: https://oandgaccounting.com/domestic-c-corporation/